- United States

- /

- Biotech

- /

- NasdaqGS:RIGL

Rigel Pharmaceuticals (RIGL) Is Up 14.2% After Raising 2025 Revenue Guidance on Strong Q3 Results

Reviewed by Sasha Jovanovic

- Earlier this week, Rigel Pharmaceuticals reported third-quarter 2025 results with revenue rising to US$69.46 million and net income at US$27.9 million, and also raised its full-year revenue guidance to a range of approximately US$285–290 million.

- The updated financial outlook, along with consistently higher earnings per share, suggests a period of robust business performance and growing optimism about future prospects.

- With Rigel's revenue guidance increase reflecting strong quarterly results, we’ll consider how this shapes the company’s medium-term investment narrative.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

Rigel Pharmaceuticals Investment Narrative Recap

Rigel Pharmaceuticals’ investment case centers on a belief in the company’s ability to translate robust revenue and earnings growth into lasting value, powered by a focused commercial portfolio and an advancing clinical pipeline. This week’s sharp upward revision in full-year revenue guidance reinforces confidence in short-term execution and improved financial performance, while the biggest near-term catalyst remains data and regulatory developments for its late-stage assets. However, the greatest risk still stems from how much recent revenue growth is driven by temporary Medicare policy changes, a factor the guidance revision may not fully resolve.

Among recent announcements, Rigel’s upcoming presentation of Phase 1b data for its IRAK1/4 inhibitor R2891 in lower-risk myelodysplastic syndromes gains particular relevance. Progress with R2891 stands out because future revenue and pipeline diversification depend on successfully expanding this and similar clinical programs into new therapeutic areas, underlining the importance of the next clinical and regulatory milestones for Rigel’s medium-term outlook.

On the other hand, investors should be aware that as the effects from the Medicare out-of-pocket cap normalize, Rigel’s organic revenue growth could revert to...

Read the full narrative on Rigel Pharmaceuticals (it's free!)

Rigel Pharmaceuticals' outlook forecasts $297.0 million in revenue and $42.4 million in earnings by 2028. This is based on a 3.5% annual revenue growth rate, but earnings are expected to fall by $55.4 million from $97.8 million today.

Uncover how Rigel Pharmaceuticals' forecasts yield a $38.33 fair value, a 6% upside to its current price.

Exploring Other Perspectives

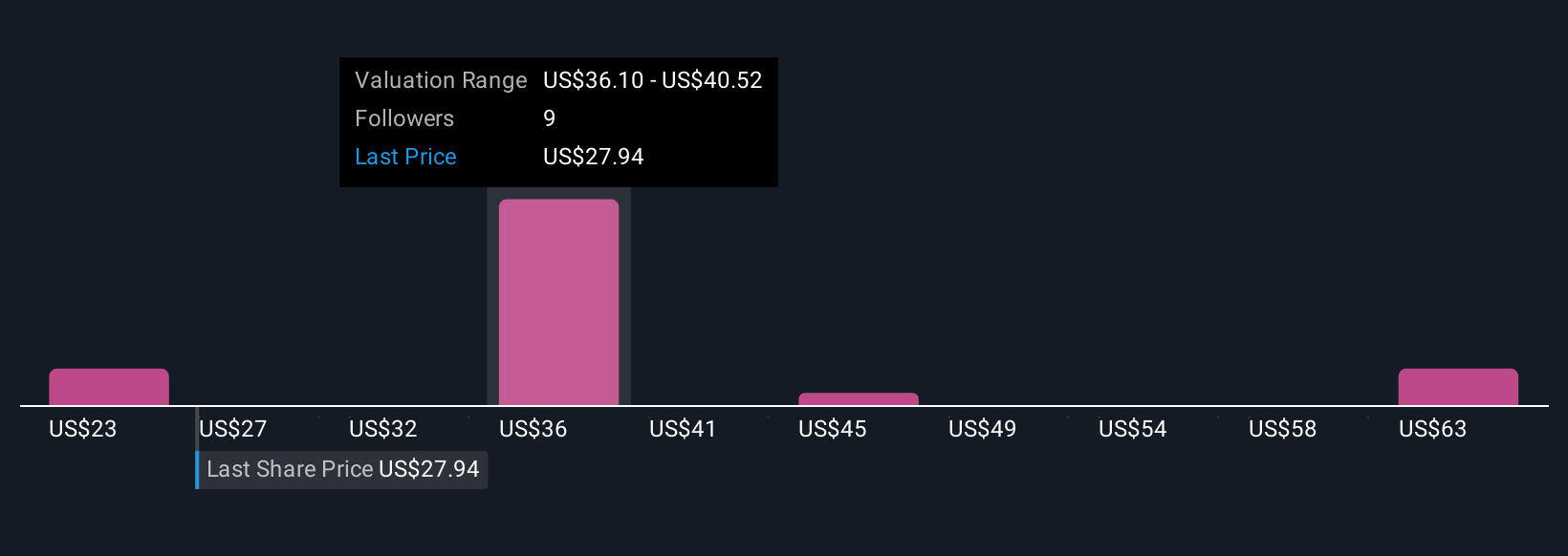

Six members of the Simply Wall St Community estimate Rigel’s fair value between US$22.86 and US$67, showing sharply contrasting viewpoints. While some see considerable upside, others point out risks related to one-off policy-driven revenue surges, reminding you to weigh all the potential drivers at play.

Explore 6 other fair value estimates on Rigel Pharmaceuticals - why the stock might be worth 37% less than the current price!

Build Your Own Rigel Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rigel Pharmaceuticals research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Rigel Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rigel Pharmaceuticals' overall financial health at a glance.

No Opportunity In Rigel Pharmaceuticals?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RIGL

Rigel Pharmaceuticals

A biotechnology company, engages in discovering, developing, and providing therapies that enhance the lives of patients with hematologic disorders and cancer.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives