- United States

- /

- Life Sciences

- /

- NasdaqGS:SHC

Sotera Health (SHC): Examining Valuation After Q3 Earnings Beat and Renewed Healthcare Optimism

Reviewed by Simply Wall St

Sotera Health (SHC) stock climbed after the company beat third quarter expectations. This caught the attention of investors who were already eyeing healthcare gains amid renewed rate-cut hopes following comments from a Federal Reserve official.

See our latest analysis for Sotera Health.

Sotera Health's latest surge to $16.78 comes after upbeat quarterly results and a lift in sentiment for healthcare stocks, driven by renewed hopes for interest rate cuts. The company's 1-day share price return of 2.76% and 7-day return of nearly 10% point to building momentum. Its 1-year total shareholder return stands out at 26.17%, and an impressive 105.89% over three years, firmly outpacing short-term dips and marking it as a long-term winner in a sector that is catching fresh investor interest.

If you’re looking to tap into more market movers in healthcare, don't miss the chance to discover See the full list for free.

With Sotera Health shares now approaching analyst price targets and strong recent gains supported by robust fundamentals, investors are left wondering whether the stock remains undervalued or if the anticipated growth is already reflected in its price.

Most Popular Narrative: 11.4% Undervalued

Sotera Health’s narrative-based fair value sits at $18.93, comfortably above the recent closing price of $16.78. This situation has market watchers on alert for continued upside as the narrative takes center stage in driving price targets and expectations.

Strong and sustained growth in sterilization volumes, fueled by increased demand from MedTech and bioprocessing customers following inventory normalization, is likely to support robust revenue growth and operating leverage as healthcare utilization trends higher globally. Continued investments in high-efficiency and expanded sterilization capacity, including recently launched and planned facility expansions, will enhance Sotera Health's ability to capture incremental market share and drive margin improvement as new capacity comes online. This is expected to positively impact EBITDA and net margins.

What is the secret behind this bullish narrative? It hinges on a formula of margin expansion, steady revenue acceleration, and a future earnings multiple rarely seen in typical life sciences stories. Which critical financial levers did analysts pull to justify this premium? Find out how profit projections and sector headwinds come together in a valuation that could surprise many investors.

Result: Fair Value of $18.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory scrutiny over emissions and rising capital expenditures could weigh on Sotera Health’s growth prospects if these issues are not addressed.

Find out about the key risks to this Sotera Health narrative.

Another View: Multiples Tell a Different Story

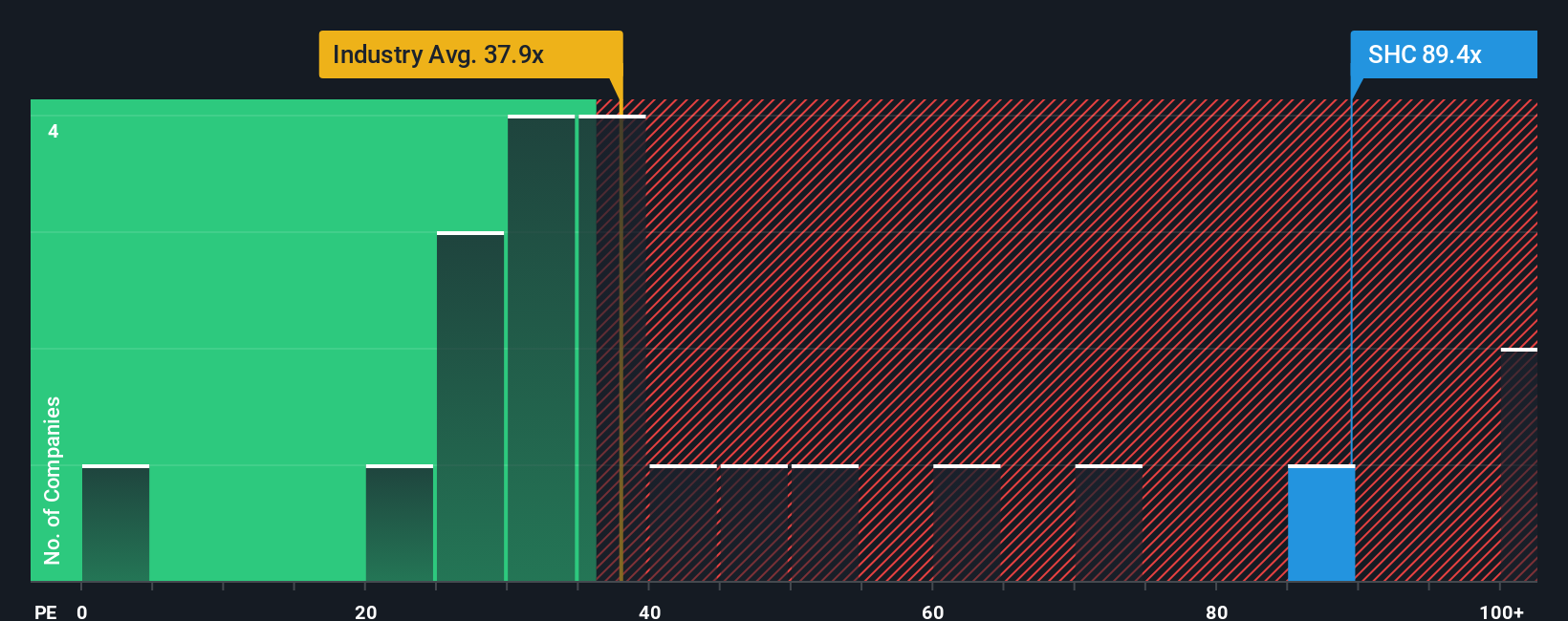

Looking at valuation from a market-based perspective, Sotera Health is trading at a price-to-earnings ratio of 86x. This is well above both the peer average of 53.2x and the North American industry average of 36.9x. Even when compared to our calculated fair ratio of 35.1x, the stock looks expensive. Could this premium be justified by future growth, or does it signal potential downside ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sotera Health Narrative

If you see things differently or trust your own research process, crafting a personalized narrative takes just a few minutes. Do it your way

A great starting point for your Sotera Health research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Unlock your edge by checking out other game-changing stocks tailored to your strategy. The right pick at the right time can redefine your portfolio’s growth path.

- Capitalize on high yields and growing income streams by browsing these 14 dividend stocks with yields > 3%, where strong payouts meet compelling fundamentals.

- Position yourself early in the AI evolution by tapping into these 26 AI penny stocks and see what fast-moving innovators are transforming tomorrow’s industries.

- Enhance your watchlist with overlooked bargains by starting with these 928 undervalued stocks based on cash flows, which is packed with quality companies trading below intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SHC

Sotera Health

Provides sterilization, lab testing, and advisory services for the healthcare industry in the United States, Canada, Europe, and internationally.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success