- United States

- /

- Biotech

- /

- NasdaqGM:PTGX

Does Protagonist Therapeutics Offer Value After Major Pipeline Updates and Triple Digit 2024 Gains?

Reviewed by Bailey Pemberton

- Wondering if Protagonist Therapeutics is trading at a bargain right now? You are not alone, as there is plenty of buzz around finding value in this biotech stock.

- The share price has increased by 119.7% year-to-date and is up more than 1,000% over three years, although it dipped 4.7% last week. This signals a mix of strong growth and some market nerves.

- Recent news has centered on promising pipeline updates and strategic partnerships that have captured market attention. Investors are watching closely to see if these developments can deliver on their potential and drive further gains, or if the excitement is getting ahead of fundamentals.

- Right now, Protagonist Therapeutics earns a valuation score of 2 out of 6 based on traditional checks for undervaluation. We will break down how these standard valuation methods stack up, and later, reveal a more powerful perspective to help you judge the company's true value.

Protagonist Therapeutics scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Protagonist Therapeutics Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s real worth by projecting how much cash it will generate in the future, then discounting those cash flows back to today’s value. This lets investors assess whether a stock is undervalued or overvalued compared to its market price.

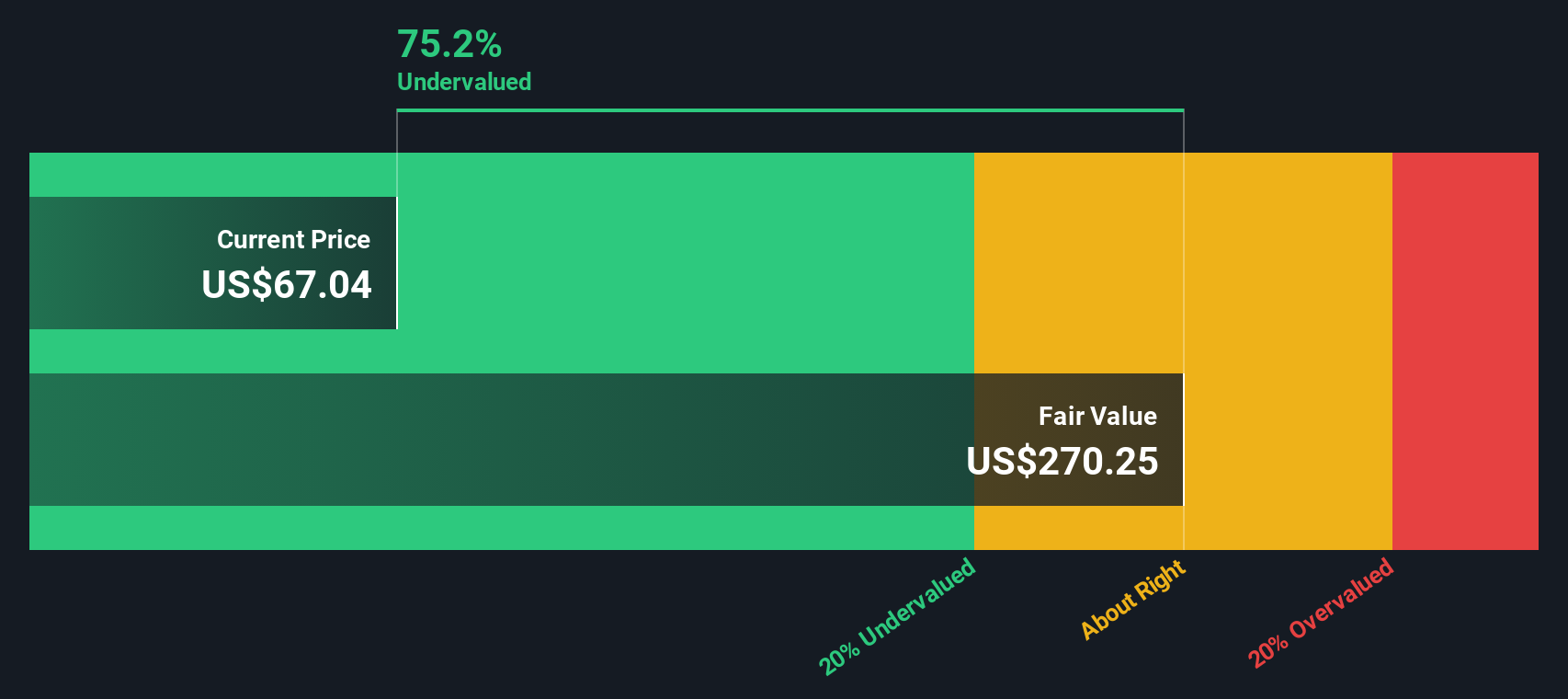

For Protagonist Therapeutics, the DCF analysis uses the latest Free Cash Flow (FCF) figure of $64.10 million in the last twelve months, with analyst projections for FCF growth over the next five years. The forecast suggests FCF could reach $231 million by the end of 2029, with further estimates based on both analyst inputs and model extrapolations extending out to 2035. These projections include periods of both strong increases and short-term volatility, reflecting the unpredictable nature of biotech revenue streams.

After discounting all expected cash flows to their present value, the DCF model estimates an intrinsic value of $117.26 per share. This implies the stock is trading at a 27.0% discount to its fair value based on these cash flow projections, which points to a notable undervaluation at current prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Protagonist Therapeutics is undervalued by 27.0%. Track this in your watchlist or portfolio, or discover 928 more undervalued stocks based on cash flows.

Approach 2: Protagonist Therapeutics Price vs Earnings

For profitable companies, the Price-to-Earnings (PE) ratio is one of the most telling valuation metrics. It gives investors a snapshot of how much they are paying for every dollar of earnings, helping to assess whether a stock is realistically valued given its current profitability.

