- United States

- /

- Biotech

- /

- NasdaqGS:STOK

Stoke Therapeutics (STOK) Is Down 23.9% After Reporting Sharp Nine-Month Profit Turnaround and Revenue Surge

Reviewed by Sasha Jovanovic

- Stoke Therapeutics reported third quarter 2025 earnings, highlighting a rise in sales to US$10.63 million from US$4.89 million a year earlier, and a reduced quarterly loss but a profitable nine months ending September 30, 2025, compared to a loss in the prior year period.

- For the nine months, Stoke’s financial turnaround was reflected in net income of US$51.05 million after previously recording a net loss of US$78.5 million in the prior year, signaling a sharp shift in profitability.

- We’ll explore how Stoke’s very large year-over-year revenue gains and move to profitability shape its ongoing investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Stoke Therapeutics' Investment Narrative?

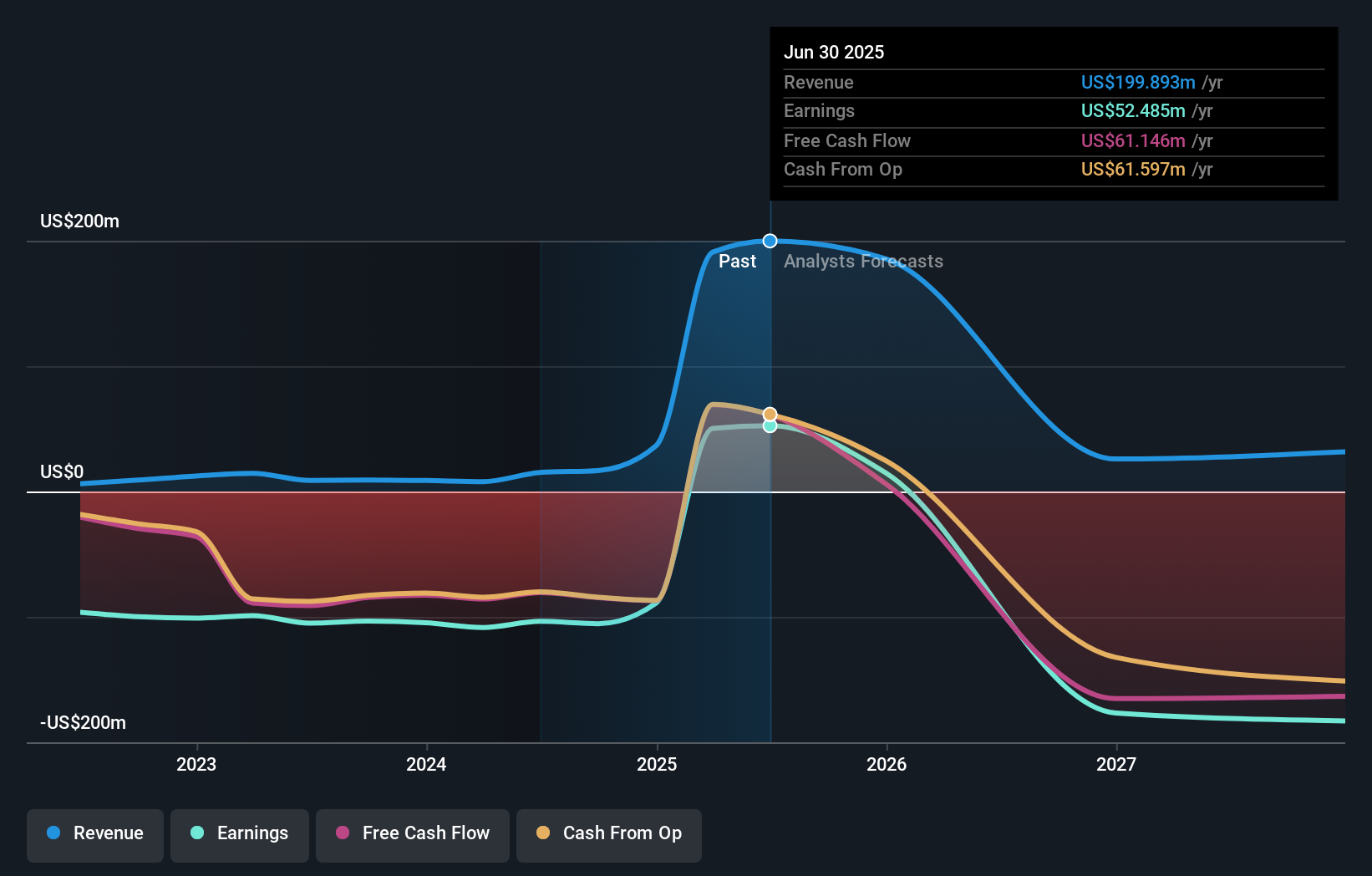

To be a Stoke Therapeutics shareholder right now, you need confidence in the company's ability to translate recent strong revenue gains and its unexpected nine-month profitability into a stable, longer-term trajectory. The latest earnings report, showing a huge year-over-year sales increase and first-time profit for the nine months, could provide momentum for the investment story, particularly as it follows on positive clinical updates for the company's lead drug candidates. However, this news does not erase core risks that remain front of mind. Analysts are still projecting declining revenue and earnings over the next three years, and the stock price has fallen sharply in recent weeks after earlier gains. Volatility, an inexperienced management team and significant insider selling could temper optimism from the recent results by signaling that the underlying business faces new challenges, even as its clinical and financial achievements make headlines. On the other hand, heavy insider selling is something investors should keep an eye on.

Stoke Therapeutics' share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 3 other fair value estimates on Stoke Therapeutics - why the stock might be worth less than half the current price!

Build Your Own Stoke Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Stoke Therapeutics research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Stoke Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Stoke Therapeutics' overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STOK

Stoke Therapeutics

An early-stage biopharmaceutical company, engages in the development of treatments for severe genetic diseases by upregulating protein expression.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives