- United States

- /

- Pharma

- /

- NasdaqGM:SEPN

Septerna (SEPN) Is Up 9.9% After Swinging to Q3 Profit and Revenue Surge – Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

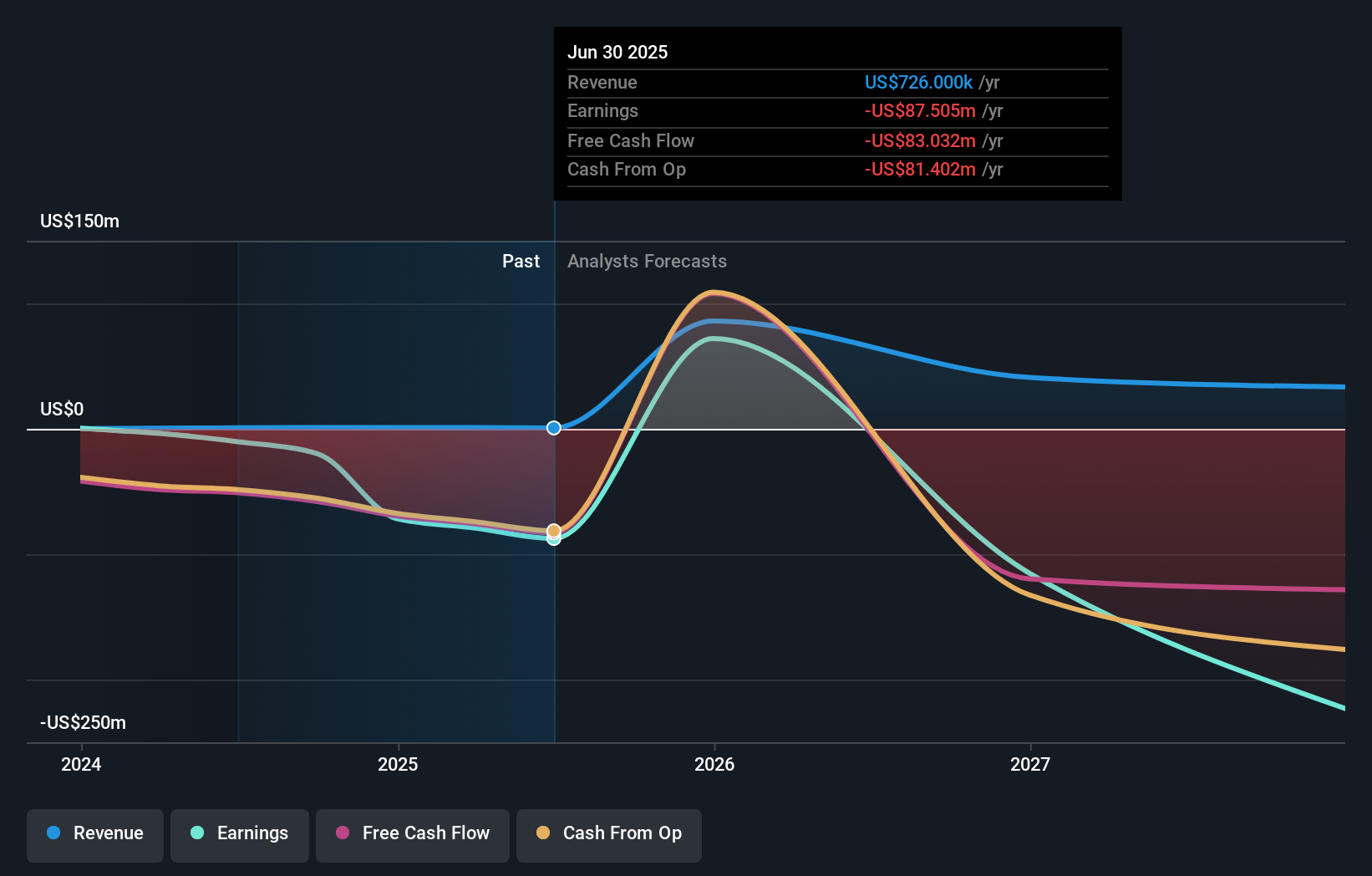

- Septerna, Inc. recently reported third quarter 2025 earnings, showing sales of US$21.5 million and net income of US$8.17 million, a turnaround from both low sales and a net loss in the same period last year.

- This shift to profitability in a single quarter reflects a very large year-over-year improvement and suggests accelerated business momentum compared to recent performance.

- We’ll explore how Septerna’s return to profitability and revenue growth informs its investment narrative after a strong 7-day share price gain.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Septerna's Investment Narrative?

For investors evaluating Septerna now, the latest quarterly earnings have reset the narrative in a substantial way. The shift from extremely low sales and heavy losses to a meaningful profit and rapidly rising revenue in just one quarter stands out, especially following months of persistently negative results and cautious analyst outlooks. This sudden performance lift, paired with the recent surge in share price, will likely force a reassessment of short-term catalysts: questions about the sustainability of recent profitability and revenue growth will move to the forefront, while prior concerns about ongoing losses may become less immediate. At the same time, risks remain firmly in focus despite encouraging financials, particularly the company's history of volatile results, a relatively new board, ongoing R&D requirements in early-stage programs, and mixed experiences with clinical trials. The recent earnings do materially change sentiment and make the next quarters critical for validating whether long-term momentum is real or a one-off event.

But even with this jump, there are still risks tied to product development and board stability investors should watch.

Exploring Other Perspectives

Explore 2 other fair value estimates on Septerna - why the stock might be worth less than half the current price!

Build Your Own Septerna Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Septerna research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Septerna research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Septerna's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SEPN

Septerna

A clinical-stage biotechnology company, discovers and develops G protein-coupled receptor (GPCR) oral small molecule products for the treatment of endocrinology, immunology and inflammation, and metabolic diseases.

Flawless balance sheet with very low risk.

Market Insights

Community Narratives