- United States

- /

- Biotech

- /

- NasdaqGS:STOK

Should Investors Rethink Stoke Therapeutics After Shares Climb 122% on Gene Therapy Hype?

Reviewed by Bailey Pemberton

If you’re standing at the crossroads with Stoke Therapeutics stock, you’re certainly not alone. After all, over the past year, shares have soared by 122.4%. That is only the tip of the iceberg when you look at the 142.3% climb since the start of the year. More recently, Stoke put up a hefty 32.1% gain in the last month and is up 16.2% just in the past week. It is no wonder this biotech name is catching investors’ attention, especially as recent market optimism around gene-based therapies has driven a refreshed wave of risk-on sentiment across the sector.

Of course, all that excitement also brings a big question with it: is Stoke Therapeutics stock still worth buying, or are we looking at a classic case of buyers chasing momentum? There is always more beneath the surface, especially for a company that has seen both rapid recent growth and a not-so-glamorous -30.1% return over the last five years. Fundamentals matter, and so does valuation, which is exactly where we are headed next.

Looking at a wide set of standard valuation checks, Stoke Therapeutics comes in with a score of 1 out of 6 for undervaluation. In other words, it might not jump off the page as a screaming bargain, but there is more to the story than any single metric can tell us. Let’s dig into those valuation approaches so you can decide what really drives value here. Stick around, because at the end, we will look at a smarter way to make sense of the numbers.

Stoke Therapeutics scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Stoke Therapeutics Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a common method for estimating a company’s true value by projecting its expected future cash flows and discounting them back to their present value. This approach aims to answer one simple question: how much are Stoke Therapeutics’ future earnings worth today in dollars?