It's important to remember that a "normal" or fair PE ratio depends on more than just profitability. Companies with high earnings growth tend to justify higher PE ratios because investors are willing to pay up for future gains. Conversely, higher risk or uncertain earnings can warrant a lower PE, since investors demand a discount for those risks.

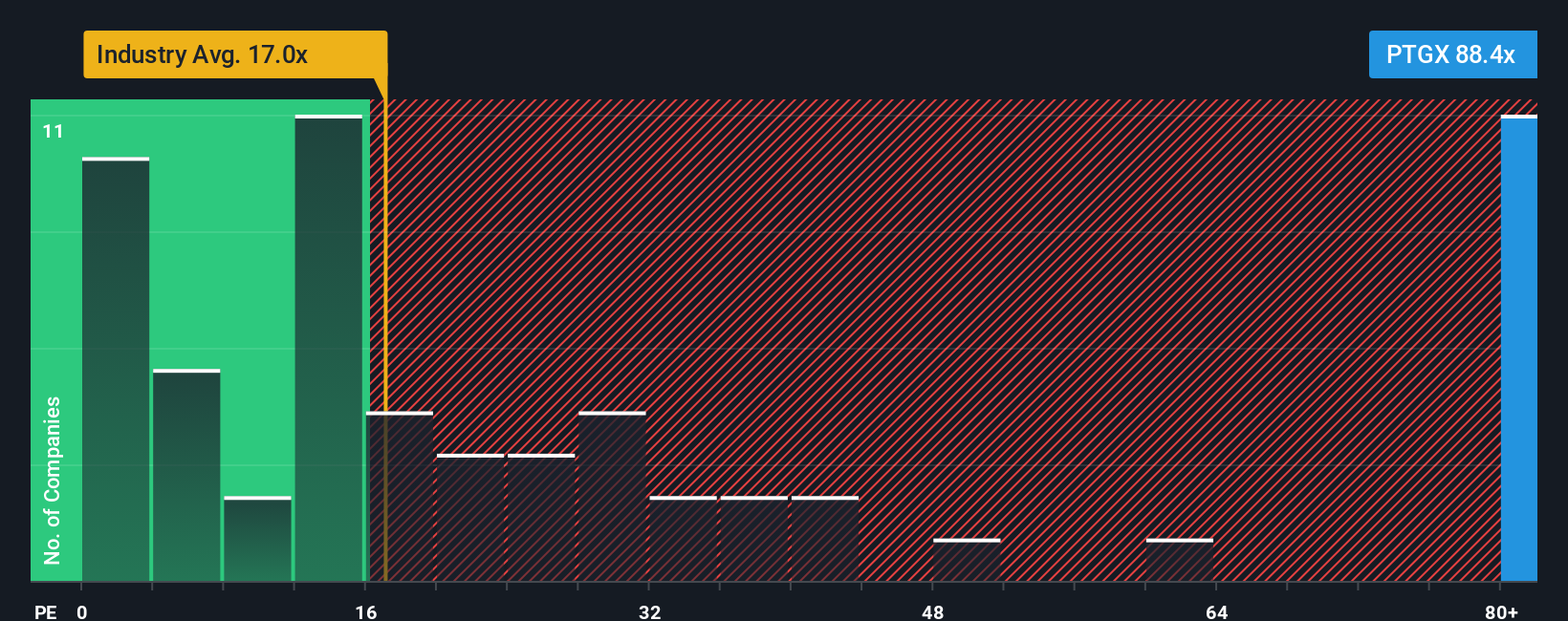

Right now, Protagonist Therapeutics trades at a PE ratio of 116.6x. That is significantly higher than the Biotechs industry average of 18.7x and above the average PE of its peers at 30.8x. At first glance, this might look expensive, but numbers do not tell the whole story.

Simply Wall St uses a "Fair Ratio" to get a more nuanced view, calculating what an appropriate PE should be by weighing factors like Protagonist’s earnings growth, profit margins, industry dynamics, market capitalization and overall risk profile. This custom benchmark is more meaningful than raw averages, as it tailors the expected multiple to the company’s real prospects and risks. For Protagonist Therapeutics, the Fair Ratio stands at 30.5x, a sizable gap below the stock’s current PE ratio.

With the PE ratio sitting so far above its Fair Ratio, the stock appears to be priced with a lot of optimism included. Based on this approach, Protagonist Therapeutics may be overvalued at current levels.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Protagonist Therapeutics Narrative

Earlier, we mentioned there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is your personal story or perspective behind the numbers, where you outline your own assumptions for a company’s future revenue, earnings, and margins, then see how those beliefs translate into a fair value estimate.

Narratives connect the dots between a company’s story, its financial outlook, and whether a stock is actually a good deal. It is an easy and accessible tool, available to millions of investors within the Simply Wall St Community page, allowing you to create and view diverse investment stories for any stock, side by side with fellow investors.

By comparing your Narrative’s fair value to the current share price, Narratives help you decide if it’s time to buy or sell, guided by logic rather than guesswork. These forecasts are dynamically updated as key news and earnings releases roll in, keeping your assessment relevant at all times.

For Protagonist Therapeutics, you might see very optimistic Narratives driven by breakthrough drug progress (with high future values), while more cautious investors might focus on competitive risks and price in much lower fair values, offering a full spectrum of possible outcomes.

Do you think there's more to the story for Protagonist Therapeutics? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:PTGX

Protagonist Therapeutics

A biopharmaceutical company, develops peptide therapeutics for hematology and blood disorders, and inflammatory and immunomodulatory diseases.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026