- United States

- /

- Biotech

- /

- NasdaqGS:SRRK

Will Analyst Attention on SRRK Spotlight the Strategic Risks in Scholar Rock’s FDA Response Plan?

Reviewed by Sasha Jovanovic

- Earlier this month, an analyst at Bank of America Securities began coverage of Scholar Rock Holding, highlighting the clinical-stage biotech’s leading investigational therapy for spinal muscular atrophy, apitegromab, and noted the company is working to address the FDA's concerns after a complete response letter for its approval application.

- This development draws attention to Scholar Rock’s progress in advancing treatments beyond current options for neuromuscular disorders.

- To assess how this heightened analyst attention and ongoing regulatory efforts could influence Scholar Rock’s investment narrative, let's focus on apitegromab’s potential.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is Scholar Rock Holding's Investment Narrative?

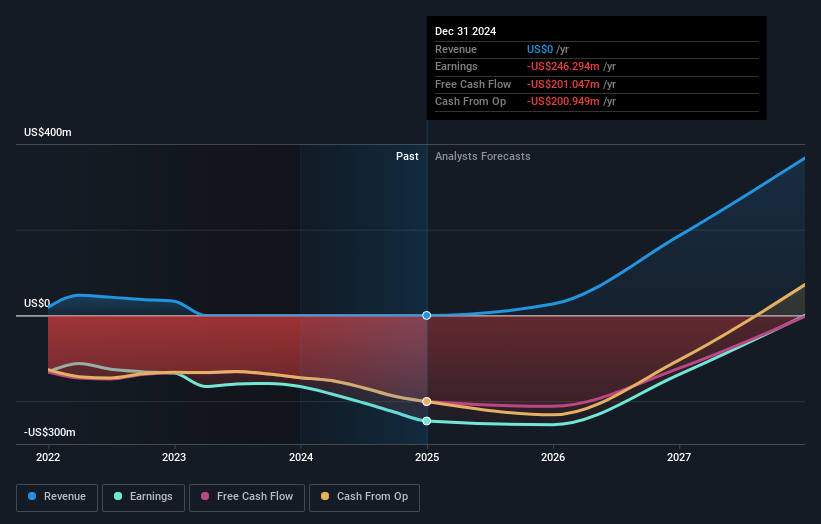

For anyone considering Scholar Rock as a potential investment, the big picture centers on believing in the company’s ability to bring apitegromab, its lead SMA therapy, through regulatory hurdles and into the market. The recent analyst coverage from Bank of America Securities adds a shot of confidence, shining a brighter spotlight on upcoming regulatory milestones and short-term catalysts. Importantly, with the FDA’s complete response letter focused on manufacturing issues, the real hurdle right now is not efficacy but regulatory remediation at Catalent Indiana. The company’s near-term catalyst remains the resubmission and potential approval of apitegromab, but risks tied to clinical setbacks, ongoing losses, and regulatory delays have not disappeared. While this renewed analyst interest may help sentiment and has already pushed the share price higher in recent weeks, the path to revenue generation and profitability remains uncertain, and none of the underlying risks have meaningfully lessened.

However, manufacturing challenges and ongoing losses remain issues that investors should not overlook.

Exploring Other Perspectives

Explore another fair value estimate on Scholar Rock Holding - why the stock might be worth just $47.80!

Build Your Own Scholar Rock Holding Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Scholar Rock Holding research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Scholar Rock Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Scholar Rock Holding's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SRRK

Scholar Rock Holding

A biopharmaceutical company, focuses on the discovery, development, and delivery of medicines for the treatment of serious diseases in which signaling by protein growth factors plays a fundamental role.

Good value with adequate balance sheet.

Market Insights

Community Narratives