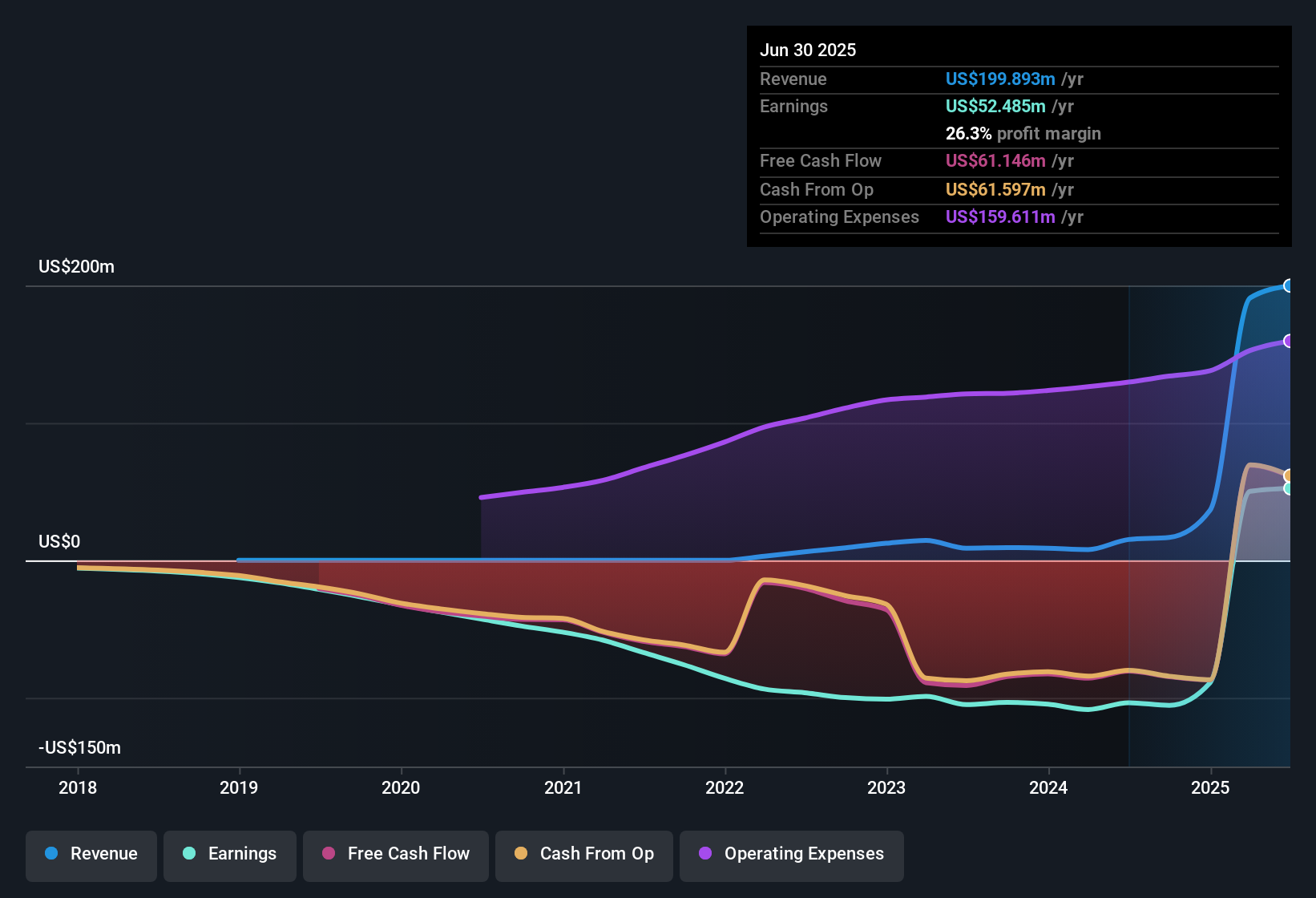

For Stoke Therapeutics, analysts report a last twelve months (LTM) free cash flow of $57.5 million. Future projections are mixed, with estimates showing negative free cash flow over the next few years, then an eventual rebound. By 2029, projected free cash flow turns positive at roughly $11 million, and by 2035, models expect Stoke to generate about $33 million annually. It is worth noting that projections past five years are extrapolated and therefore carry extra uncertainty.

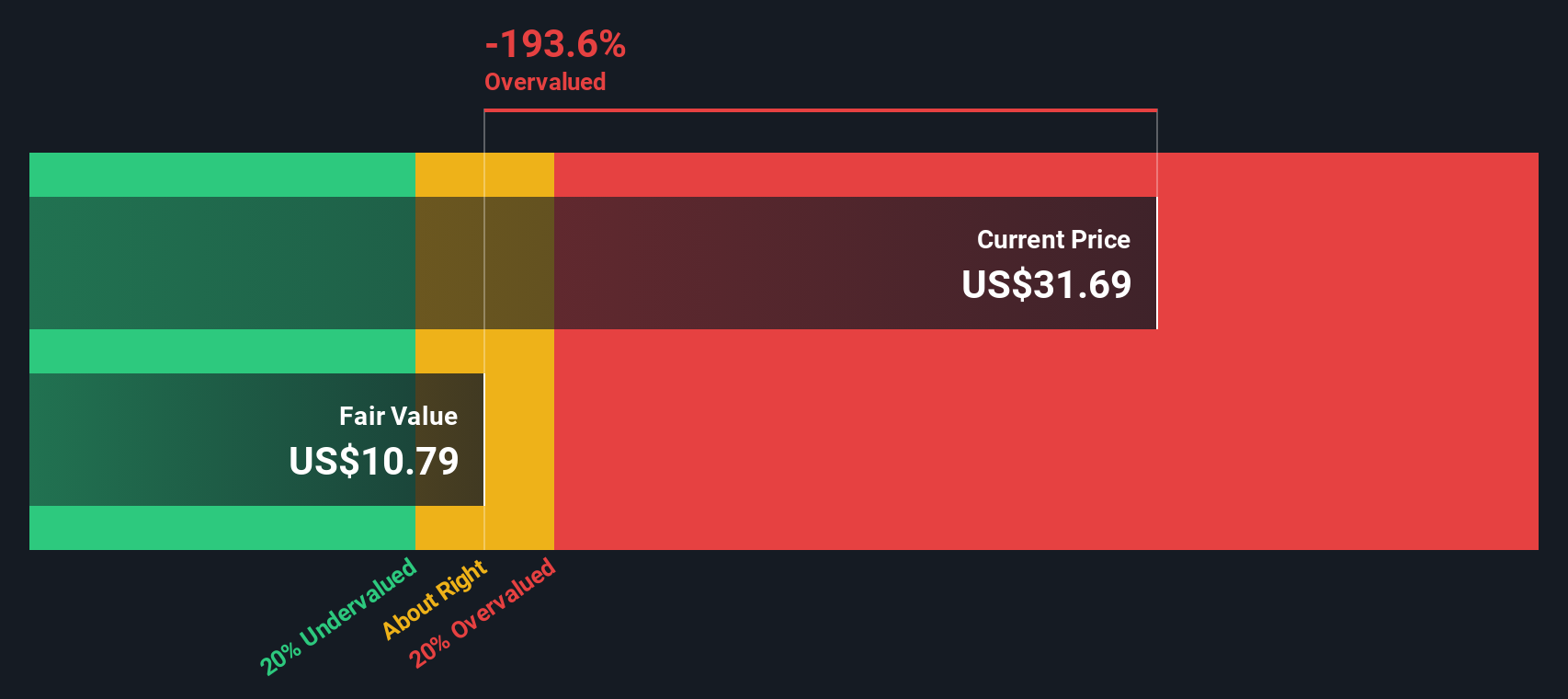

Crunching the numbers, the DCF model calculates Stoke Therapeutics’ fair value at $3.64 per share. However, the current share price stands far above that, and the model’s implied discount indicates the stock is a massive 650.6% overvalued based on these cash flow forecasts.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Stoke Therapeutics may be overvalued by 650.6%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Stoke Therapeutics Price vs Earnings (PE Ratio)

For companies that have moved into profitability, the Price-to-Earnings (PE) ratio is often the go-to metric for valuation. It measures how much investors are willing to pay for each dollar of current earnings and is especially relevant for biotech firms like Stoke Therapeutics that have matured from early-stage R&D to actual earnings.

It is important to note that the “headline” PE number is only the starting point. Higher-growth or lower-risk companies generally command higher PE ratios, while more uncertain or slower-growing businesses typically trade at a discount. So, simply looking at Stoke's PE ratio is not enough; it needs context.

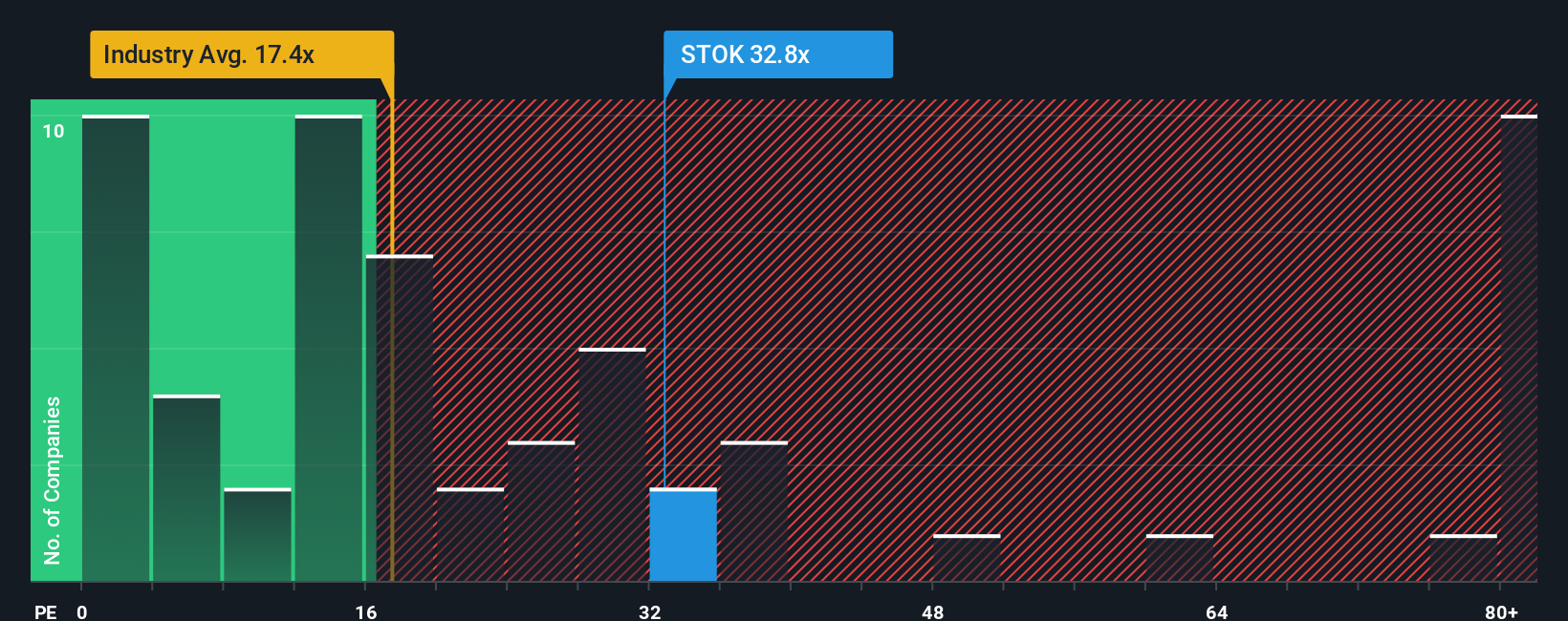

Currently, Stoke Therapeutics trades at a PE of 28.5x. Compared to the biotech industry average of 16.6x and a peer group average of 29.5x, Stoke stands out as more expensive than most biotechs but roughly in line with immediate peers. However, benchmarks like these can only tell part of the story.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. The Fair Ratio for Stoke is 11.7x, which accounts for the company’s growth prospects, industry characteristics, profit margins, market cap, and specific risks. This tailored approach gives a much clearer sense of what a reasonable multiple for Stoke should be compared to just using peers or the broader industry.

With Stoke’s actual PE of 28.5x sitting well above its Fair Ratio of 11.7x, the stock screens as overvalued by this perspective.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Stoke Therapeutics Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story or perspective on a company, describing how you think its future will play out based on factors like revenue, profit margins, and growth, all incorporated into a fair value estimate.

Narratives bridge the gap between a company’s business story and the numbers behind it, connecting your outlook with a financial forecast and arriving at a fair value that is uniquely yours. The best part is that Narratives are easy to create and use, and they are available right on Simply Wall St’s Community page, where millions of investors share their perspectives.

Using Narratives, you can see at a glance whether Stoke Therapeutics’ price looks attractive compared to your fair value, helping you decide when it might be time to buy or sell. These Narratives automatically update as new news or earnings reports come in, so your view stays fresh and relevant.

For example, one investor’s Narrative might put Stoke’s fair value at $2 per share, while another sees a much more optimistic case at $14 per share. This gives you clarity on how real people are interpreting the same business from different angles.

Do you think there's more to the story for Stoke Therapeutics? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STOK

Stoke Therapeutics

An early-stage biopharmaceutical company, engages in the development of treatments for severe genetic diseases by upregulating protein expression.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives