- United States

- /

- Life Sciences

- /

- NasdaqGS:SHC

What Sotera Health (SHC)'s Earnings Surge Means for Its Long-Term Investment Outlook

Reviewed by Sasha Jovanovic

- Sotera Health Company released its third quarter 2025 earnings results on November 4, reporting revenue of US$311.31 million and net income of US$48.4 million, both significantly higher than the prior year period.

- The company’s performance highlights a material increase in profitability, with basic and diluted earnings per share from continuing operations more than doubling compared to last year.

- We’ll explore how these stronger earnings and revenue results impact Sotera Health’s long-term investment story.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Sotera Health Investment Narrative Recap

To own Sotera Health stock, an investor must believe in the company's ability to capture sustained demand for sterilization and lab testing services, as well as its capacity to navigate ongoing regulatory and competitive pressures. The strong third quarter earnings report points to enhanced profitability, but does not meaningfully alter the major short-term catalyst, demand growth in core sterilization services, or the most significant risk from regulatory scrutiny, litigation, and continued high compliance costs.

Among recent announcements, the September 2025 follow-on equity offering stands out, as the influx of US$307 million is relevant to Sotera Health’s ability to support facility investments tied to growth and regulatory compliance. This additional capital could influence the company’s flexibility in funding expansion or emissions controls, both key areas that link directly to short-term performance drivers.

By contrast, even with higher profits, investors should be mindful of the lingering cost pressures posed by ongoing capital expenditures and...

Read the full narrative on Sotera Health (it's free!)

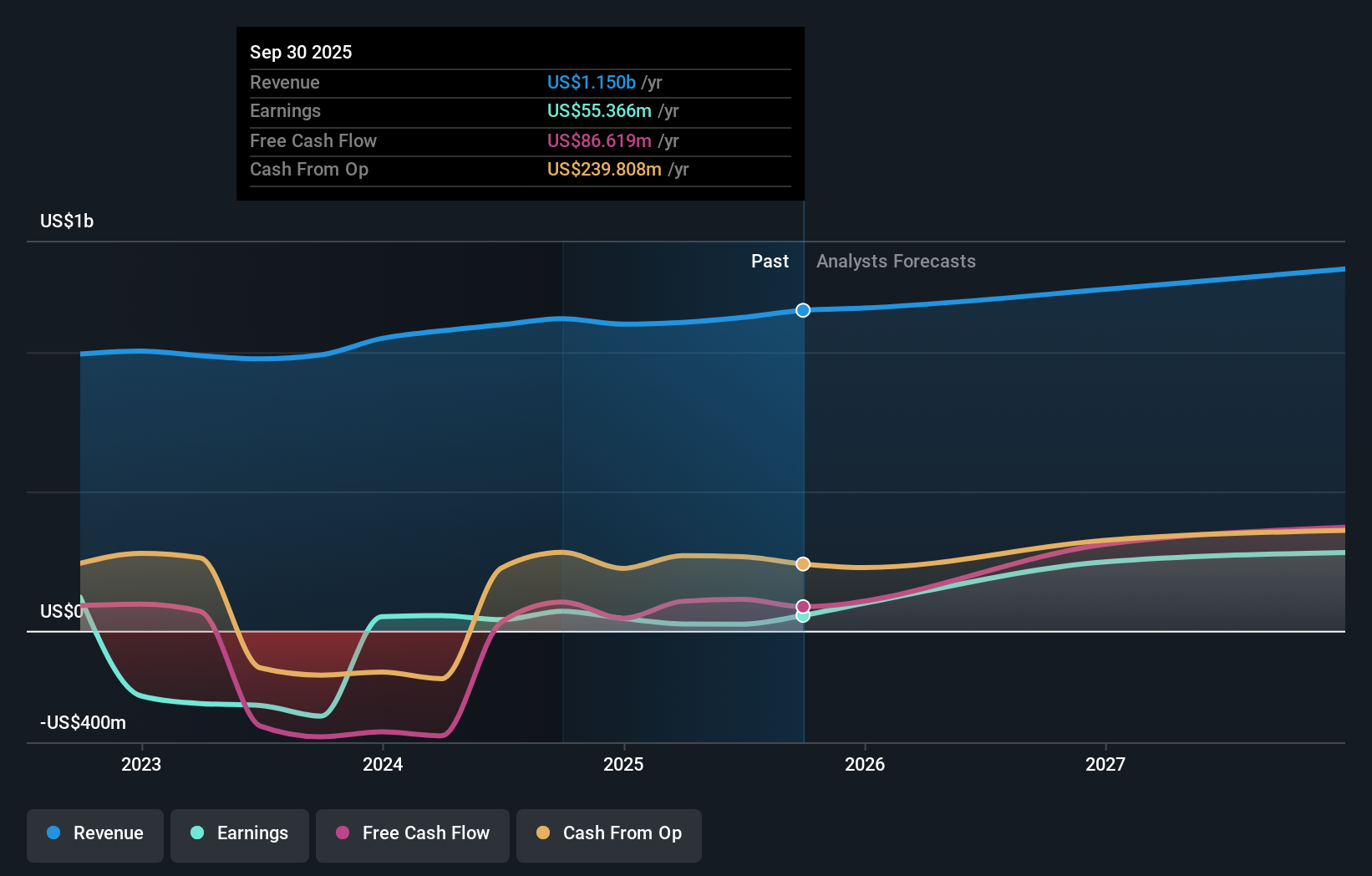

Sotera Health's outlook forecasts $1.3 billion in revenue and $314.2 million in earnings by 2028. This projection assumes a 6.0% annual revenue growth rate and an increase in earnings of $290.2 million from the current $24.0 million.

Uncover how Sotera Health's forecasts yield a $17.00 fair value, in line with its current price.

Exploring Other Perspectives

Only one fair value estimate from the Simply Wall St Community sits at US$22.51. While profits rose this quarter, ongoing regulatory and litigation risks remain central to the company’s outlook. Explore other viewpoints and see how your expectations compare.

Explore another fair value estimate on Sotera Health - why the stock might be worth just $22.51!

Build Your Own Sotera Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sotera Health research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Sotera Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sotera Health's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SHC

Sotera Health

Provides sterilization, lab testing, and advisory services for the healthcare industry in the United States, Canada, Europe, and internationally.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives