- United States

- /

- Life Sciences

- /

- NasdaqGS:SHC

Sotera Health (SHC) Reports $98.8M One-Off Loss, Challenging Profit Recovery Narratives

Reviewed by Simply Wall St

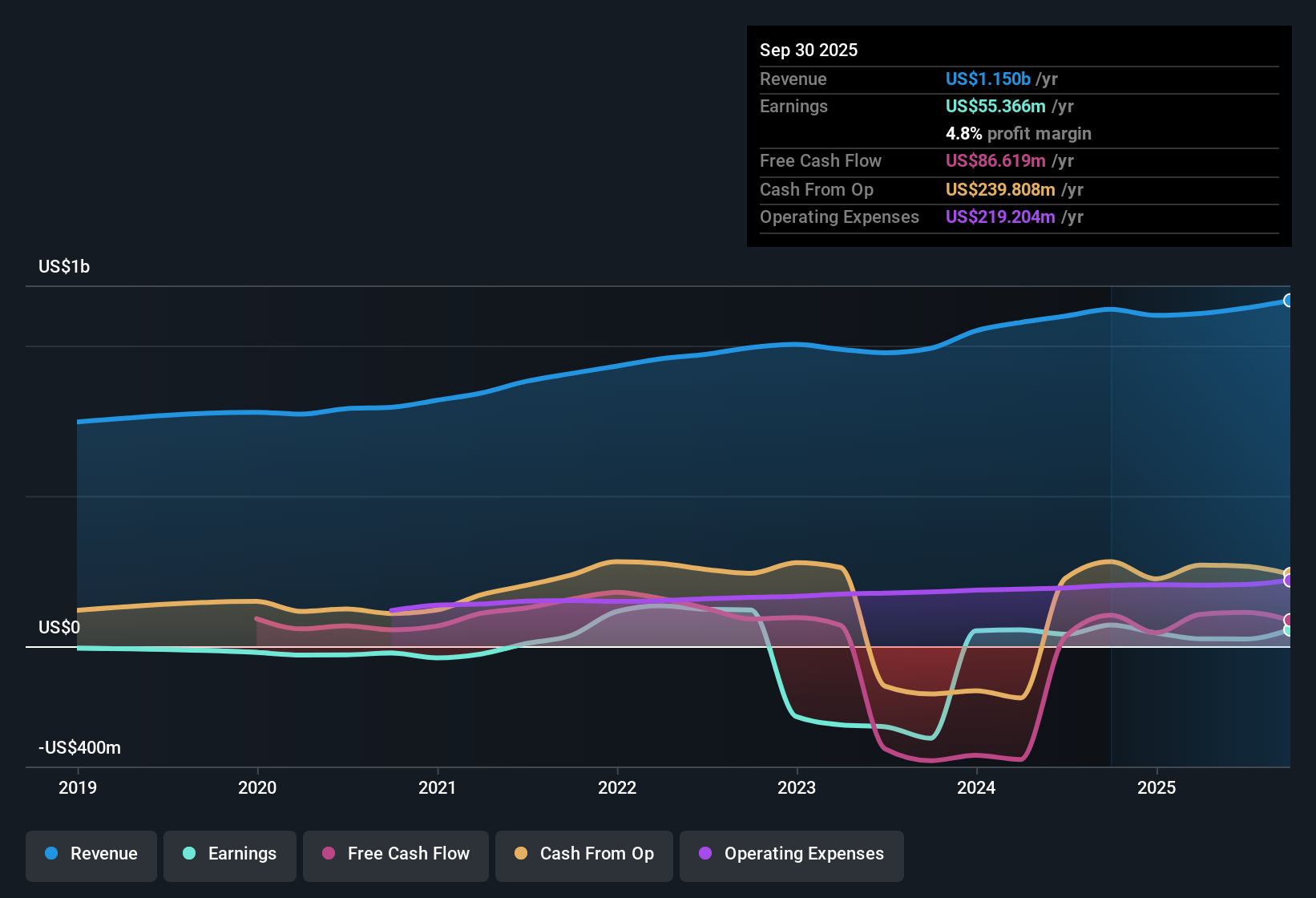

Sotera Health (SHC) reported net profit margins of 4.8% in its recent results, down from last year's 6.3%, as a one-off loss of $98.8 million weighed on the bottom line. Over the past five years, the company has moved into profitability with earnings growing at 2.2% per year, but in the latest period, earnings growth turned negative. Looking forward, analysts expect a sharp rebound, forecasting 56.1% annualized earnings growth against a more modest 5.7% revenue increase. This suggests optimism despite the recent dip in profitability.

See our full analysis for Sotera Health.Next, we will see how Sotera's numbers stack up against the current market narratives. Some expectations might be confirmed, while others could get a reality check.

See what the community is saying about Sotera Health

Margins Poised for Turnaround

- Analysts anticipate profit margins climbing from today's 2.1% to 23.4% by 2028, a dramatic swing from the subdued 4.8% reported this year. This suggests expectations for a major boost in profitability as regulatory headwinds fade and scale improves.

- Analysts' consensus view balances optimism on margin recovery with notes of caution:

- Consensus sees investments in new sterilization capacity and compliance supporting higher margins. If realized, this would materially lift net income and justify forecasts for earnings of $314.2 million in 2028.

- However, significant compliance and legal costs tied to ethylene oxide emissions, such as the $34 million settlement and annual capital expenditures projected at $170 to $180 million for 2025, pose persistent threats to margin expansion and can quickly erode the anticipated profitability rebound.

- Results bring fresh momentum for margin bulls but also reinforce the consensus caveat that realizing full profit potential depends on regulatory, legal, and cost execution falling into place. 📊 Read the full Sotera Health Consensus Narrative.

Peer-High Valuation Despite Discount to DCF

- Sotera trades at a price-to-earnings ratio of 84.3x, which is much higher than its peer group average of 54.9x and the broader North American Life Sciences industry's 36.3x. Despite this, its $16.43 share price is well below the DCF fair value of $22.14, creating a tension between fundamentals and multiples.

- Consensus narrative spotlights this valuation crossroads:

- On one hand, trading at a discount to DCF fair value should appeal to value-focused investors and is underpinned by forecasted rapid earnings expansion.

- On the other hand, the high P/E suggests investors are already pricing in much of the expected future growth, which leaves less margin for error if earnings recovery is slower or margins stall below consensus expectations.

Cash Flow and Contracts Anchor Stability

- Consensus points to Sotera's consistent cash generation, long-term multi-year customer contracts, and an accelerating deleveraging trend as key factors underpinning predictable revenue and greater financial flexibility.

- Reviewing consensus narrative claims:

- Strong underlying cash flows and contract renewals help offset volatility from one-time losses and shifting regulatory costs, providing a buffer to fund growth investments even when headline profits temporarily dip.

- That said, elevated capital expenditures for emissions controls and facility upgrades, targeted at $170 to $180 million in 2025, may still constrain free cash flow and restrict investments in innovation or acquisitions if not managed carefully.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Sotera Health on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the numbers from a different angle? Put your view into action and shape your personal take in just a few minutes. Do it your way

A great starting point for your Sotera Health research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Sotera Health faces uncertainty as high compliance costs, legal settlements, and large capital outlays threaten margin expansion and stable free cash flow.

For investors who prize steadier results and fewer surprises, turn your attention to stable growth stocks screener (2080 results) to spot companies that deliver reliable earnings and revenue growth, even in challenging environments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SHC

Sotera Health

Provides sterilization, lab testing, and advisory services for the healthcare industry in the United States, Canada, Europe, and internationally.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives