- United States

- /

- Biotech

- /

- NasdaqGM:RNA

Will FDA Accelerated Pathway for Delpacibart Zotadirsen Reshape Avidity Biosciences' (RNA) Rare Disease Trajectory?

Reviewed by Sasha Jovanovic

- In November 2025, Avidity Biosciences announced the launch of its Managed Access Program for the investigational therapy delpacibart zotadirsen for eligible Duchenne muscular dystrophy (DMD44) patients in the United States, aligning with the FDA on a 2026 accelerated approval submission pathway.

- This move reflects significant clinical and regulatory progress, as the therapy has earned multiple expedited designations from both U.S. and European regulators.

- We'll explore how securing FDA pathway alignment for delpacibart zotadirsen could influence Avidity Biosciences' long-term position in rare disease therapeutics.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

What Is Avidity Biosciences' Investment Narrative?

To believe in Avidity Biosciences as a shareholder, you're really buying into the potential of its RNA-targeted therapies to break new ground in rare disease treatment, especially Duchenne muscular dystrophy. The recent news, launching the Managed Access Program and aligning with the FDA for an accelerated approval pathway, is a crucial short-term catalyst that could improve regulatory visibility and confidence. However, this progress comes in the context of steep operating losses and ongoing unprofitability, which have only grown in the past year. Any gains from pipeline milestones have to be weighed against significant cash burn and the risk of fundraising or dilution. Adding to the mix is the pending Novartis acquisition, which may reshape catalysts and risks ahead. For now, this latest regulatory step suggests a stronger position in the race toward commercialization, but investors should be mindful that even positive trial data does not guarantee market success or eventual profitability. Still, heavy operational losses remain a real concern that investors should be aware of.

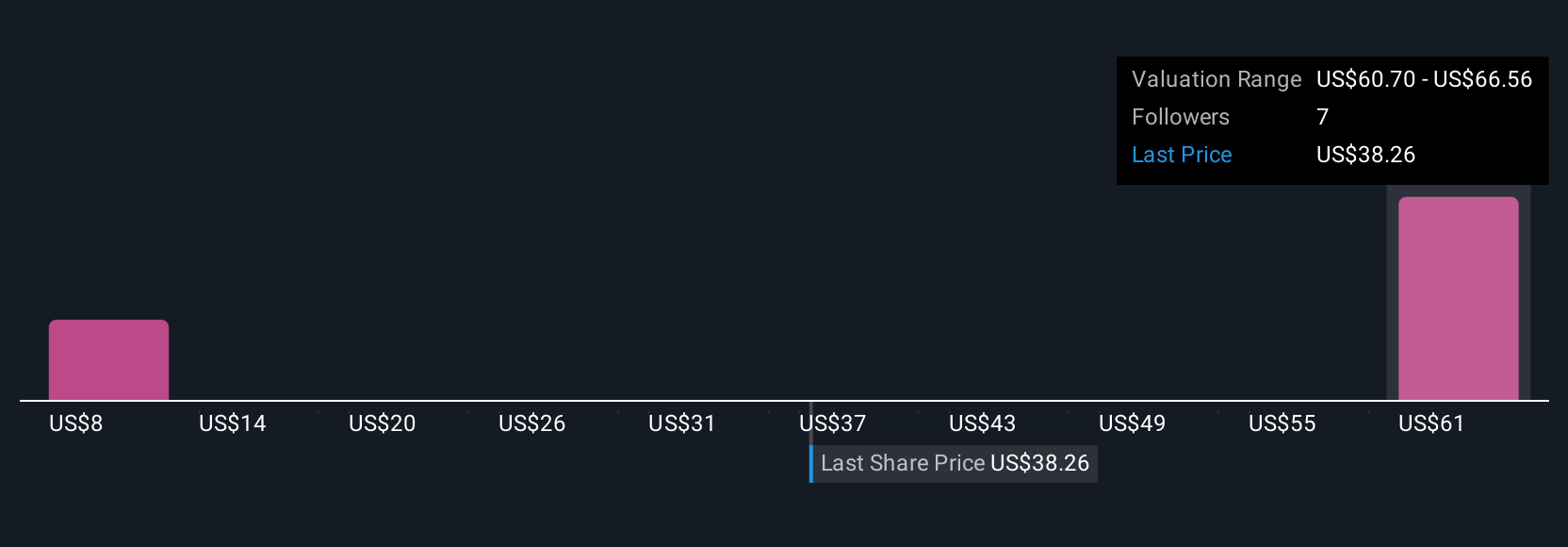

Avidity Biosciences' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 2 other fair value estimates on Avidity Biosciences - why the stock might be worth less than half the current price!

Build Your Own Avidity Biosciences Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Avidity Biosciences research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Avidity Biosciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Avidity Biosciences' overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:RNA

Avidity Biosciences

A biopharmaceutical company, engages in the delivery of RNA therapeutics called antibody oligonucleotide conjugates (AOCs).

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success