- United States

- /

- Biotech

- /

- NasdaqGS:ROIV

Can Roivant Sciences’ (ROIV) Subsidiary Model Unlock Sustainable Pipeline Success in Healthcare Innovation?

Reviewed by Sasha Jovanovic

- In recent days, Baron Health Care Fund highlighted Roivant Sciences as a key holding, praising its subsidiary-based business model and recent clinical pipeline achievements from Immunovant and Priovant, as well as ongoing high-stakes litigation involving Genevant. The fund pointed to IMVT-1402’s progress in autoimmune conditions and potential legal settlements, which could materially strengthen Roivant’s ability to fund drug development efforts.

- This major institutional recognition underscores how Roivant's approach to building and empowering focused subsidiaries is gaining broader acknowledgement among healthcare investors.

- With Baron Health Care Fund spotlighting the pipeline progress of Immunovant and positive Phase 3 results from Priovant, we'll assess the implications for Roivant's investment narrative.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Roivant Sciences Investment Narrative Recap

Anyone considering an investment in Roivant Sciences needs to understand the importance of the company’s decentralized subsidiary strategy, giving each "Vant" flexibility to innovate while managing a large-scale, risk-tolerant clinical pipeline. The recent spotlight from Baron Health Care Fund highlights short-term catalysts like the progress of IMVT-1402 and the Priovant Phase 3 readout, but it remains to be seen whether ongoing litigation involving Genevant will materially shift the balance for Roivant’s most prominent high-stakes risk: legal uncertainties around LNP-related claims.

The Phase 3 positive results for brepocitinib in dermatomyositis, announced in September, are highly relevant, demonstrating tangible clinical momentum in Roivant’s late-stage pipeline, one of the areas Baron referenced as central to the company's near-term investment outlook.

By contrast, investors should be mindful of the potential impact that protracted legal proceedings regarding LNP technology could have on...

Read the full narrative on Roivant Sciences (it's free!)

Roivant Sciences' narrative projects $520.7 million in revenue and $83.8 million in earnings by 2028. This requires 59.2% yearly revenue growth and a decrease in earnings of $4.5 billion from $4.6 billion today.

Uncover how Roivant Sciences' forecasts yield a $20.86 fair value, in line with its current price.

Exploring Other Perspectives

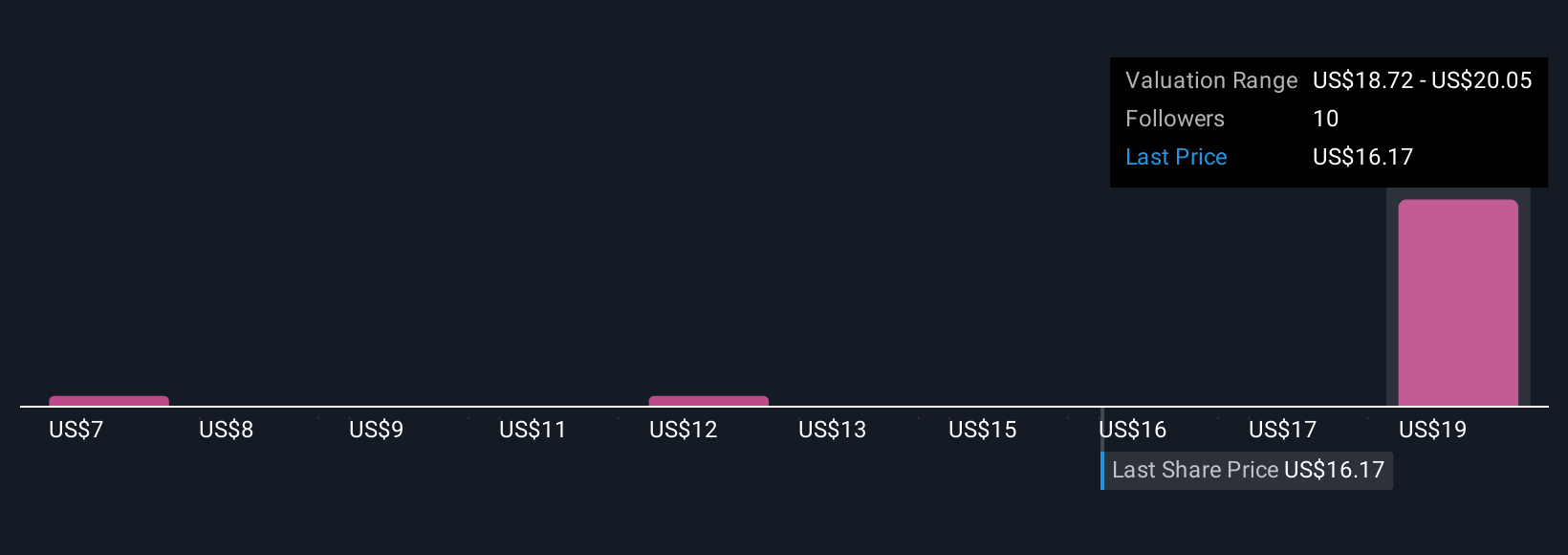

Four members of the Simply Wall St Community assigned Roivant a fair value between US$6.84 and US$20.86 per share. With clinical trial execution as a key company catalyst, these wide-ranging perspectives underline how expectations for future progress can differ, explore several viewpoints to inform your own opinion.

Explore 4 other fair value estimates on Roivant Sciences - why the stock might be worth as much as $20.86!

Build Your Own Roivant Sciences Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Roivant Sciences research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Roivant Sciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Roivant Sciences' overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROIV

Roivant Sciences

A clinical-stage biopharmaceutical company, focuses on the discovery, development, and commercialization of medicines and technologies.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives