- United States

- /

- Life Sciences

- /

- NasdaqGS:RGEN

Repligen (RGEN): $48.1 Million One-Off Loss Raises Questions Despite Forecasted Earnings Surge

Reviewed by Simply Wall St

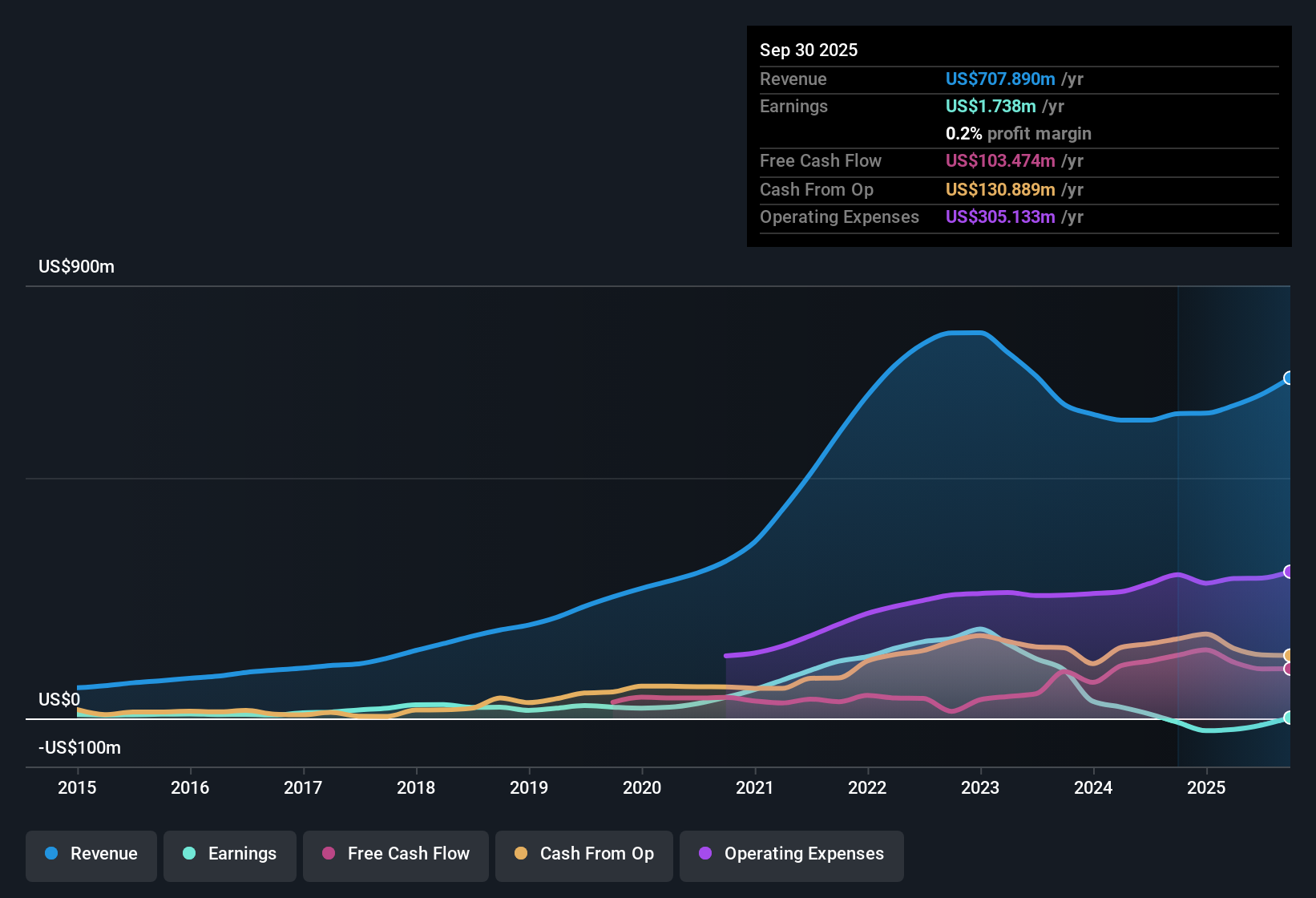

Repligen (RGEN) is back in focus after reporting a one-off net loss of $48.1 million for the twelve months ending September 30, 2025. Despite this significant charge and a five-year annual earnings decline of 33.2%, the company has just returned to profitability and is forecast to grow earnings by a rapid 45.02% per year, with revenue growth expected at 14% per year, a rate well ahead of the broader US market. As investors weigh the transition from historical earnings volatility to robust growth prospects, anticipation is running high for the company’s next chapter.

See our full analysis for Repligen.Next, we're going to stack these headline numbers against the current narratives in the market to see which expectations hold up and which could be in for a rethink.

See what the community is saying about Repligen

Profit Margins Expected to Climb from -2.1% to 13.4%

- Analysts anticipate Repligen’s profit margins will rise sharply over the next three years, improving from -2.1% currently to 13.4%. This signals a swing toward healthy operational profitability.

- According to analysts' consensus view, accelerated margin expansion is driven by a growing focus on innovative, higher-margin products and ongoing global manufacturing investments.

- Strategic diversification and product mix improvements, including launches in filtration and single-use systems, are expected to further support recurring revenue streams and protect margins from volatility.

- Efforts to broaden international supply chains and shift toward resilient sales models are seen as key levers in achieving consistent operational performance despite sector headwinds.

Premium Price-to-Sales Ratio Reflects High Growth Bets

- Repligen is currently valued at a Price-to-Sales Ratio of 11.6x, which is considerably higher than both the peer average (2.8x) and the US Life Sciences industry average (3.4x).

- Analysts' consensus view highlights that while the premium valuation is steep, it is underpinned by forecast annual earnings growth of over 45% and revenue growth of 14% per year, both of which outpace sector benchmarks.

- This disparity in pricing suggests investors are betting heavily on the company's ability to sustain its higher growth trajectory and expand profit margins significantly in the years ahead.

- However, the current share price of $145.84 still trails the analyst target price of $187.00, leaving headroom for positive sentiment if execution matches expectations.

One-Off $48.1 Million Loss Raises Quality Questions

- Despite a return to profitability, Repligen booked a one-off net loss of $48.1 million for the latest twelve months, a charge that impacted the consistency of recent financial results.

- The consensus narrative cautions that recurrent restructuring impacts and exposure to struggling biotech customers create potential headwinds for both revenue stability and margin progression.

- Heavily concentrated exposure to specific modalities, like gene therapy and AAV, increases the risk that negative trends could extend into future reporting periods and challenge near-term growth forecasts.

- Industry-wide debate continues around whether Repligen’s efforts to strengthen recurring revenue and diversify globally will be enough to offset lingering volatility arising from sector pressures and global trade risks.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Repligen on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the data from a new angle? In just a few minutes, you can create and share your own perspective that challenges the consensus. Do it your way.

A great starting point for your Repligen research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Repligen faces questions on revenue quality and margin stability as one-off losses, sector headwinds, and valuation pressures raise concerns about near-term consistency.

If you want steadier results, use stable growth stocks screener (2074 results) to focus on companies proven to deliver reliable earnings and revenue growth through market uncertainty.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RGEN

Repligen

A life sciences company, develops and commercializes bioprocessing technologies and systems in North America, Europe, the Asia Pacific, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives