- United States

- /

- Pharma

- /

- NasdaqCM:SNDL

A Look at SNDL (NasdaqCM:SNDL) Valuation After Recent Earnings Show Higher Sales and Slimmer Net Losses

Reviewed by Simply Wall St

SNDL (NasdaqCM:SNDL) has released its third quarter and nine month earnings for 2025, revealing higher sales and a narrower net loss compared to the same periods last year. These updates are sparking fresh investor interest.

See our latest analysis for SNDL.

SNDL’s share price has been on a rollercoaster this year. After a rally earlier in the quarter, it’s taken a breather with a 27.7% drop over the past month and a 14.4% fall in the last week, despite the latest earnings showing meaningful sales growth and a slimmer net loss. Looking at the bigger picture, the stock’s one-year total shareholder return of -10.2% and a five-year total return of -52% highlight the long road of recovery that still lies ahead. However, recent momentum in sales and swift management decisions suggest investors are watching for signs of a turnaround.

If you’re curious about what else the market is serving up, this is a smart time to broaden your search and discover fast growing stocks with high insider ownership

With SNDL showing improving financials but still posting losses, the key question is whether the current share price reflects the company’s potential for a turnaround or if there is still an undervalued buying opportunity for investors.

Most Popular Narrative: 61.1% Undervalued

Right now, analysts see SNDL’s fair value as dramatically higher than the last closing price of $1.85. This sets the stage for a potential re-rating if the company delivers on its outlined catalysts.

Strong international growth initiatives, supported by significant working capital investments and the ramp-up of the Atholville cultivation facility, position SNDL to capitalize on expanding global acceptance and legalization of cannabis, particularly in high-margin European export markets. These factors can drive future revenue and margin expansion.

Curious what’s driving that huge valuation gap? The narrative’s math rests on bold assumptions about SNDL’s future margins and growth, supported by both global expansion plans and aggressive financial targets. Which of these projections tip the balance? Explore the narrative to uncover the surprising details behind the analyst outlook.

Result: Fair Value of $4.76 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing negative free cash flow and volatile international margins could challenge SNDL’s turnaround prospects and could dampen the upside in analyst forecasts.

Find out about the key risks to this SNDL narrative.

Another View: What Does Our DCF Model Say?

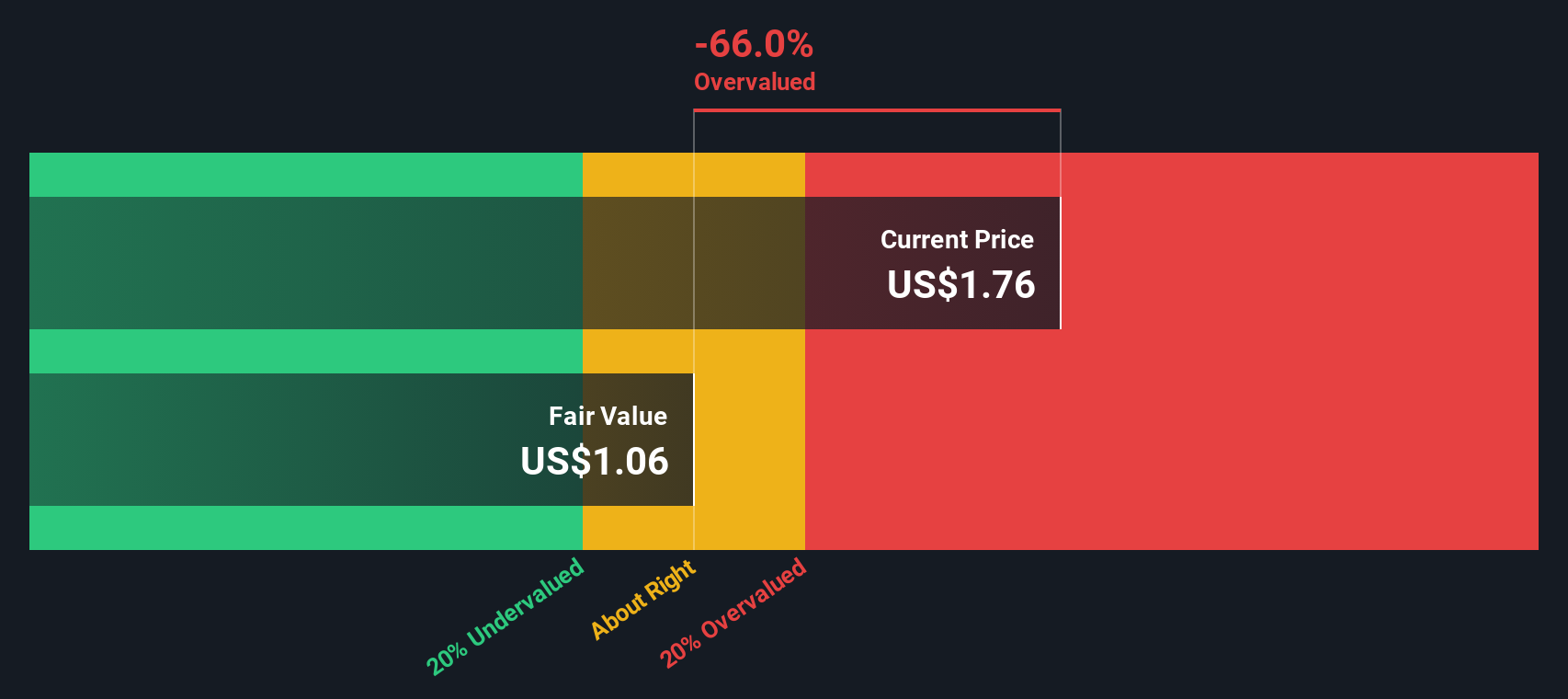

While analysts see upside based on future earnings multiples, our SWS DCF model suggests a different picture. By focusing on cash flows, it estimates SNDL’s fair value at just $1.07 per share, which is below today’s market price. Could analyst optimism be overlooking hidden execution risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out SNDL for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 845 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own SNDL Narrative

If you have your own perspective or want to dig deeper into the numbers, you can build a custom narrative in just a few minutes, your way with Do it your way.

A great starting point for your SNDL research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Expand your portfolio and seize timely opportunities in the market with handpicked stock selections. Don’t let promising possibilities pass you by. Take action on your next great investment now.

- Supercharge your portfolio by targeting companies with consistent and attractive payouts in these 20 dividend stocks with yields > 3%. Make income generation a core part of your strategy.

- Capture the wave of AI innovation by tapping into leading-edge businesses featured in these 26 AI penny stocks to position yourself at the forefront of transformative technology trends.

- Strengthen your search for hidden potential by zeroing in on standout names trading well below their intrinsic worth, all available with these 845 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SNDL

SNDL

Engages in the production, distribution, and sale of cannabis products for the adult-use market in Canada.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives