- United States

- /

- Pharma

- /

- NasdaqGM:SUPN

How BofA Securities' Focus on CNS Portfolio and Sage Deal Could Shape Supernus (SUPN)'s Investment Story

Reviewed by Sasha Jovanovic

- In recent days, BofA Securities initiated coverage on Supernus Pharmaceuticals, highlighting its central nervous system drug portfolio and the company's recent acquisition of Sage Therapeutics as key growth drivers.

- Analyst attention has centered on Supernus' expanding pipeline and acquisition activity in CNS therapies, underscoring a shift in investor sentiment and focus on future revenue prospects.

- We'll explore how BofA Securities' focus on the Sage Therapeutics acquisition may influence Supernus Pharmaceuticals' broader investment narrative.

We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Supernus Pharmaceuticals Investment Narrative Recap

To own Supernus Pharmaceuticals, investors need confidence in the company's ability to expand its CNS drug portfolio and realize value from acquisitions like Sage Therapeutics. While BofA Securities' coverage emphasizes growth drivers such as Qelbree and Onapgo, near-term performance will likely hinge on upcoming earnings, with the standout risk remaining the company's sensitivity to pricing pressure and reliance on a limited number of core products. The Sage Therapeutics acquisition adds to the narrative, but it does not materially change the importance of protecting market share for existing drugs. One relevant recent announcement is Supernus's legal response to Paragraph IV Notice Letters tied to generic challenges for Qelbree. Intellectual property protection remains directly linked to revenue stability and future earnings, especially as competition in CNS therapies intensifies. How Supernus manages these challenges will continue to shape its outlook and directly influence both the risk profile and revenue growth prospects for shareholders. However, investors should also be aware that increased competition and tightening payer controls may...

Read the full narrative on Supernus Pharmaceuticals (it's free!)

Supernus Pharmaceuticals' projections suggest revenues of $837.3 million and earnings of $55.4 million by 2028. This implies annual revenue growth of 7.8%, but earnings are expected to decrease by $6.5 million from current earnings of $61.9 million.

Uncover how Supernus Pharmaceuticals' forecasts yield a $55.20 fair value, in line with its current price.

Exploring Other Perspectives

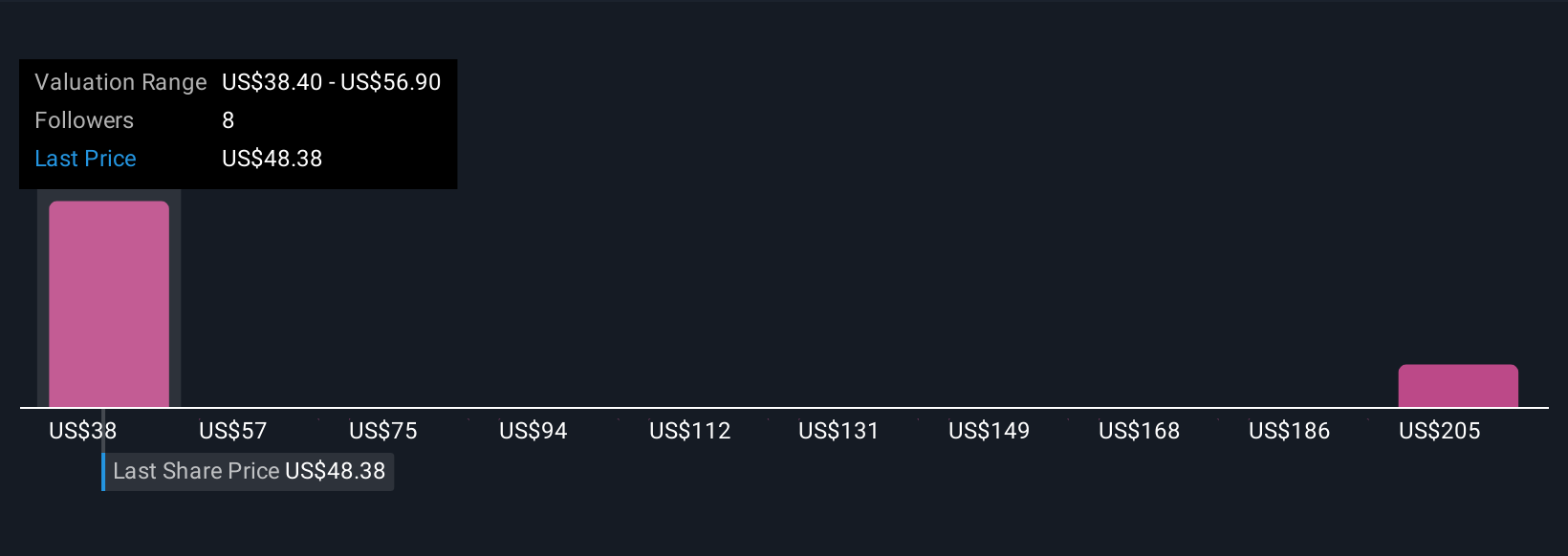

Three separate fair value estimates from the Simply Wall St Community range from US$38.40 to US$226.06 per share. With such varied perspectives, consider how rising R&D costs and heavy reliance on a few core products could affect Supernus Pharmaceuticals' future performance.

Explore 3 other fair value estimates on Supernus Pharmaceuticals - why the stock might be worth over 4x more than the current price!

Build Your Own Supernus Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Supernus Pharmaceuticals research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Supernus Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Supernus Pharmaceuticals' overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SUPN

Supernus Pharmaceuticals

A biopharmaceutical company, develops and commercializes products for the treatment of central nervous system (CNS) diseases in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives