- United States

- /

- Biotech

- /

- NasdaqGS:RARE

Ultragenyx Pharmaceutical (RARE) Remains Unprofitable, but 28.5% Revenue Growth Strengthens Bullish Narratives

Reviewed by Simply Wall St

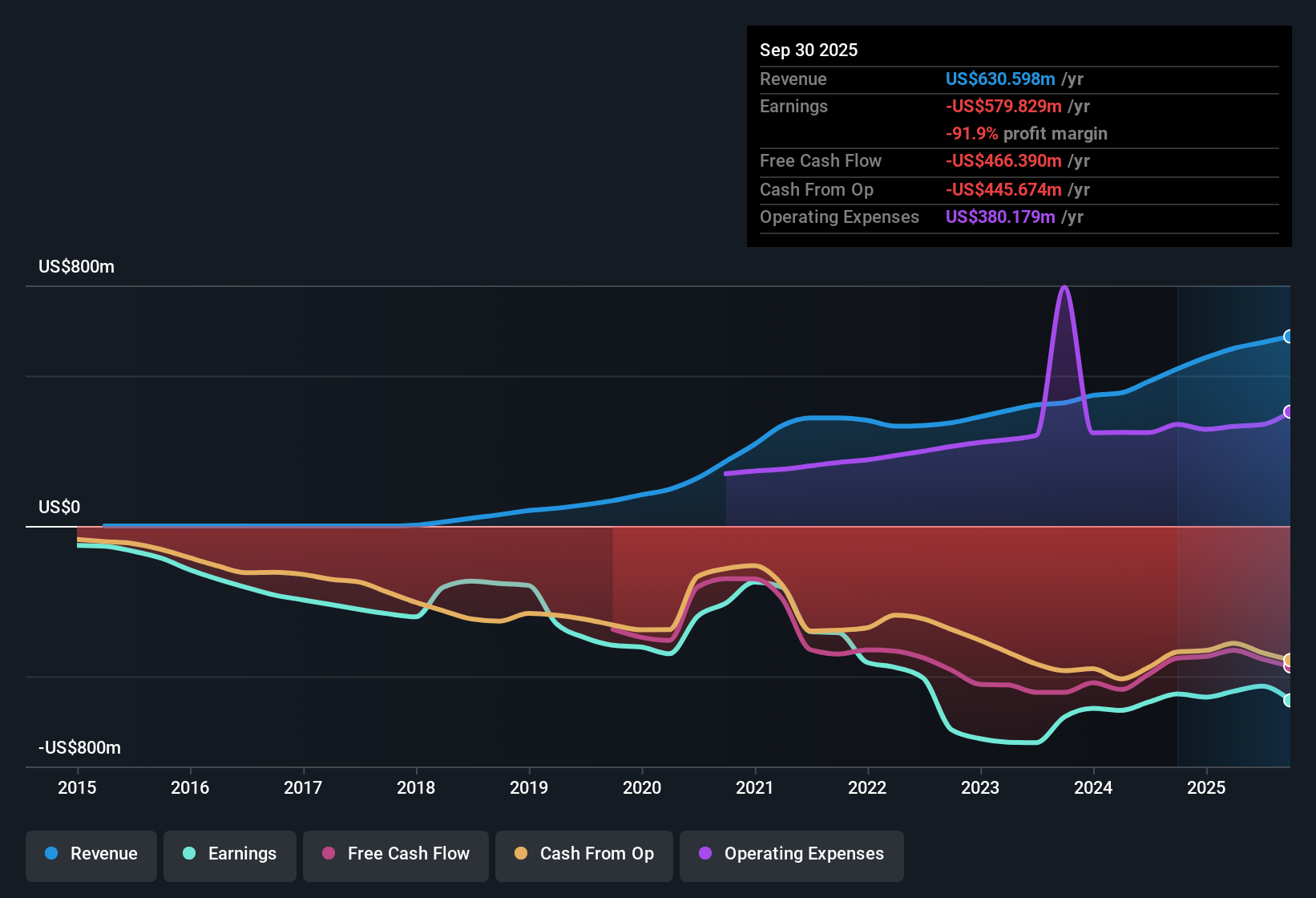

Ultragenyx Pharmaceutical (RARE) continues to operate at a loss, with net losses growing at a rate of 14.8% per year over the past five years and no improvement in profit margins. Despite these persistent losses, revenue is forecast to climb 28.5% per year and earnings are set to jump 81.24% annually, with expectations for RARE to reach profitability within three years. The stock is trading at $31.87, notably below its estimated fair value of $361.43, positioning it as potentially undervalued at current levels based on discounted cash flow analysis.

