- United States

- /

- Life Sciences

- /

- NasdaqGM:QTRX

Quanterix (NASDAQ:QTRX) adds US$48m to market cap in the past 7 days, though investors from three years ago are still down 72%

It's nice to see the Quanterix Corporation (NASDAQ:QTRX) share price up 10% in a week. But only the myopic could ignore the astounding decline over three years. Indeed, the share price is down a whopping 72% in the last three years. So it sure is nice to see a bit of an improvement. Of course the real question is whether the business can sustain a turnaround.

While the stock has risen 10% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

View our latest analysis for Quanterix

Quanterix isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually desire strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In the last three years, Quanterix saw its revenue grow by 5.2% per year, compound. Given it's losing money in pursuit of growth, we are not really impressed with that. But the share price crash at 20% per year does seem a bit harsh! While we're definitely wary of the stock, after that kind of performance, it could be an over-reaction. Of course, revenue growth is nice but generally speaking the lower the profits, the riskier the business - and this business isn't making steady profits.

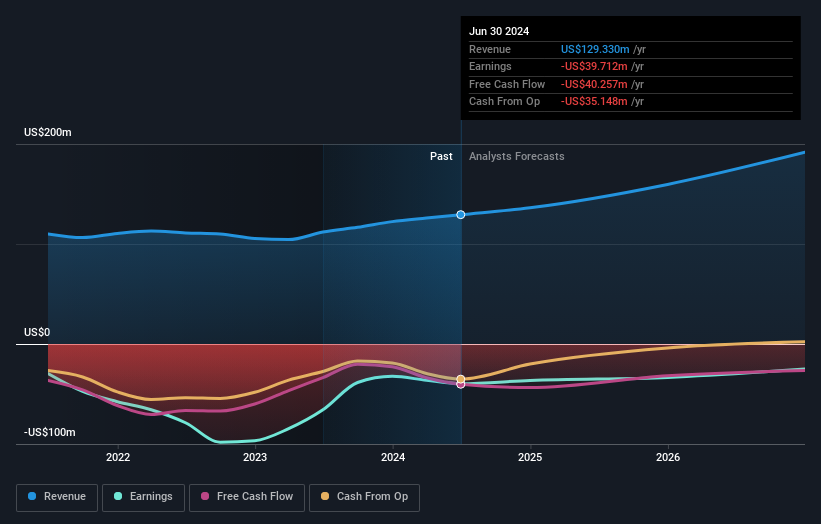

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

Investors in Quanterix had a tough year, with a total loss of 49%, against a market gain of about 27%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 7% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Quanterix better, we need to consider many other factors. Take risks, for example - Quanterix has 2 warning signs we think you should be aware of.

Quanterix is not the only stock insiders are buying. So take a peek at this free list of small cap companies at attractive valuations which insiders have been buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Quanterix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:QTRX

Quanterix

A life sciences company, engages in development and marketing of digital immunoassay platforms that advances precision health for life sciences research and diagnostics in North America, Europe, the Middle East, Africa, and the Asia Pacific regions.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives