- United States

- /

- Biotech

- /

- NasdaqGS:SNDX

Syndax Pharmaceuticals (SNDX) Is Down 5.4% After FDA Approves Revuforj for Expanded Leukemia Use – Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- On October 24, 2025, Syndax Pharmaceuticals announced that the U.S. FDA has approved Revuforj (revumenib) to treat relapsed or refractory acute myeloid leukemia (AML) with an NPM1 mutation in adults and children aged one year and older who lack other satisfactory treatment options.

- This latest approval makes Revuforj the first and only FDA-approved therapy for both NPM1-mutated and KMT2A-translocated relapsed/refractory acute leukemias, expanding its reach as a menin inhibitor in the oncology landscape.

- We'll examine how the expanded FDA approval for Revuforj shapes Syndax Pharmaceuticals' investment narrative and future precision oncology potential.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Syndax Pharmaceuticals Investment Narrative Recap

To be a Syndax Pharmaceuticals shareholder, you need conviction that Revuforj and Niktimvo can drive meaningful commercial success and regulatory progress, overcoming the company's concentrated late-stage pipeline risk. The recent FDA approval of Revuforj for NPM1-mutated acute myeloid leukemia directly addresses a major near-term catalyst, opening an expanded patient population; however, the accompanying severe safety warnings and negative stock reaction underscore that significant commercial, regulatory, and competitive challenges persist, which may materially impact the risk profile in the short run.

Among recent announcements, the September 2025 update from the National Comprehensive Cancer Network including revumenib as a category 2A recommendation for NPM1-mutated relapsed/refractory AML is closely tied to the new FDA approval. This guideline inclusion could support increased physician adoption and help drive revenue, but real-world uptake and pricing power remain open questions against the backdrop of industry and payer headwinds.

Yet, despite this progress, investors should be aware that Revuforj's labeling now includes critical safety warnings and the commercial path ahead depends on...

Read the full narrative on Syndax Pharmaceuticals (it's free!)

Syndax Pharmaceuticals' narrative projects $603.4 million in revenue and $43.5 million in earnings by 2028. This requires 97.8% yearly revenue growth and a $378.5 million increase in earnings from -$335.0 million today.

Uncover how Syndax Pharmaceuticals' forecasts yield a $36.55 fair value, a 170% upside to its current price.

Exploring Other Perspectives

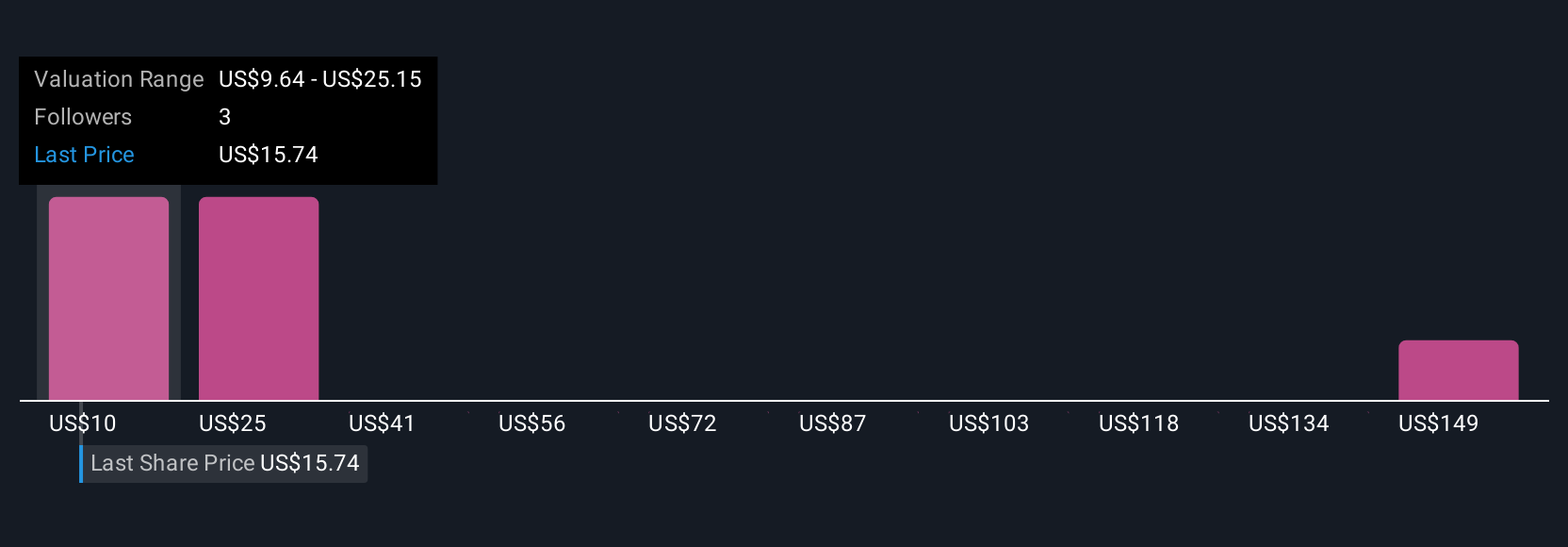

Simply Wall St Community members estimate fair value for Syndax Pharmaceuticals from US$9.64 to US$214.93 across six opinions. While some see upside after guideline inclusions, others point to ongoing financial and competitive risks that could shape contrasting expectations for revenue growth and stock performance.

Explore 6 other fair value estimates on Syndax Pharmaceuticals - why the stock might be worth 29% less than the current price!

Build Your Own Syndax Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Syndax Pharmaceuticals research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Syndax Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Syndax Pharmaceuticals' overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SNDX

Syndax Pharmaceuticals

A commercial-stage biopharmaceutical company, develops therapies for the treatment of cancer.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives