- United States

- /

- Pharma

- /

- NasdaqCM:SNDL

SNDL (NasdaqCM:SNDL) Forecasts 168% Annual Earnings Growth, Reinforcing Bullish Valuation Narrative

Reviewed by Simply Wall St

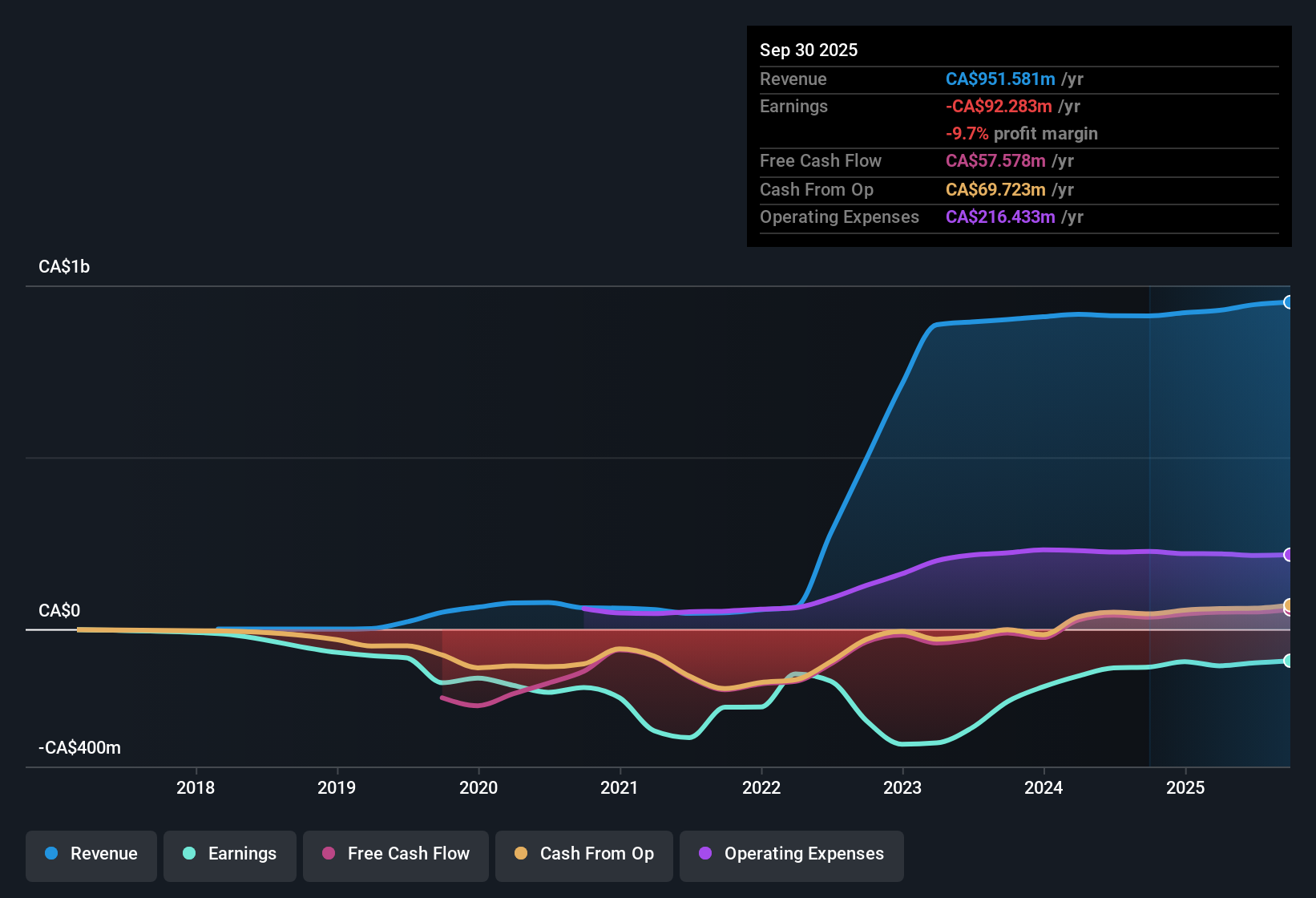

SNDL (NasdaqCM:SNDL) narrowed its losses by an average of 16.4% per year over the last five years, with forecasts now calling for explosive 168.19% annual earnings growth and a move to profitability within three years. While revenue is anticipated to grow just 2.8% per year, lagging the US market’s 10.5% rate, shares have remained volatile in recent months and stability is still elusive. Investors are weighing this rapid progress on the earnings front and SNDL’s discounted Price-to-Sales ratio of 0.7x against choppy trading and the slower revenue outlook.

See our full analysis for SNDL.Next, we will put these new numbers head-to-head with the major narratives investors are following to see which themes hold up under scrutiny.

See what the community is saying about SNDL

International Push Lifts Margins

- Gross margins reached record levels and SNDL posted its first-ever positive operating income, attributed to international expansion and high-margin European exports as noted in the consensus narrative.

- Consensus narrative highlights that disciplined cost control and realized synergies from acquisitions, such as Indiva and 1CM, contributed to these margin gains.

- Outperformance of cannabis operations compared to the Canadian market and a strategic focus on high-margin markets support the pursuit of durable profitability.

- Strong cash reserves and vertical integration enable SNDL to manage volatility while investing for growth.

Heavy Investment Pressures Cash Flow

- Despite reaching positive operating income, SNDL continues to report negative free cash flow due to significant working capital outlays and aggressive capital expenditures.

- Consensus narrative notes risks that heavy spending on international growth and new store openings could strain cash reserves if expected expansion does not materialize.

- Ongoing capital commitments and exposure to margin compression in new markets may limit improvements to net margins in the coming years.

- Challenges such as low Canadian market share and slow alcohol retail growth raise questions about SNDL’s ability to quickly scale operating leverage.

Valuation Frames the Upside

- SNDL’s Price-to-Sales ratio of 0.7x is well below the peer average of 5.7x and the industry’s 4.3x, indicating a significant discount at the current $1.86 share price compared to the $4.69 analyst target, based on consensus narrative expectations for a turnaround.

- Consensus narrative suggests that in order to meet the analyst price target, SNDL must achieve aggressive forecasts, including reaching $1.1 billion in revenue and raising margins to align with the industry average of 23.2% by 2028.

- Analysts project the number of shares outstanding will decline by over 3% per year, supporting per-share earnings growth if operational targets are achieved.

- Investors are advised to evaluate these assumptions, as achieving the projected 168% annual earnings growth and maintaining expansion are critical to realizing potential gains from today’s valuation.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for SNDL on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the data? Shape your own story in just a few minutes and share your perspective. Do it your way.

A great starting point for your SNDL research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

SNDL’s progress on margins and earnings comes with ongoing negative free cash flow and uncertainty about sustaining growth amid capital-intensive expansion.

If you want steadier momentum and fewer cash flow surprises, use stable growth stocks screener (2077 results) to zero in on companies that deliver consistent results across market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SNDL

SNDL

Engages in the production, distribution, and sale of cannabis products for the adult-use market in Canada.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives