- United States

- /

- Biotech

- /

- NasdaqGS:PTCT

PTC Therapeutics (PTCT) Profit Margin Improvement Tests Bearish Outlook on Declining Growth Forecasts

Reviewed by Simply Wall St

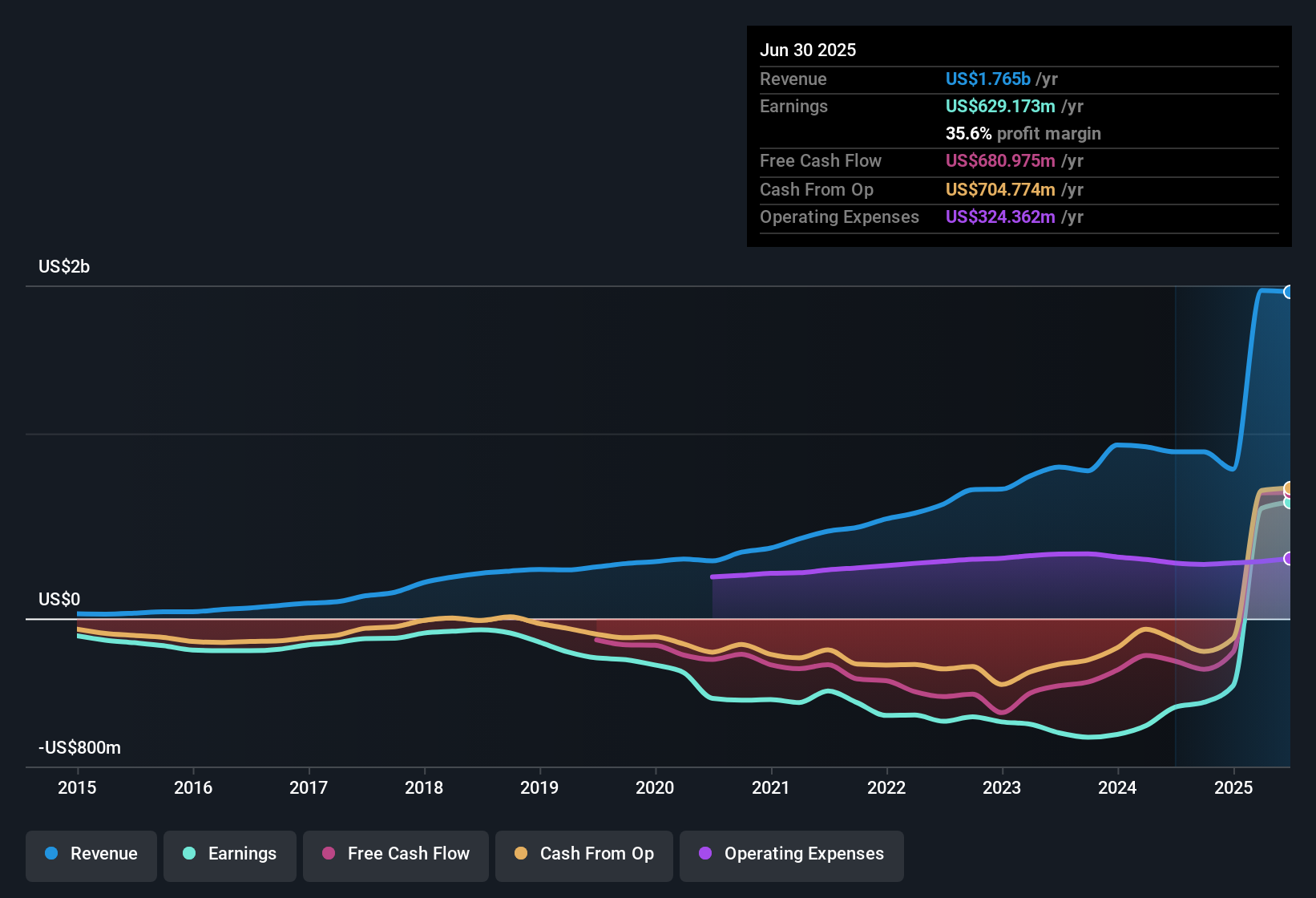

PTC Therapeutics (PTCT) has recently turned profitable, with notable improvements in its net profit margin over the past year. Over the last five years, the company grew its earnings at an annualized rate of 20.9%. However, forecasts are now signaling a reversal, with earnings expected to fall by 46% per year and revenue anticipated to decrease by 2.3% per year over the next three years. Investors are now weighing PTCT’s past margin gains and growth track record against expectations of a more challenging period ahead, setting the stage for a closely watched earnings season.

See our full analysis for PTC Therapeutics.The next section will dig into how these headline results measure up against the most widely debated narratives around PTC Therapeutics, highlighting where consensus holds and where views may shift.

See what the community is saying about PTC Therapeutics

Margin Shrinkage Faces Revenue Headwinds

- Profit margins are projected to contract from 35.6% today to just 4.3% in three years, while revenue is forecast to decrease by 10.3% per year over the same horizon.

- Analysts' consensus view points to short-term challenges but recognizes several growth levers:

- Despite shrinking margins and declining sales, Sephience's recent broad approvals and launch activities position the company to accelerate topline growth in rare diseases. This could potentially offset losses if early uptake is robust.

- The pipeline includes two NDAs under FDA review and a late-stage program for Huntington's, which could provide fresh revenue streams to stabilize profits if successful, even as legacy product risks and pricing pressure persist.

- The current consensus calls for ongoing vigilance as declining margins and revenue reflect both company-specific hurdles and broader industry pressures on biopharmaceutical innovators.

- Curious how fresh launches and margin pressures are reshaping the big picture for PTCT? See what analysts and the community expect next: 📊 Read the full PTC Therapeutics Consensus Narrative.

Discounted Valuation Versus Industry Peers

- PTC Therapeutics trades at a price-to-earnings ratio of 9.2x, below the peer average of 15.8x and the US biotech industry norm of 16.9x, with shares at $71.77 currently.

- According to analysts' consensus view, this deep discount is seen as partly reflective of substantial risks but also perceived as undervaluation in light of the company’s high-quality past earnings:

- The current share price sits over 60% below the DCF fair value estimate of $188.68. This suggests long-term earnings potential may be more robust than the falling forecast implies.

- However, to reach the $77.93 analyst price target, the company would need to deliver on key pipeline milestones and stem the projected profitability decline; otherwise, investors may continue to demand a steep discount compared to established peers.

Product Reliance Adds Risk in Transition Period

- The company is heavily reliant on revenue from a small number of products, especially Translarna and Sephience. Both have unique risks around international reimbursements, regulatory approval, and market acceptance.

- Analysts' consensus view highlights both the reward and risk in this transition:

- Recent strategic moves such as the buyout of future sales obligations for Sephience may improve net margins. However, persistent negative cash flow and limited diversification increase vulnerability to setbacks in a single product line.

- With Translarna's access now dependent on temporary, country-by-country mechanisms and increasing generic competition eroding sales of Emflaza, the path to sustained growth is highly sensitive to successful new launches and stable reimbursement environments.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for PTC Therapeutics on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Not convinced by the consensus view? Add your take and bring a fresh angle to the story in just a few clicks. Do it your way

A great starting point for your PTC Therapeutics research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

PTC Therapeutics faces declining margins and revenue, limited product diversification, and significant reliance on risky pipeline launches for future growth.

If you want more consistency and lower risk, check out stable growth stocks screener (2074 results) to discover companies delivering reliable earnings expansion year in and year out.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PTCT

PTC Therapeutics

A biopharmaceutical company, focuses on the discovery, development, and commercialization of medicines to children and adults living with rare disorders in the United States and internationally.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives