- United States

- /

- Biotech

- /

- NasdaqGM:STRO

There's No Escaping Sutro Biopharma, Inc.'s (NASDAQ:STRO) Muted Revenues Despite A 29% Share Price Rise

Sutro Biopharma, Inc. (NASDAQ:STRO) shares have had a really impressive month, gaining 29% after a shaky period beforehand. Unfortunately, despite the strong performance over the last month, the full year gain of 8.9% isn't as attractive.

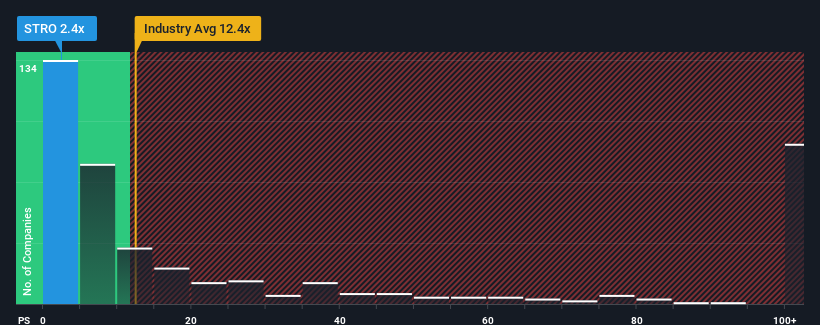

In spite of the firm bounce in price, Sutro Biopharma's price-to-sales (or "P/S") ratio of 2.4x might still make it look like a strong buy right now compared to the wider Biotechs industry in the United States, where around half of the companies have P/S ratios above 12.4x and even P/S above 72x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Sutro Biopharma

How Has Sutro Biopharma Performed Recently?

With revenue growth that's superior to most other companies of late, Sutro Biopharma has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Sutro Biopharma will help you uncover what's on the horizon.How Is Sutro Biopharma's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as Sutro Biopharma's is when the company's growth is on track to lag the industry decidedly.

If we review the last year of revenue growth, the company posted a terrific increase of 198%. The latest three year period has also seen an excellent 146% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the eleven analysts covering the company suggest revenue growth is heading into negative territory, declining 13% per annum over the next three years. That's not great when the rest of the industry is expected to grow by 139% per annum.

With this in consideration, we find it intriguing that Sutro Biopharma's P/S is closely matching its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What Does Sutro Biopharma's P/S Mean For Investors?

Even after such a strong price move, Sutro Biopharma's P/S still trails the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Sutro Biopharma's analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. As other companies in the industry are forecasting revenue growth, Sutro Biopharma's poor outlook justifies its low P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Sutro Biopharma, and understanding these should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:STRO

Moderate risk and fair value.

Market Insights

Community Narratives