- United States

- /

- Biotech

- /

- NasdaqCM:SLNO

Soleno Therapeutics (SLNO): Assessing Valuation Following Securities Probe and Short-Seller Safety Allegations

Reviewed by Simply Wall St

Soleno Therapeutics (SLNO) is under the spotlight after Rosen Law Firm launched an investigation into possible securities claims. The move follows a Scorpion Capital short report that questioned the safety and future of its newly approved VYKAT XR treatment.

See our latest analysis for Soleno Therapeutics.

These headlines cap an eventful year for Soleno, with the latest share price at $67.16 after recent legal and safety concerns sparked fresh volatility. Despite some sharp swings, including a 1-day share price return of -3.06% but an impressive 46.93% jump year-to-date, momentum remains positive and its 1-year total shareholder return stands at 20.23%. The three-year figure is a staggering 6,649.75%.

If Soleno's wild ride has you curious about what else is gathering momentum in biotech, this is a perfect chance to discover See the full list for free.

While Soleno’s stock boasts extraordinary long-term gains, investor sentiment is now being tested by legal and safety uncertainties. The key question is whether the market is currently undervaluing shares, or if all future growth has already been factored in.

Price-to-Book of 14.9x: Is it justified?

Soleno Therapeutics trades at a price-to-book ratio of 14.9x, far above both peer and industry averages. This signals a premium valuation at the current $67.16 share price.

The price-to-book ratio compares a company's market value to its book value and is often used in biotech to assess how the market views intangible assets such as future pipeline potential. In this case, it suggests investors are pricing in significant future growth or success beyond what is reflected on the balance sheet.

However, Soleno’s price-to-book of 14.9x is much higher than the peer average of 12.1x and the broader US biotech industry average of 2.6x. This indicates the market is factoring in much higher expectations for Soleno compared to its competitors. If the market re-evaluates based on fundamentals, this premium could be reassessed.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 14.9x (OVERVALUED)

However, risks remain, including heightened legal scrutiny and the potential for market overreaction if Soleno’s growth prospects disappoint or if regulatory concerns intensify.

Find out about the key risks to this Soleno Therapeutics narrative.

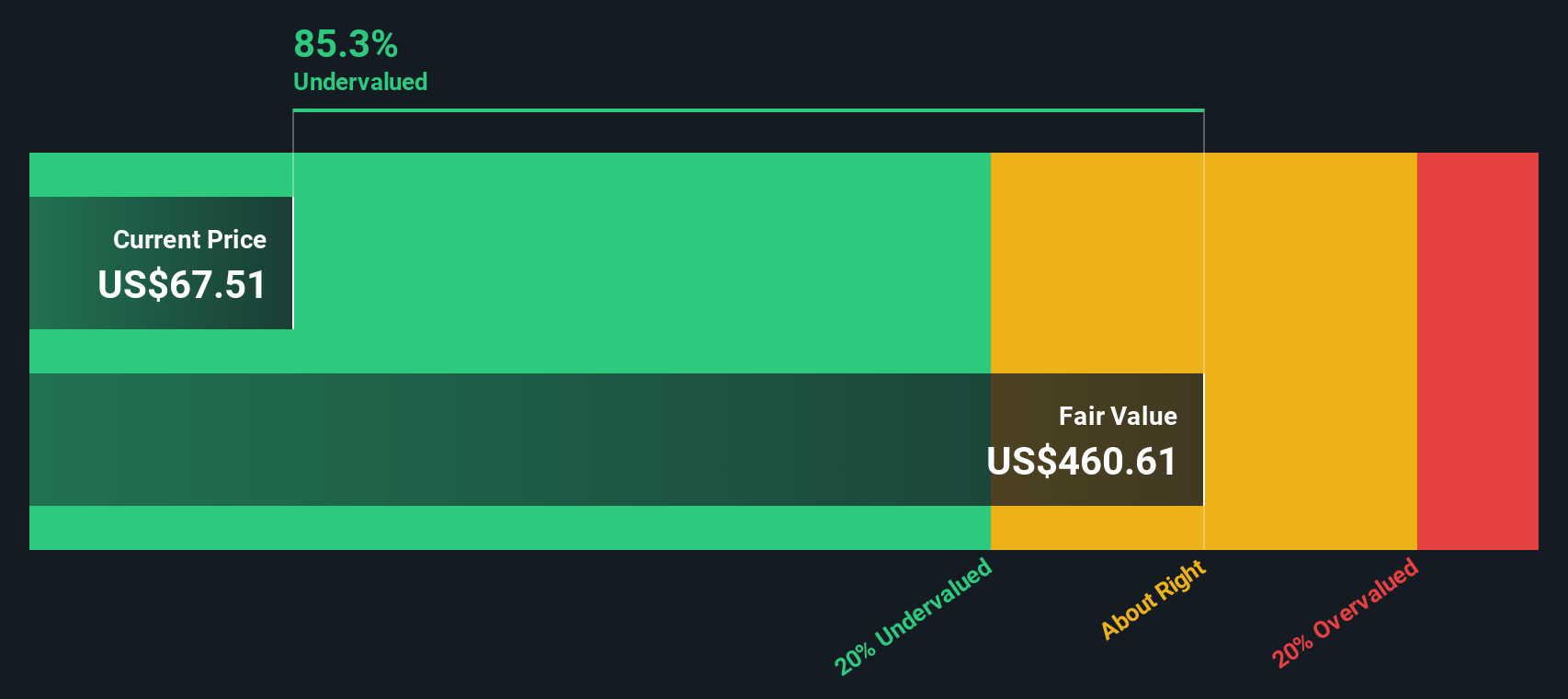

Another View: Discounted Cash Flow Suggests Deep Undervaluation

While the price-to-book ratio paints Soleno as expensive relative to peers, our DCF model offers a completely different perspective. According to this method, shares trade at an 85% discount to their estimated fair value of $450.77. This raises the question: could the market be underestimating Soleno's long-term cash flow potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Soleno Therapeutics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 832 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Soleno Therapeutics Narrative

If you see things differently or simply want a deeper dive into the numbers, you can easily craft your own perspective in just a few minutes, Do it your way

A great starting point for your Soleno Therapeutics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Expand your portfolio and put your money to work in other high-potential sectors that could transform your returns this year. Don't wait for the crowd. Go straight to opportunities that align with your strategy.

- Grow your passive income by tapping into companies with consistent, high yields through these 22 dividend stocks with yields > 3%.

- Capitalize on early-stage innovation by targeting affordable stocks well positioned in future growth markets using these 3580 penny stocks with strong financials.

- Embrace the next tech wave by checking out companies at the frontier of artificial intelligence with these 26 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SLNO

Soleno Therapeutics

A clinical-stage biopharmaceutical company, focuses on the development and commercialization of novel therapeutics for the treatment of rare diseases.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives