- United States

- /

- Biotech

- /

- NasdaqCM:SLNO

Soleno Therapeutics (SLNO): Profitability Forecasts Reinforce Growth Narrative Despite Ongoing Losses

Reviewed by Simply Wall St

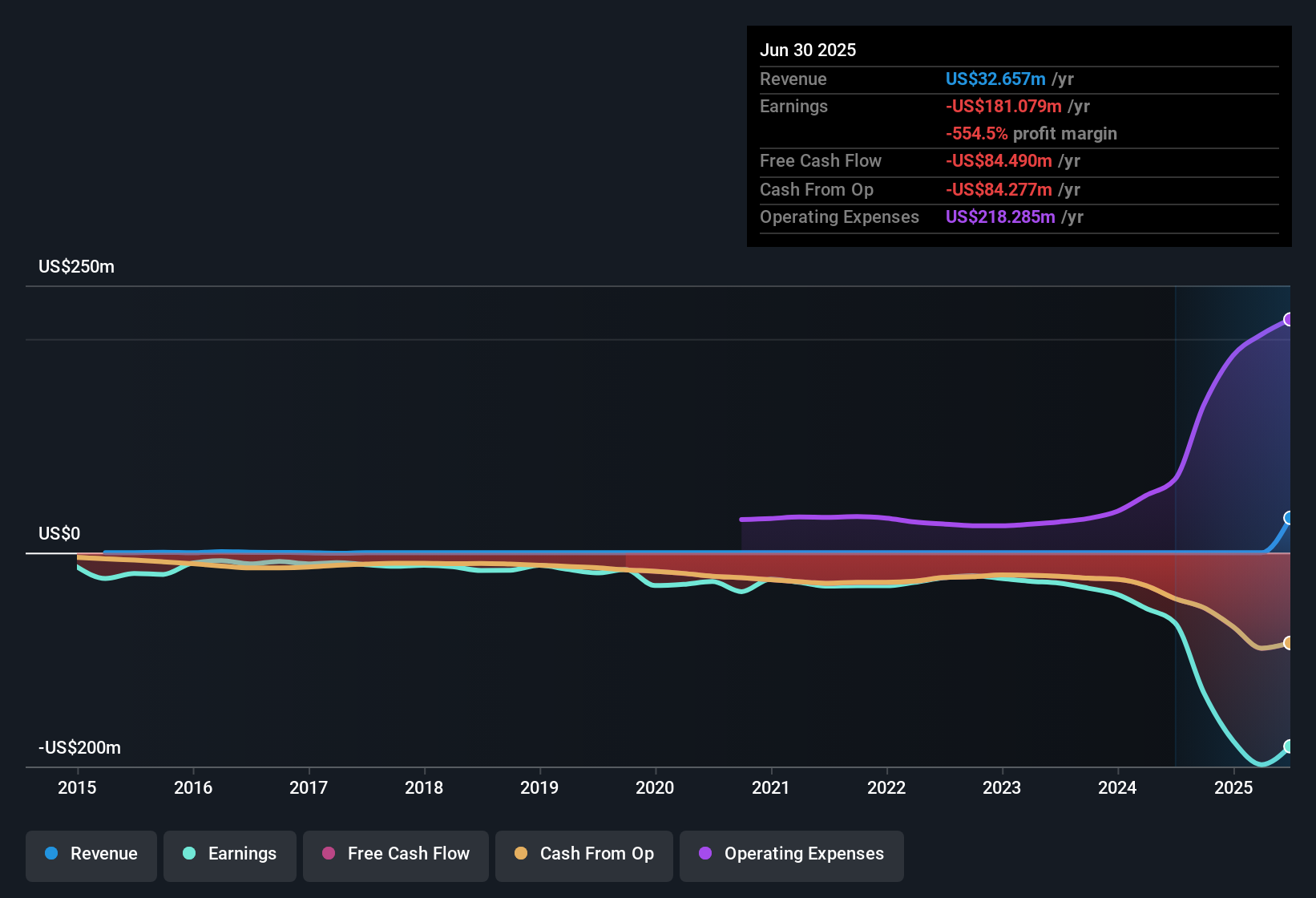

Soleno Therapeutics (SLNO) remains in the red, with losses having increased by 49.5% per year over the last five years. Looking ahead, revenue is forecast to grow 42.8% annually and earnings are projected to surge 54.8% per year. This puts profitability within reach in the next three years. As the company charts an ambitious path forward, investors are weighing Soleno’s rapid growth potential against persistent losses and recent share price volatility.

See our full analysis for Soleno Therapeutics.Next, we’ll see how these results match up with the market’s narrative, highlighting areas where the latest numbers either reinforce or challenge expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Timeline Narrows: 3-Year Path

- Soleno is projected to reach profitability within the next three years, with forecast annual earnings growth of 54.8%, overtaking the broader US market average.

- Momentum for rare disease therapeutics, along with forecasts of above-market profit growth, heavily supports the view that Soleno stands to benefit from sector tailwinds and growing credibility for its clinical pipeline.

- Current forecasts for revenue growth at 42.8% per year reinforce the optimism that Soleno can convert clinical progress into financial strength faster than most peers.

- However, the dependence on successful development of lead candidates remains a key risk, keeping upside tied to clinical outcomes.

Share Price Fluctuates After Dilution

- The share price has been unstable over the past three months, and recent share dilution adds another layer of uncertainty for current investors.

- Concerns about high volatility and dilution echo the prevailing market view that “high risk, high reward” best describes investor attitudes toward Soleno.

- Share price swings and reliance on a focused product pipeline provide fuel both for risk-seeking investors and critics wary of reversals.

- Share price is currently $46.97, well below the $119.00 analyst price target, which keeps speculative traders engaged but underscores substantial risk embedded in the story.

Valuation Sits Below Targets, Yet Above Industry Norms

- The stock trades below both its $119.00 analyst price target and its DCF fair value of $459.55, but its Price-to-Book Ratio of 10.5x still signals a premium over the broader US Biotech industry average of 2.4x.

- While current price levels invite reward-seeking investors, the premium to the sector average and lingering profitability concerns mean valuation is still driven by optimism for future growth rather than strong present-day fundamentals.

- Trading below target prices supports the view that upside could remain if forecasts deliver. The premium to sector benchmarks highlights why some investors remain cautious.

- This tension between a discounted headline price and a high relative Price-to-Book serves as a reminder that Soleno’s investment case hinges more on what it could achieve than what it has already demonstrated.

See what the community is saying about Soleno Therapeutics

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Soleno Therapeutics's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite promising growth forecasts, Soleno remains unprofitable, shows share price volatility, and trades at a premium to industry norms with limited balance sheet strength.

If you want companies backed by steadier fundamentals and lower financial risk, discover solid balance sheet and fundamentals stocks screener (1979 results), designed to highlight those built for resilience in uncertain markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SLNO

Soleno Therapeutics

A clinical-stage biopharmaceutical company, focuses on the development and commercialization of novel therapeutics for the treatment of rare diseases.

High growth potential and good value.

Market Insights

Community Narratives