See our full analysis for Ultragenyx Pharmaceutical.Now, let’s see how these numbers compare to the prevailing narratives. Some expectations could be confirmed, while others may face new questions in light of the latest results.

See what the community is saying about Ultragenyx Pharmaceutical

DCF Fair Value Seen at Over 11 Times Current Share Price

- The DCF fair value for Ultragenyx Pharmaceutical is estimated at $361.43, which is more than 11 times the current share price of $31.87. This highlights a striking gap between intrinsic value and where shares are trading today.

- Analysts' consensus narrative sees this margin as evidence of upside potential, but notes that assuming a repeat of past rapid growth and a surge to a 243.6x future PE is an unusually aggressive bet.

- The consensus narrative connects the low price-to-sales ratio of 5x (well below the US biotech industry average of 10.3x) to possible undervaluation if margins normalize. However, that assumption depends on major improvements in profitability by 2028 being realized.

- Critically, the analysts caution that only if Ultragenyx turns current net losses into meaningful positive earnings could the projected fair value be justified in practice.

Curious if the analyst price target or the DCF fair value offers a better signpost for future growth? See the full analyst and community consensus narrative for how the numbers line up against the conviction investors have in this outlook. 📊 Read the full Ultragenyx Pharmaceutical Consensus Narrative.

Net Margin Set for Dramatic Turnaround

- Profit margins are modeled to jump from -87.3% today to a positive 3.3% in three years, marking a major swing from deep losses to slight profitability based on analysts' consensus view.

- Consensus narrative highlights aggressive expectations for profitability, acknowledging that while pipeline wins and product launches (Evkeeza, Crysvita, Dojolvi) could support higher margins, continued net losses of $115 million in Q2 2025 and a projected bump in cash burn keep this turnaround far from certain.

- What’s surprising is that despite this optimism, analysts are split. Some expect $227.4 million in 2028 earnings, while the most pessimistic forecast a $438 million loss, reflecting major disagreement on how quickly break-even can be reached.

- This tension between positive product momentum and persistent cash outflows remains the key risk for the path to profitability.

Price-to-Sales Ratio Points to Relative Value

- Ultragenyx’s price-to-sales ratio is 5x, not only undercutting the US biotech sector’s 10.3x average but also coming in below the peer average of 5.7x. This helps make the value case for the stock at current pricing.

- Analysts' consensus narrative links this favorable multiple to accelerating topline growth, driven by expanding rare disease markets and pricing/reimbursement wins, while recognizing that headwinds from regulatory setbacks and stiff competition could still derail revenue scaling if launches or approvals stumble.

- For now, solid double-digit revenue growth (20% YoY top-line increase in 1H25) plus a robust late-stage pipeline are counted as drivers supporting valuation upside in the consensus view.

- Still, exposure to regulatory obstacles and the risk of heavy dependence on timely product success, called out by the consensus narrative, mean investors are watching forthcoming Phase III results and payer agreements closely.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Ultragenyx Pharmaceutical on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own angle on these numbers? Shape your perspective into a fresh narrative in just a couple of minutes by using Do it your way.

A great starting point for your Ultragenyx Pharmaceutical research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite the promise of future profitability, Ultragenyx’s persistent net losses and uncertain path to positive cash flow expose investors to ongoing financial risk.

If stable revenue and earnings matter most to you, check out stable growth stocks screener (2073 results) for companies that consistently deliver steady results across all market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RARE

Ultragenyx Pharmaceutical

A biopharmaceutical company, focuses on the identification, acquisition, development, and commercialization of novel products for the treatment of rare and ultra-rare genetic diseases in North America, Latin America, Europe, the Middle East, Africa, and the Asia-Pacific.

High growth potential and good value.

Market Insights

Community Narratives