- United States

- /

- Biotech

- /

- NasdaqGS:SNDX

Syndax Pharmaceuticals (SNDX): Valuation in Focus After Revumenib Wins Key NCCN Recommendation and Priority FDA Review

Reviewed by Kshitija Bhandaru

The National Comprehensive Cancer Network has updated its guidelines to recommend Revumenib, a Syndax Pharmaceuticals (SNDX) treatment, for relapsed or refractory AML with an NPM1 mutation. This update comes after recent positive trial results and an ongoing FDA priority review.

See our latest analysis for Syndax Pharmaceuticals.

Syndax Pharmaceuticals has stayed in focus thanks to FDA updates and encouraging progress for its lead therapies, including the recent NCCN endorsement for Revumenib and new stock option awards for incoming team members. While these catalysts have kept momentum building, Syndax’s share price return suggests the market is still weighing its growth story. Long-term total shareholder returns remain modest, reflecting both past challenges and current optimism.

If you’re watching how news can shift company trajectories, you might also want to explore other healthcare names making waves. Start your search with the See the full list for free..

With the share price still trailing analysts’ targets despite recent breakthroughs, investors might wonder if Syndax Pharmaceuticals is trading at a discount or if the current price already reflects the company’s future growth prospects.

Most Popular Narrative: 57.3% Undervalued

Syndax Pharmaceuticals’ narrative fair value stands far above its last close, sparking questions about what could fuel such a bold upside projection. Here is what is driving that optimism behind the scenes.

A fixed operating expense base, combined with expanding product sales and cash flow contributions from both franchises, is positioned to drive significant operating leverage by boosting net margins and accelerating the pathway to profitability. Late-stage pipeline advancements (including frontline trials, lifecycle management, and expansion into new indications like IPF for Niktimvo), along with strong clinical data and market-leading positions in precision oncology, provide robust long-term growth avenues aligned with surging demand for innovative, targeted therapies, supporting sustained multi-year earnings momentum.

Want to uncover why this target is so much higher than today’s market price? The narrative hinges on ambitious profit margin expansion and substantial revenue scaling in the years ahead. Wondering what surprising financial assumptions are at its core? Find out what is behind this significant valuation jump and see if it matches your outlook.

Result: Fair Value of $36.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant setbacks such as regulatory delays or disappointing trial results for Revuforj and Niktimvo could quickly undermine these optimistic projections.

Find out about the key risks to this Syndax Pharmaceuticals narrative.

Another View: Risk in the Multiples

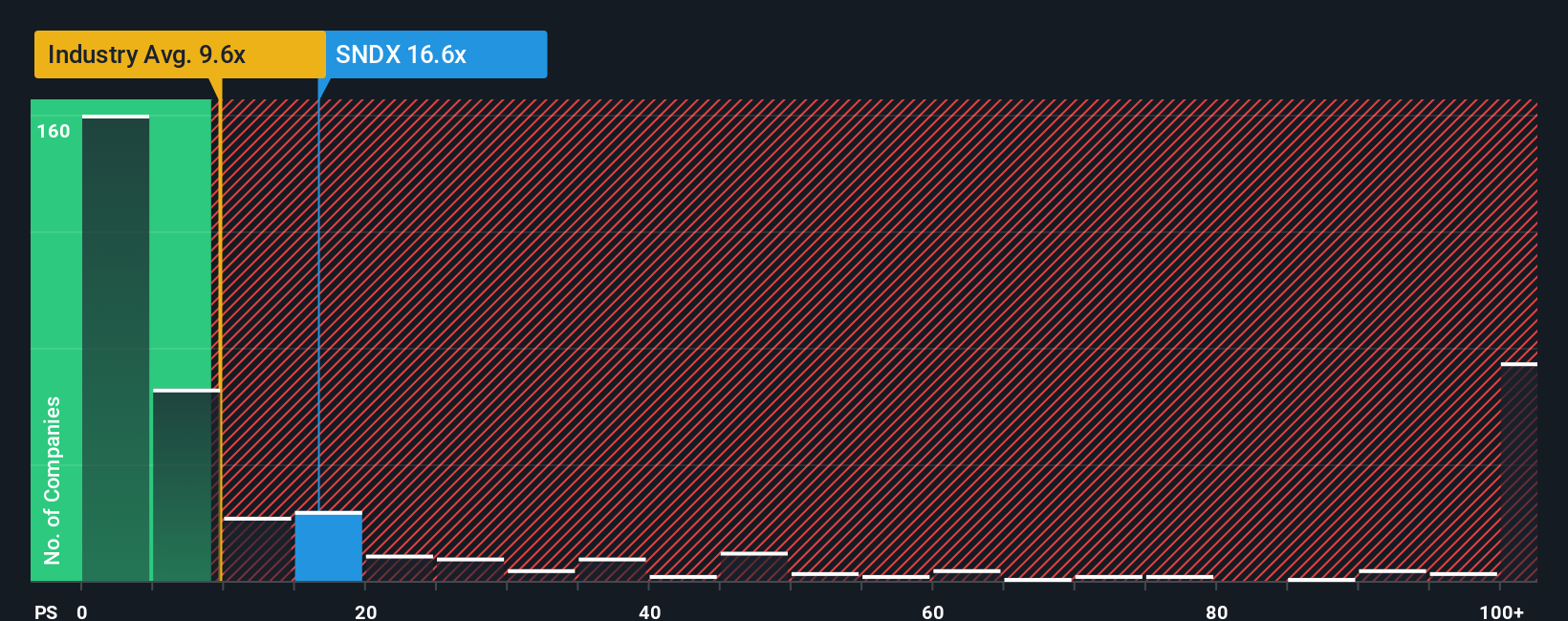

Although analysts’ forecasts suggest Syndax Pharmaceuticals is undervalued, its price-to-sales ratio is 17.2x, higher than the US Biotechs industry average of 10.5x and even further above the estimated fair ratio of just 0.2x. This premium raises tough questions about potential downside if the market’s optimism shifts.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Syndax Pharmaceuticals Narrative

If you want to examine the numbers differently or see if your perspective leads to a unique conclusion, you can craft a personalized narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Syndax Pharmaceuticals.

Looking for More Investment Ideas?

Don’t let today’s opportunities slip by. With unique ways to search across the market, you could spot the next breakout before everyone else does.

- Capture untapped growth with these 25 AI penny stocks, which are transforming industries through artificial intelligence and automation.

- Secure steady potential income by checking out these 19 dividend stocks with yields > 3%, offering generous yields over 3% for added peace of mind in your portfolio.

- Ride the next tech revolution by considering these 26 quantum computing stocks, which are at the forefront of quantum computing breakthroughs and game-changing innovations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SNDX

Syndax Pharmaceuticals

A commercial-stage biopharmaceutical company, develops therapies for the treatment of cancer.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives