- United States

- /

- Biotech

- /

- NasdaqGM:RNA

Avidity Biosciences (RNA): Assessing Valuation Following Managed Access Program Launch and FDA Alignment for Duchenne Therapy

Reviewed by Simply Wall St

Avidity Biosciences (RNA) just rolled out its new Managed Access Program in the US, offering the investigational therapy delpacibart zotadirsen to eligible patients with Duchenne muscular dystrophy mutations. The program operates under an FDA-authorized protocol.

See our latest analysis for Avidity Biosciences.

Avidity Biosciences has been gaining momentum, with its share price leaping 44.9% over the past month and up an impressive 128% year-to-date. The recent Managed Access Program launch and regulatory designations have only added fuel to the sense of long-term potential, as reflected in a stellar three-year total shareholder return of 488%.

If biotech breakthroughs like this pique your interest, you might want to explore other healthcare innovators. See the full line-up in our See the full list for free..

With shares at record highs and the pipeline progressing rapidly, investors are left wondering: Does Avidity Biosciences still have room to run, or is future growth already fully reflected in today’s price?

Price-to-Book of 5.7x: Is it justified?

Avidity Biosciences trades at a price-to-book ratio of 5.7x, notably higher than the US Biotechs industry average of 2.6x. This suggests that investors are paying a hefty premium relative to the company’s net assets.

The price-to-book ratio measures how much investors are willing to pay per dollar of net assets. For biotechs, where tangible assets might not capture all intangible pipeline value, this ratio can help signal whether optimism about future breakthroughs is already reflected in the share price.

With the market valuing Avidity Biosciences at over double the industry average, there is a clear expectation of significant future growth or breakthrough potential. This optimism does not appear to be explained by accounting metrics alone. If the sector returns to historical norms, this multiple could be at risk of falling.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 5.7x (OVERVALUED)

However, downside risks remain. These include clinical setbacks or valuation contraction if market optimism cools, either of which could quickly dampen current gains.

Find out about the key risks to this Avidity Biosciences narrative.

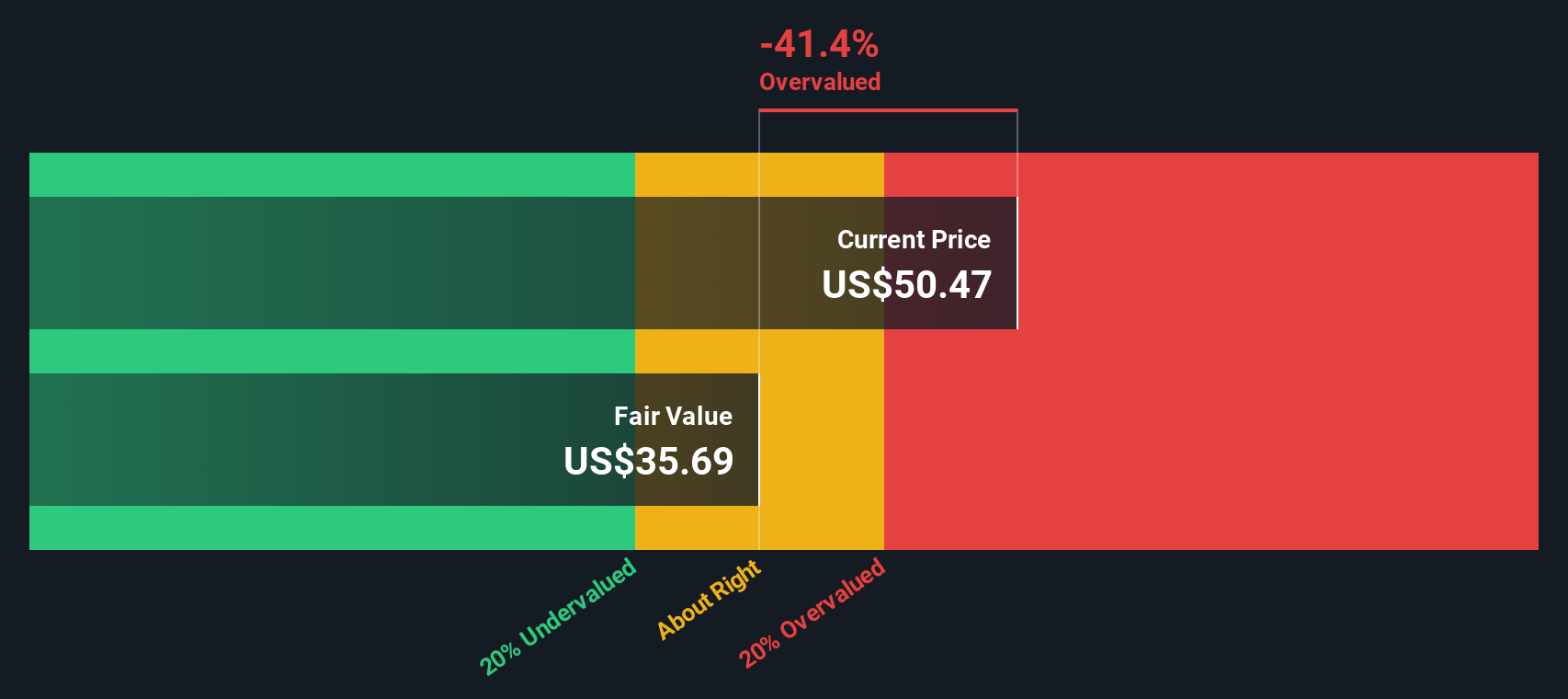

Another View: SWS DCF Model Weighs In

Looking at Avidity Biosciences with our DCF model gives a more cautious perspective. The SWS DCF model estimates a fair value of $30.99, while shares currently trade at $71.20. This suggests the stock could be significantly overvalued if future cash flows do not accelerate. Is the market pricing in too much potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Avidity Biosciences for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 924 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Avidity Biosciences Narrative

Feel free to dig into the numbers yourself and craft a storyline that fits your perspective. You can do this all in just a few minutes. Do it your way

A great starting point for your Avidity Biosciences research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your investment journey to just one opportunity. Take action now and uncover stocks primed for the next wave of growth using these handpicked ideas:

- Boost your portfolio with strong income potential and check out these 14 dividend stocks with yields > 3% that consistently deliver yields above 3% in today’s market.

- Unleash your curiosity and scan these 26 quantum computing stocks making strides in quantum computing and redefining what’s possible in technology.

- Stay ahead of the crowd by investigating these 26 AI penny stocks at the forefront of artificial intelligence, where innovation is driving tomorrow’s market leaders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:RNA

Avidity Biosciences

A biopharmaceutical company, engages in the delivery of RNA therapeutics called antibody oligonucleotide conjugates (AOCs).

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success