- United States

- /

- Biotech

- /

- NasdaqGM:RYTM

Rhythm Pharmaceuticals (RYTM): FDA Review Extension Sparks Fresh Look at Valuation Prospects

Reviewed by Simply Wall St

Rhythm Pharmaceuticals (RYTM) just announced that the FDA has extended its review period for the company’s supplemental New Drug Application for IMCIVREE. This update comes after the FDA requested additional sensitivity analyses on clinical efficacy data.

See our latest analysis for Rhythm Pharmaceuticals.

Rhythm Pharmaceuticals has been on quite a run this year, with its share price climbing 66.97% since January and the stock closing at $100.3. Momentum has cooled in the last week after the FDA extended its review of IMCIVREE. Still, the big picture remains impressive, with a 48.97% total shareholder return over the past twelve months and gains of more than 350% for long-term holders. Investors are clearly weighing both the company’s long-term drug pipeline progress and near-term regulatory uncertainty as they reassess growth potential at these levels.

If you’re interested in uncovering other standouts in the healthcare space, take the next step and explore See the full list for free.

With shares still trading at a sizable discount to consensus price targets, investors are now left wondering if Rhythm Pharmaceuticals is an undervalued growth story or if the recent run has already priced in the company’s future potential.

Most Popular Narrative: 17.4% Undervalued

With Rhythm Pharmaceuticals closing at $100.30 and its fair value pegged at $121.43 by the most-followed narrative, analysts see meaningful upside from current levels, largely hinging on forthcoming regulatory and commercial milestones.

Upcoming potential regulatory approvals and launches for setmelanotide (IMCIVREE) in new indications like acquired hypothalamic obesity and Prader-Willi syndrome, alongside expansion into younger age groups, are set to materially grow Rhythm's commercial opportunity and topline over the next several years.

Want to know why this narrative stands out from other Wall Street calls? The growth story is built on bold bets, rapid revenue expansion, and a leap in profit margins. Yet the most eye-opening estimates are still under wraps. Find out exactly which future milestones and financial leaps drive that valuation, and what could send the shares even higher or pull them back, by reading the full narrative now.

Result: Fair Value of $121.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent operating losses and overreliance on IMCIVREE could quickly dampen investor optimism if there are regulatory delays or competitive threats.

Find out about the key risks to this Rhythm Pharmaceuticals narrative.

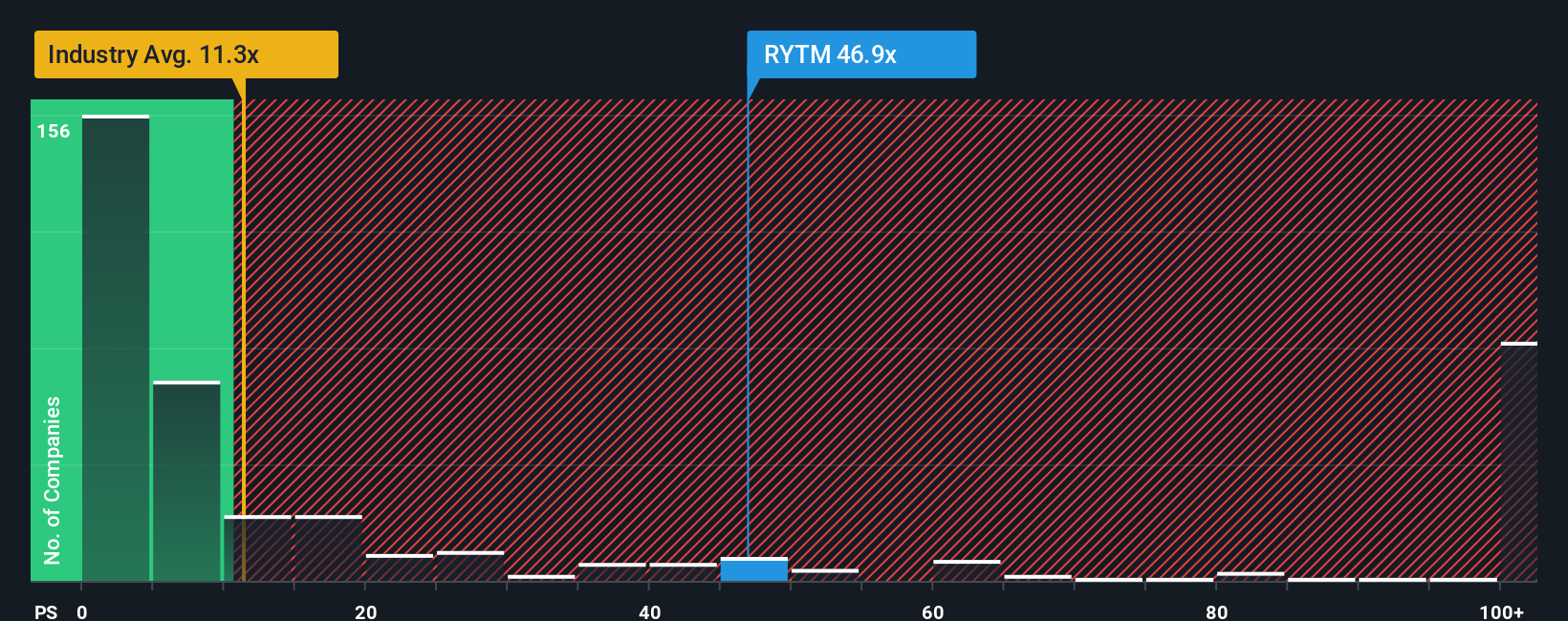

Another View: How Price Ratios Tell a Different Story

Looking beyond narratives and analyst targets, valuation based on the current price to sales paints Rhythm Pharmaceuticals as expensive. At 38.4 times sales, its ratio is more than double that of both its peer group (17.4x) and Biotech industry average (11.2x), and also well above the fair ratio of 21.7x. This sizeable gap suggests investors are anticipating big successes ahead, but it also raises the stakes if expectations are not met. Might the market eventually pull back to a more typical level?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rhythm Pharmaceuticals Narrative

If you see things differently or want to draw your own conclusions, you can dive into the numbers and craft your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Rhythm Pharmaceuticals.

Looking for more investment ideas?

Take your investing to the next level by grabbing hold of opportunities others may overlook. The Simply Wall Street Screener makes it easy to find high-potential stocks that match your strategy and goals.

- Unlock powerful income streams when you scan for strong performers among these 16 dividend stocks with yields > 3% paying over 3% yields in today’s market.

- Get ahead of the crowd by jumpstarting your search for tomorrow's tech giants with these 24 AI penny stocks addressing real-world problems through artificial intelligence.

- Secure an advantage by finding companies with untapped potential using these 876 undervalued stocks based on cash flows based on robust cash flows and value metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:RYTM

Rhythm Pharmaceuticals

A commercial-stage biopharmaceutical company, focuses on the rare neuroendocrine diseases.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives