- United States

- /

- Pharma

- /

- NasdaqGS:RPRX

How Investors May Respond To Royalty Pharma (RPRX) Raising 2025 Guidance and Completing Share Buybacks

Reviewed by Sasha Jovanovic

- Royalty Pharma raised its full-year 2025 earnings guidance, now projecting portfolio receipts between US$3.20 billion and US$3.25 billion, an increase from its previous outlook, following the release of its third quarter results and announcement of completed share buybacks.

- This upward revision highlights greater confidence in the company’s future cash inflows from its portfolio of biopharmaceutical royalties amid ongoing revenue growth and shareholder return initiatives.

- We’ll explore how higher 2025 guidance, alongside continued buybacks, could influence Royalty Pharma’s investment case and risk outlook.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Royalty Pharma Investment Narrative Recap

Investing in Royalty Pharma means believing in its ability to source, evaluate, and acquire high-value biopharmaceutical royalties, driving cash flow and long-term shareholder returns. The recent 2025 guidance upgrade reinforces confidence in short-term portfolio receipt growth, but does not materially resolve the ongoing royalty dispute with Vertex, which remains the biggest risk to near-term revenue stability.

Among recent announcements, the completion of the US$1.15 billion buyback program stands out as most relevant, as it underscores Royalty Pharma’s commitment to returning cash to shareholders and signals management’s confidence in future cash flows, factors directly tied to portfolio performance and the quality of new royalty acquisitions, both important short-term catalysts.

However, investors should remember that elevated guidance does not diminish the financial exposure associated with unresolved royalty disputes...

Read the full narrative on Royalty Pharma (it's free!)

Royalty Pharma's outlook expects $4.0 billion in revenue and $922.7 million in earnings by 2028. This is based on an annual revenue growth rate of 20.0% but reflects a decrease in earnings of about $77 million from current earnings of $1.0 billion.

Uncover how Royalty Pharma's forecasts yield a $44.10 fair value, a 14% upside to its current price.

Exploring Other Perspectives

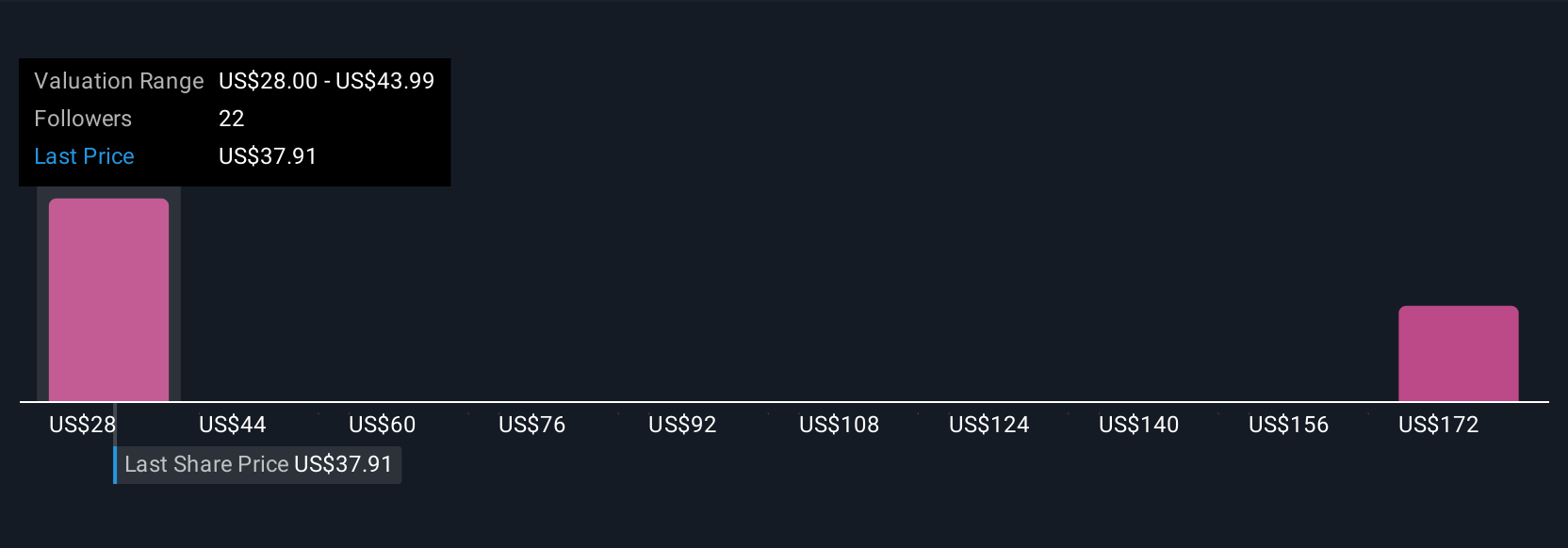

Five independent Simply Wall St Community fair value opinions range from US$39.10 to US$172.41, capturing vastly different outlooks for Royalty Pharma. While guidance has improved, the unresolved Vertex royalty dispute still shapes short-term expectations, making it important to compare your view with others and consider what could shift the story next.

Explore 5 other fair value estimates on Royalty Pharma - why the stock might be worth just $39.10!

Build Your Own Royalty Pharma Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Royalty Pharma research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Royalty Pharma research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Royalty Pharma's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RPRX

Royalty Pharma

Operates as a buyer of biopharmaceutical royalties and a funder of innovation in the biopharmaceutical industry in the United States.

Fair value with moderate growth potential.

Market Insights

Community Narratives