- United States

- /

- Biotech

- /

- NasdaqGS:RIGL

Rigel Pharmaceuticals (NASDAQ:RIGL) adds US$26m to market cap in the past 7 days, though investors from three years ago are still down 67%

Rigel Pharmaceuticals, Inc. (NASDAQ:RIGL) shareholders will doubtless be very grateful to see the share price up 39% in the last quarter. But over the last three years we've seen a quite serious decline. Indeed, the share price is down a tragic 67% in the last three years. So the improvement may be a real relief to some. The rise has some hopeful, but turnarounds are often precarious.

While the last three years has been tough for Rigel Pharmaceuticals shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

Check out our latest analysis for Rigel Pharmaceuticals

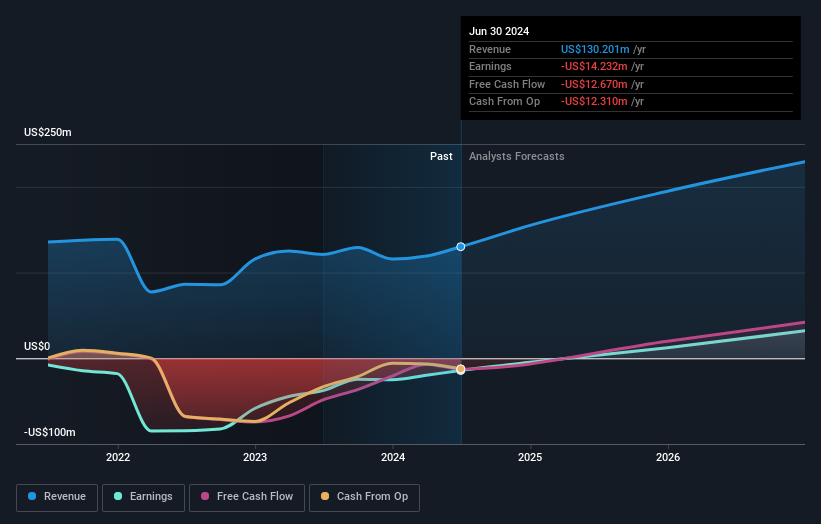

Given that Rigel Pharmaceuticals didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years, Rigel Pharmaceuticals saw its revenue grow by 0.9% per year, compound. Given it's losing money in pursuit of growth, we are not really impressed with that. It's likely this weak growth has contributed to an annualised return of 19% for the last three years. When a stock falls hard like this, some investors like to add the company to a watchlist (in case the business recovers, longer term). Keep in mind it isn't unusual for good businesses to have a tough time or a couple of uninspiring years.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Rigel Pharmaceuticals provided a TSR of 19% over the last twelve months. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 4% endured over half a decade. So this might be a sign the business has turned its fortunes around. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Rigel Pharmaceuticals has 2 warning signs (and 1 which shouldn't be ignored) we think you should know about.

But note: Rigel Pharmaceuticals may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:RIGL

Rigel Pharmaceuticals

A biotechnology company, engages in discovering, developing, and providing therapies that enhance the lives of patients with hematologic disorders and cancer.

Undervalued with high growth potential.