- United States

- /

- Biotech

- /

- NasdaqGS:RARE

Is Now the Right Moment for Ultragenyx After Shares Jumped 7% This Week?

Reviewed by Bailey Pemberton

If you are wondering what to do with Ultragenyx Pharmaceutical stock right now, you are not alone. Whether you are thinking about buying the dip, holding on through the rollercoaster, or cutting your losses, there is a lot to consider. The company has experienced significant volatility recently, with the stock jumping 7.3% over the last week. However, if you take a broader view, the picture becomes a little more sobering: Ultragenyx is down 1.1% for the month and 24.2% for the year so far. Looking even further back, the five-year performance stands at a loss of 67.0%.

Since the start of the year, the entire biotech sector has been dealing with changing investor sentiment, with many names like Ultragenyx getting caught in the crosshairs. Some of the price moves can be tied to shifts in the market's appetite for risk and to announcements about competition in rare diseases, which is the primary focus for Ultragenyx. Despite the turbulence, the stock has started to attract attention again on growth hopes as the sector shows signs of stabilizing. This renewed interest serves as a reminder that the story is not just about the past but also about the possibility of a turnaround, if the valuation is appropriate.

Regarding valuation, Ultragenyx scores a 4 out of 6 on our value checklist, indicating it appears undervalued on most major measures. However, scoring well on traditional valuation models does not always provide the full picture. Next, I will break down each of those valuation approaches, and at the end, share an additional way to evaluate whether Ultragenyx is truly a bargain.

Why Ultragenyx Pharmaceutical is lagging behind its peers

Approach 1: Ultragenyx Pharmaceutical Discounted Cash Flow (DCF) Analysis

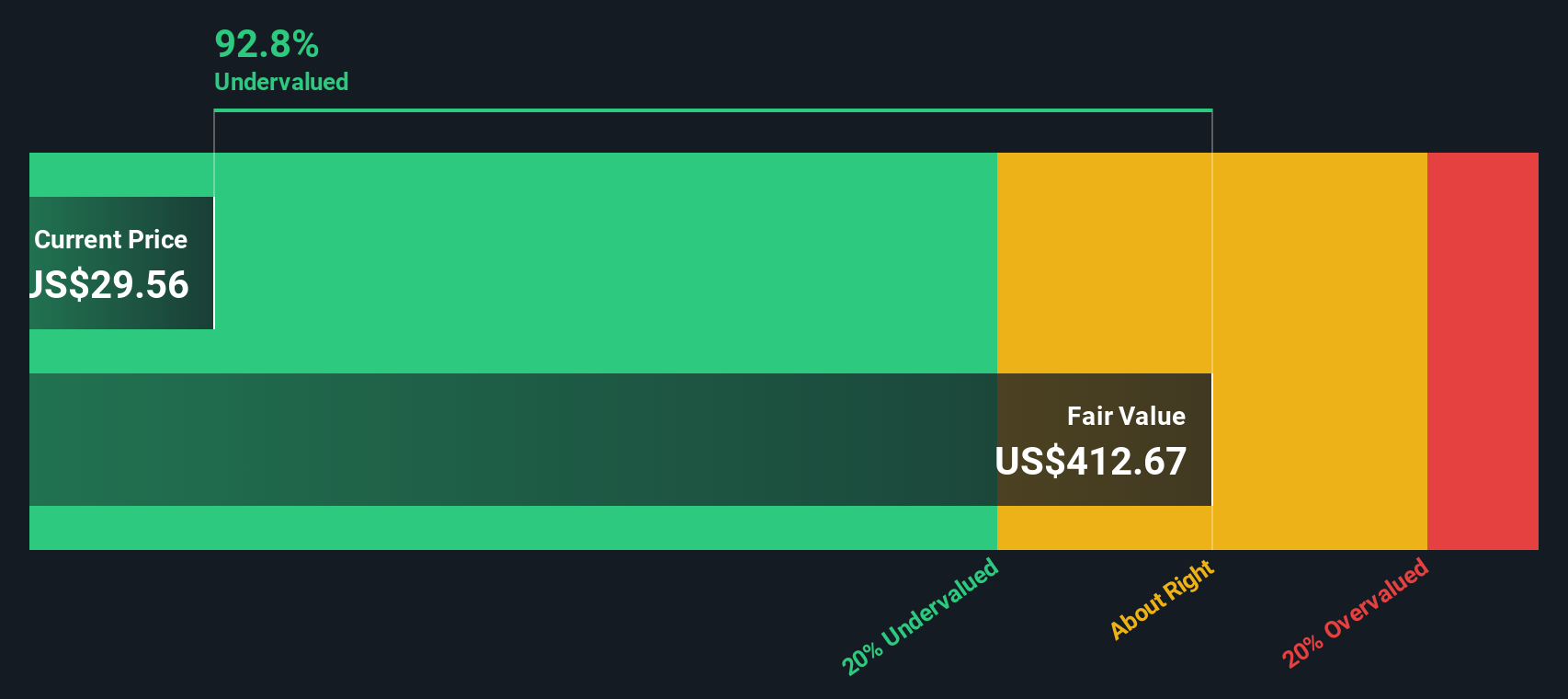

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's dollars. For Ultragenyx Pharmaceutical, this approach provides a forward-looking perspective based on expected cash generation.

Currently, Ultragenyx's last twelve months Free Cash Flow sits at -$477.8 Million, reflecting the company's heavy investment phase. Analyst forecasts indicate a significant turnaround ahead, projecting Free Cash Flow to rise to $892 Million by late 2029. Looking further out, these figures continue to increase, with extrapolations suggesting Free Cash Flow could surpass $2.25 Billion by 2035. The initial five years are based on analyst consensus, while the long-term numbers rely on extended modeling.

Using these cash flow projections, the DCF analysis calculates Ultragenyx's intrinsic value at $364.39 per share. When compared with the current market price, this implies the stock is trading at a 91.4% discount compared to the intrinsic value. This suggests it is significantly undervalued on this measure.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Ultragenyx Pharmaceutical is undervalued by 91.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Ultragenyx Pharmaceutical Price vs Sales

The Price-to-Sales (P/S) ratio is the preferred metric here because it can offer valuable insight for companies like Ultragenyx that are not yet generating accounting profits. For biotechs investing heavily for future growth, sales can provide a more stable benchmark for valuation than profit-based multiples.

When growth expectations are high or risk is perceived as low, investors tend to be willing to pay a higher P/S ratio. Conversely, slower growth or higher risk usually results in a lower "fair" multiple. This means that context, such as industry averages and a company’s financial outlook, is vitally important when interpreting a valuation ratio.

Ultragenyx currently trades at a P/S ratio of 4.9x. This is well below the average for its biotech peers, which stands at roughly 22.4x, and also below the broader biotech industry average of 10.5x. However, these simple comparisons can be misleading because they do not factor in important aspects like Ultragenyx's future growth trajectory, its risk profile, and profit margins, which are especially relevant for growth-stage companies.

This is where the Simply Wall St Fair Ratio comes in. The Fair Ratio for Ultragenyx is calculated to be 2.4x, reflecting a nuanced evaluation based on its growth prospects, industry risks, competitive position, and market capitalization. Unlike a direct industry or peer comparison, this Fair Ratio aims to reflect the specific characteristics that make Ultragenyx unique in its sector.

With Ultragenyx’s actual P/S ratio at 4.9x and the Fair Ratio at 2.4x, the shares trade above what would be considered fair value on this metric, and the gap is significant enough to warrant caution.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Ultragenyx Pharmaceutical Narrative

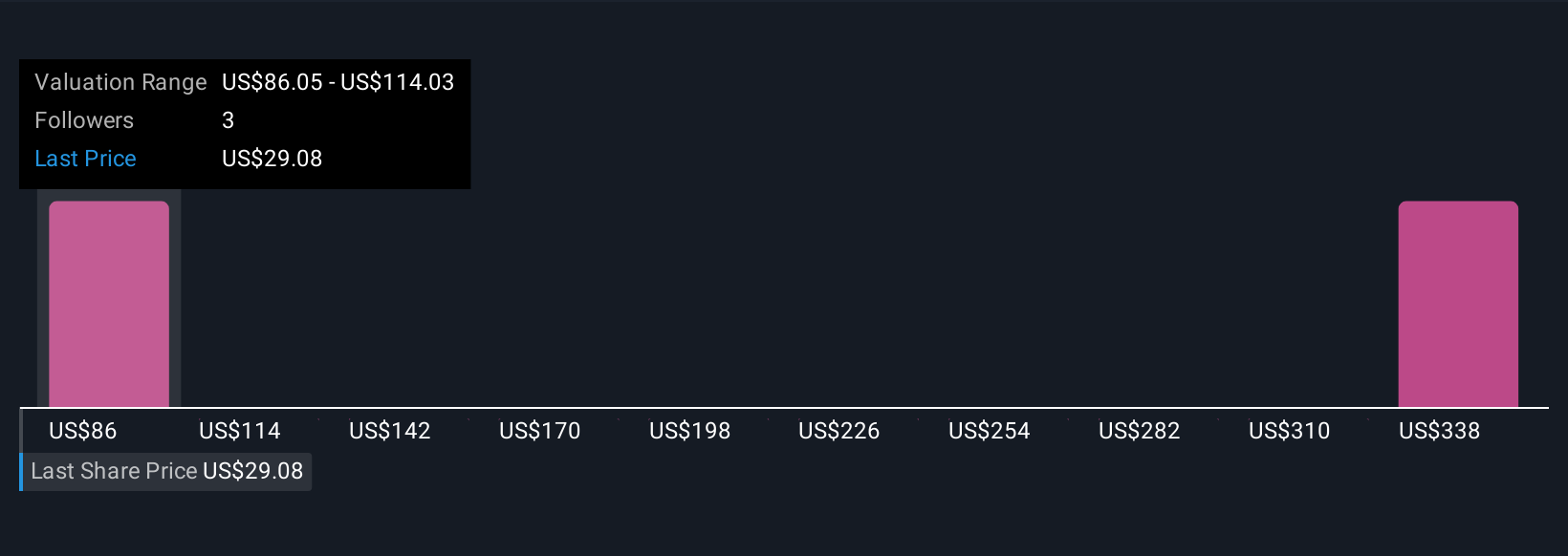

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a story-driven approach to investing that lets you connect your perspective on a company, such as your assumptions about its future revenue, profits, and margins, with your estimate of its fair value.

With Narratives, you can link the business’s story directly to a financial forecast and see how your own view stacks up against the current share price. Narratives are part of Simply Wall St's Community page, trusted by millions of investors, and let you easily create, adjust, or follow different scenarios as new information emerges, whether it is breaking news or quarterly results.

This dynamic tool enables you to see, in real time, whether Ultragenyx looks like a buy, sell, or hold based on your fair value compared with today’s price. For example, some investors expect the price to surge to $128.0 while others see it staying closer to $34.0, highlighting just how much personal assumptions can impact your view and your investment decision.

Do you think there's more to the story for Ultragenyx Pharmaceutical? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RARE

Ultragenyx Pharmaceutical

A biopharmaceutical company, focuses on the identification, acquisition, development, and commercialization of novel products for the treatment of rare and ultra-rare genetic diseases in North America, Latin America, Europe, the Middle East, Africa, and the Asia-Pacific.

High growth potential and good value.

Market Insights

Community Narratives