- United States

- /

- Biotech

- /

- NasdaqGM:SMMT

The Bull Case for Summit Therapeutics (SMMT) Could Change Following $513 Million Capital Raise Announcement

Reviewed by Sasha Jovanovic

- In the past week, Summit Therapeutics announced a shelf registration allowing for the offer and sale of up to 26,682,846 common shares valued at approximately US$513.1 million, following its previously disclosed US$500 million private placement completed with institutional and accredited investors.

- This substantial capital raise and involvement of key insiders such as Robert W. Duggan and Mahkam Zanganeh underscores management’s commitment to advancing Summit’s clinical and regulatory plans, particularly for its ivonescimab oncology program.

- We’ll explore how these significant capital raising efforts may shape Summit Therapeutics’ investment narrative as it continues expanding its clinical pipeline.

We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Summit Therapeutics' Investment Narrative?

To back Summit Therapeutics as a shareholder, you need conviction in the long-term promise of its lead asset, ivonescimab, and faith that clinical progress can eventually justify steep ongoing losses and a high valuation. The latest capital raise, over US$500 million, significantly bolsters Summit’s balance sheet at a critical time, possibly reducing capital risk as the company prepares for regulatory filings and launches new Phase III trials, especially in lung and colorectal cancer. Just as importantly, this influx may shift short-term catalysts, since financial stability can allow management to keep pace on multiple trials without the overhang of further near-term dilution. On the other hand, with profits not expected for several years and share price volatility remaining elevated, the biggest risk is still clinical or regulatory setbacks for ivonescimab. While the cash raise lessens funding concerns, it doesn’t remove the core uncertainties tied to trial outcomes or future approvals, and that’s what could most impact the share price moving forward.

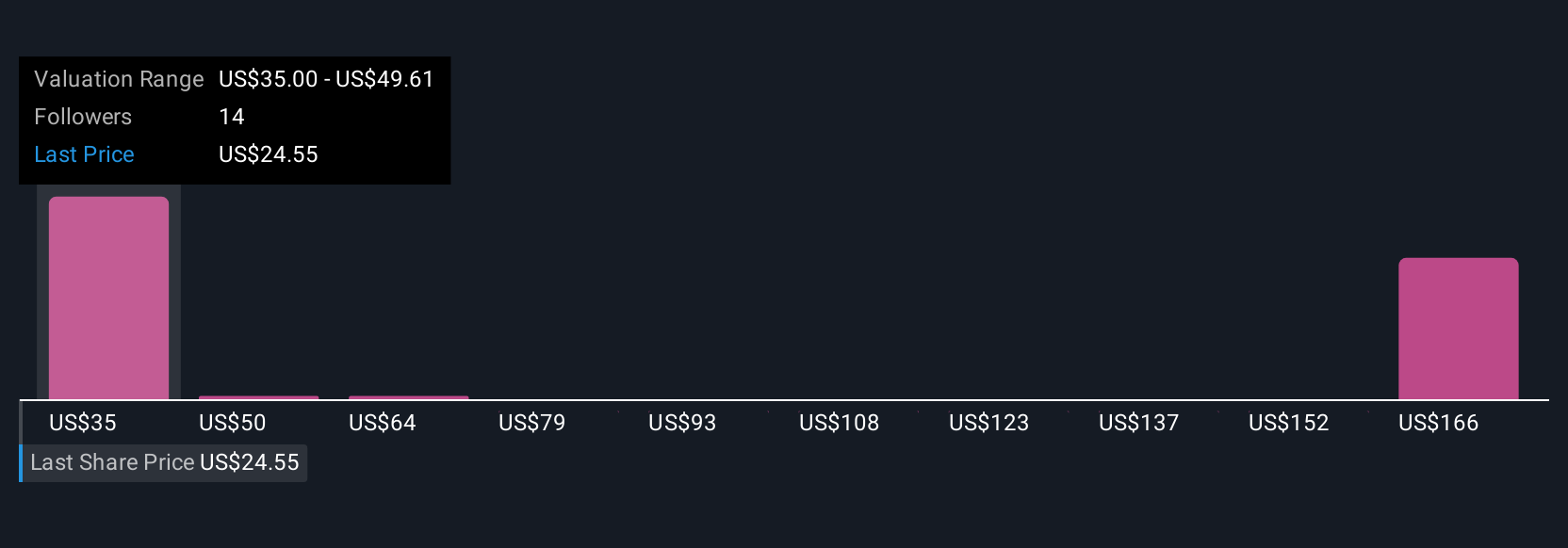

But keep in mind, clinical risk for ivonescimab remains front and center for shareholders. Despite retreating, Summit Therapeutics' shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 6 other fair value estimates on Summit Therapeutics - why the stock might be worth over 9x more than the current price!

Build Your Own Summit Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Summit Therapeutics research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Summit Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Summit Therapeutics' overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SMMT

Summit Therapeutics

A biopharmaceutical company, focuses on discovery, development, and commercialization of patient, physician, caregiver, and societal friendly medicinal therapies.

Flawless balance sheet with low risk.

Market Insights

Community Narratives