- United States

- /

- Biotech

- /

- NasdaqGS:SRRK

Does FDA’s Manufacturing Setback for Apitegromab Alter the Investment Outlook for Scholar Rock (SRRK)?

Reviewed by Simply Wall St

- On September 23, 2025, Scholar Rock announced that the U.S. FDA issued a Complete Response Letter for the apitegromab Biologics License Application due to manufacturing issues identified at Catalent Indiana, a third-party fill-finish facility.

- Importantly, the FDA's feedback relates exclusively to facility observations and does not involve any concerns regarding the drug's clinical data or patient safety.

- We'll examine how this regulatory delay, rooted in third-party manufacturing concerns, may influence Scholar Rock’s broader investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Scholar Rock Holding's Investment Narrative?

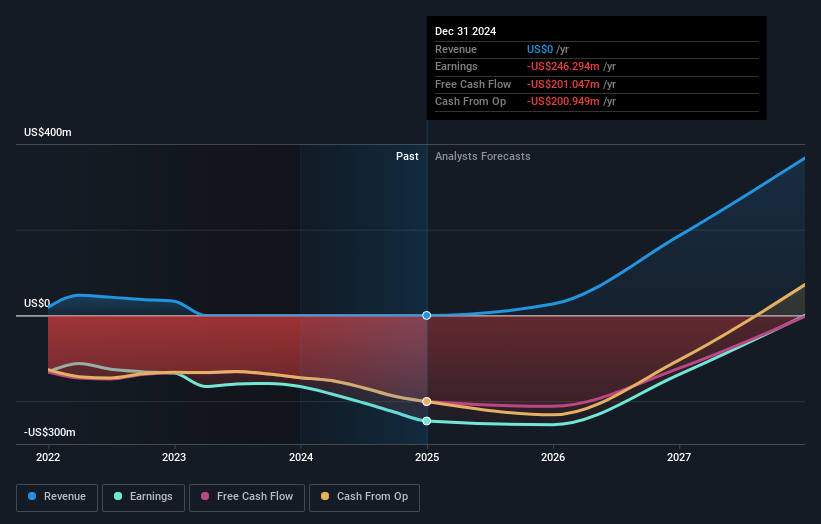

To be aligned with Scholar Rock’s story as a shareholder, you need to believe in the potential for apitegromab to become a differentiated therapy in spinal muscular atrophy, anchoring future revenue growth for a company that is currently unprofitable and has reported widening net losses. The recent FDA Complete Response Letter on apitegromab, driven solely by third-party manufacturing concerns rather than the drug’s clinical data, introduces a significant short-term setback: it delays the treatment’s possible approval and subsequent commercialization. This regulatory hurdle now becomes the dominant near-term risk, outweighing previous near-term catalysts such as a potential product launch and recognition from recent clinical milestones and regulatory designations. While Scholar Rock’s core scientific progress and data integrity remain unchanged, the delay places pressure on the company’s cash resources as it remains pre-revenue and continues to post large quarterly losses. Investors should now closely monitor both the timeline and outcome for addressing these external manufacturing issues.

But with these new manufacturing-related risks, shareholders face fresh uncertainty over future approval timing.

Exploring Other Perspectives

Explore another fair value estimate on Scholar Rock Holding - why the stock might be worth as much as 43% more than the current price!

Build Your Own Scholar Rock Holding Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Scholar Rock Holding research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Scholar Rock Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Scholar Rock Holding's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SRRK

Scholar Rock Holding

A biopharmaceutical company, focuses on the discovery, development, and delivery of medicines for the treatment of serious diseases in which signaling by protein growth factors plays a fundamental role.

Adequate balance sheet and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success