- United States

- /

- Pharma

- /

- NasdaqGM:SUPN

Supernus Pharmaceuticals (SUPN): Exploring Valuation After Three-Month Share Price Surge

Reviewed by Kshitija Bhandaru

Supernus Pharmaceuticals (SUPN) has seen its stock price climb about 5% over the past month and an impressive 45% over the past 3 months. Investors are watching these gains with interest, given the company's recent financial growth.

See our latest analysis for Supernus Pharmaceuticals.

After a strong recent run, Supernus Pharmaceuticals now boasts a 1-year total shareholder return of 48%, comfortably outpacing many peers in the sector. The stock’s upward momentum has accelerated in recent months, which suggests renewed investor optimism as the company builds on a solid run of financial results and continues to execute its growth strategy.

If you’re following pharma’s latest movers, this could be a good time to explore more names with solid pipelines and dividend potential using our See the full list for free.

With the stock now trading near its price target after such rapid gains, the key question is whether Supernus Pharmaceuticals remains undervalued, or if the market has already factored in all its future growth. Is there still a buying opportunity?

Most Popular Narrative: 2.4% Undervalued

The narrative’s fair value estimate puts Supernus Pharmaceuticals just above its last close, setting up a tug-of-war between bullish and cautious outlooks. The rationale behind this calculated optimism is best captured in the company’s multi-pronged growth story. Here is a snapshot of its underlying logic.

Growth driven by expanding CNS patient pool, innovative product launches, and pipeline advancements supports higher revenue, margin expansion, and robust market positioning.

Strong balance sheet and targeted acquisitions enable portfolio diversification, providing flexibility for inorganic growth and increased long-term shareholder value.

Curious what’s powering this optimism? The valuation rests on a transformative blend of product momentum, breakthrough pipeline hopes, and aggressive financial estimates. These are numbers that could surprise even seasoned investors. Discover the critical projections and strategic bets that shape this narrative's fair value math.

Result: Fair Value of $49.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, such as Supernus’s heavy reliance on a few core CNS products and mounting pressures on drug pricing. Both of these factors could challenge its growth story.

Find out about the key risks to this Supernus Pharmaceuticals narrative.

Another View: Price-to-Earnings Tells a Different Story

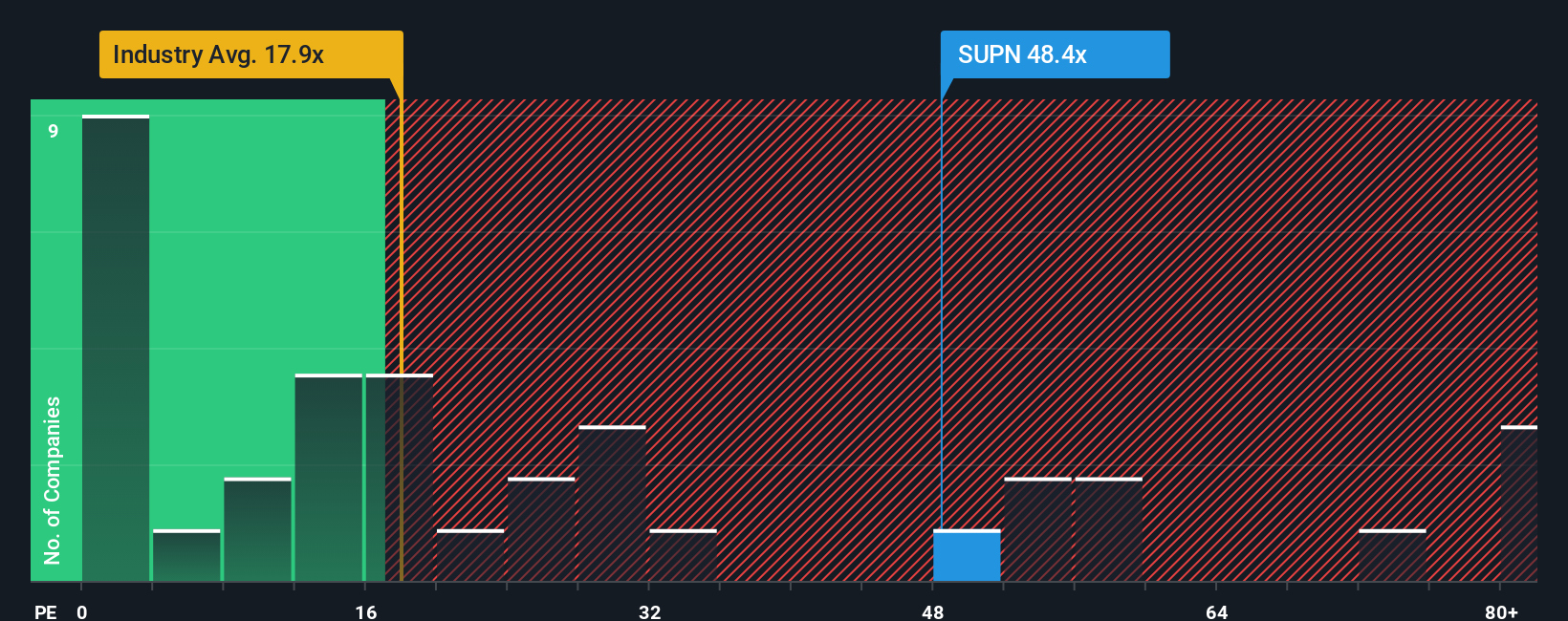

While the narrative suggests Supernus Pharmaceuticals is undervalued, the price-to-earnings ratio paints a more cautious picture. Trading at 41.7 times earnings, SUPN looks expensive compared to both its peers (24.8x) and the US pharmaceuticals industry average (18.3x). The fair ratio the market could move towards is 26.4x, which signals a potential valuation risk if expectations reset. So, does the optimism outweigh the pricing risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Supernus Pharmaceuticals Narrative

If you see the story differently or want to dig deeper into the numbers, you can quickly build your own perspective and conclusions in minutes. Do it your way

A great starting point for your Supernus Pharmaceuticals research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Give yourself a clear edge in the market by quickly scanning handpicked stocks that have the numbers and trends to match your ambitions. Don’t let the next winner slip by.

- Capture high dividends and steady income potential by checking out these 19 dividend stocks with yields > 3% yielding above 3% on reliable fundamentals.

- Tap into innovation at the intersection of medicine and artificial intelligence by reviewing these 32 healthcare AI stocks transforming healthcare outcomes and investor returns.

- Spot tomorrow’s biggest gainers early with these 3573 penny stocks with strong financials that combine sound financials and proven resilience at a bargain price.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SUPN

Supernus Pharmaceuticals

A biopharmaceutical company, develops and commercializes products for the treatment of central nervous system (CNS) diseases in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives