- United States

- /

- Biotech

- /

- NasdaqGS:RVMD

How Daraxonrasib’s FDA Breakthrough and Orphan Designations Have Changed Revolution Medicines’ (RVMD) Investment Story

Reviewed by Sasha Jovanovic

- Earlier this week, Revolution Medicines announced that its lead candidate daraxonrasib received both FDA Breakthrough Therapy and Orphan Drug designations, following reports of a 47% objective response rate in first-line metastatic pancreatic cancer and confirmation of progressing Phase III trials.

- These regulatory milestones, coupled with promising clinical data, have drawn substantial attention to the company’s expanding precision oncology pipeline aimed at difficult-to-treat cancers.

- Next, we'll explore how daraxonrasib's special FDA designations and clinical outcomes inform Revolution Medicines' evolving investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Revolution Medicines' Investment Narrative?

For shareholders of Revolution Medicines, the company’s investment narrative hinges on belief in its ability to turn pipeline innovation, especially in difficult-to-treat cancers, into successful commercial therapies. The latest news, with daraxonrasib receiving FDA Breakthrough Therapy and Orphan Drug designations on the back of strong clinical data, marks a potentially meaningful catalyst, signaling increased regulatory momentum and commercial opportunity. This could accelerate timelines to potential approval and broaden the addressable patient base. However, what stands out just as much is the scale of ongoing losses. The quarterly net loss topped US$305 million, and the company projects a full-year net loss above US$1 billion, reflecting the high upfront costs of advancing Phase III programs. While the recent regulatory milestones could positively influence sentiment around near-term data readouts, they do not change Revolution’s pressing need for eventual revenue to contain widening losses, making future trial outcomes and commercialization progress crucial to the story. But despite the excitement, Revolution’s rising operating losses are something investors should keep firmly in view.

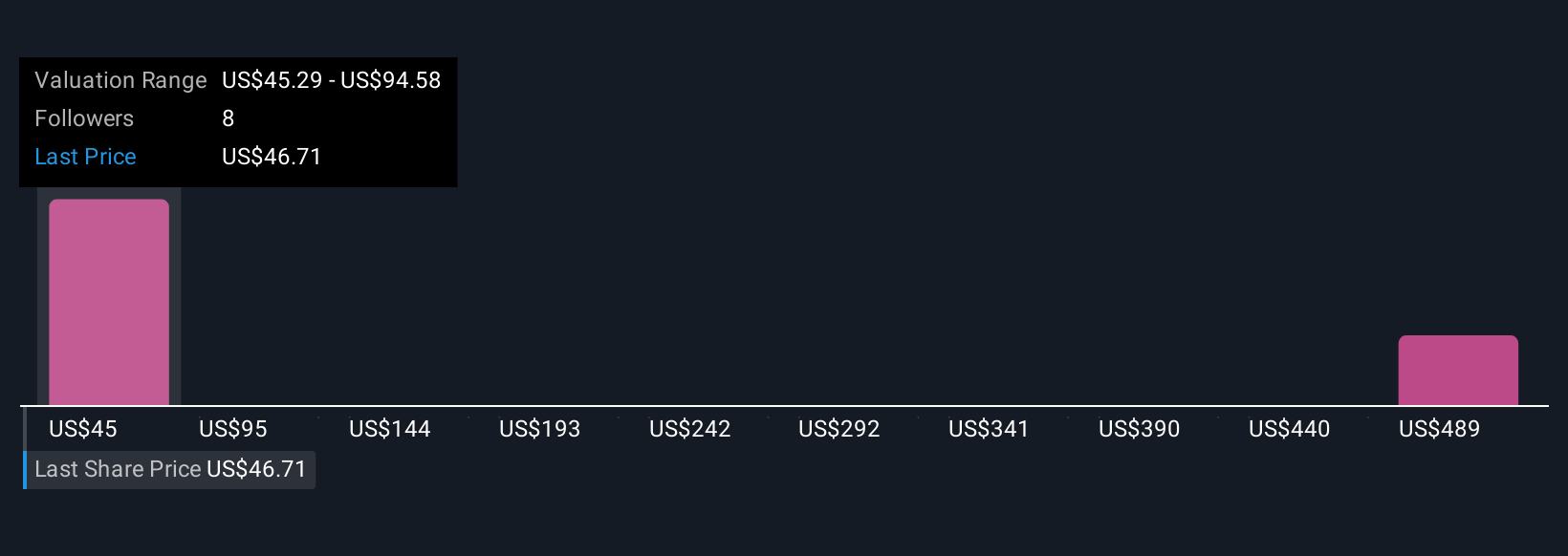

Our expertly prepared valuation report on Revolution Medicines implies its share price may be too high.Exploring Other Perspectives

Explore 3 other fair value estimates on Revolution Medicines - why the stock might be worth over 3x more than the current price!

Build Your Own Revolution Medicines Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Revolution Medicines research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Revolution Medicines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Revolution Medicines' overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RVMD

Revolution Medicines

A clinical-stage precision oncology company, develops novel targeted therapies for RAS-addicted cancers.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives