- United States

- /

- Biotech

- /

- NasdaqGS:PTCT

PTC Therapeutics (PTCT) Is Up 14.1% After Joining the S&P SmallCap 600 Index – Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- PTC Therapeutics recently joined the S&P SmallCap 600 index, replacing SanDisk before markets opened last Friday, increasing its visibility to a wider investor base.

- This index inclusion is expected to prompt significant buying activity by passive funds that track the S&P SmallCap 600, highlighting greater institutional attention for the company.

- We'll explore how this heightened visibility from joining a major index may influence PTC Therapeutics' investment narrative and future prospects.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

PTC Therapeutics Investment Narrative Recap

To be a shareholder in PTC Therapeutics, you need conviction in its ability to leverage recent FDA and European approvals for Sephience to capture global rare disease markets, accelerating profitable growth despite concentrated product risk. While joining the S&P SmallCap 600 increases short-term visibility and attracts passive fund flows, this news does not directly change the near-term catalyst of Sephience’s commercial uptake nor address the ongoing revenue reliance on a few major products, still the clearest current risk to stability.

The recently announced broad FDA approval of Sephience for phenylketonuria is most relevant, as it shapes the near-future revenue base that underpins expectations following index inclusion. The success of Sephience’s launch, aided by rapid patient access initiatives and expanding health coverage, remains integral to delivering the revenue growth and profitability investors expect, particularly as fresh institutional attention could increase scrutiny on product execution.

Yet, even as PTC’s investor profile rises, it is important to remember that sudden regulatory or reimbursement setbacks for core products could...

Read the full narrative on PTC Therapeutics (it's free!)

PTC Therapeutics is projected to have $1.3 billion in revenue and $55.4 million in earnings by 2028. This reflects a 10.3% annual revenue decline and a $573.8 million decrease in earnings from the current $629.2 million.

Uncover how PTC Therapeutics' forecasts yield a $77.93 fair value, a 10% downside to its current price.

Exploring Other Perspectives

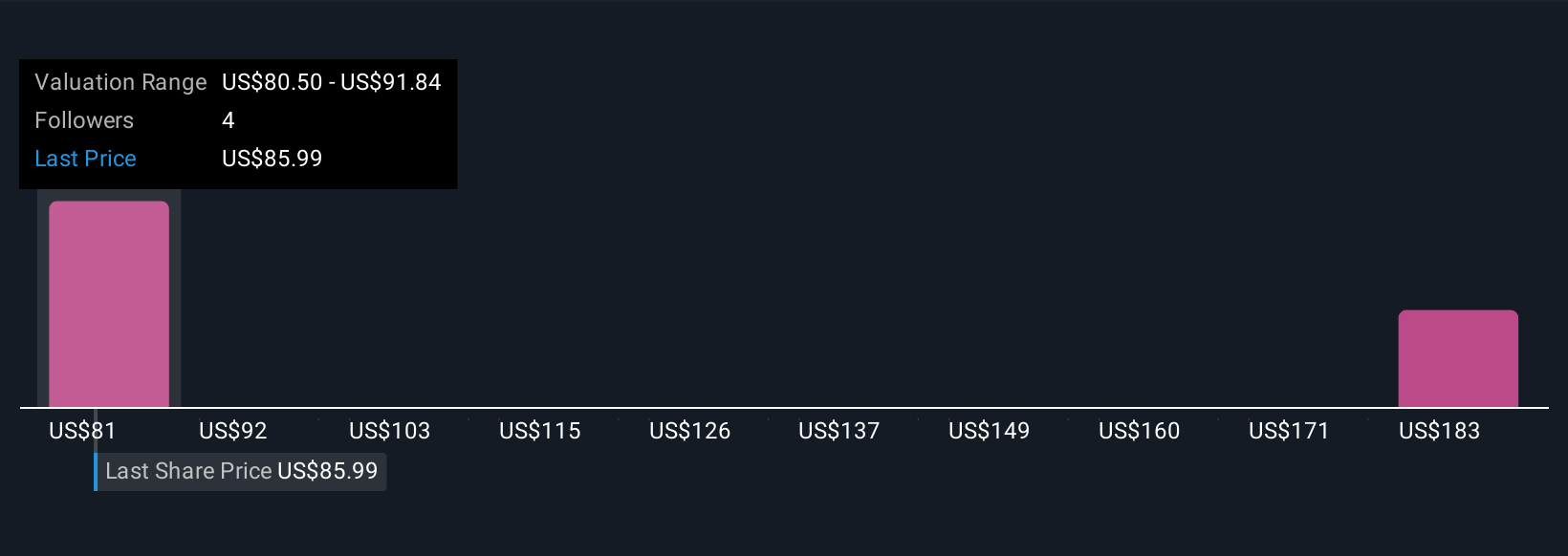

Private fair value estimates from the Simply Wall St Community range widely, from US$77.93 to US$193.26 per share, with just two submitted perspectives. While many now focus on Sephience’s commercial roll-out, some participants flag that heavy reliance on a handful of products leaves near-term earnings vulnerable to setbacks, urging readers to weigh several different viewpoints before making up their minds.

Explore 2 other fair value estimates on PTC Therapeutics - why the stock might be worth over 2x more than the current price!

Build Your Own PTC Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PTC Therapeutics research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free PTC Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PTC Therapeutics' overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PTCT

PTC Therapeutics

A biopharmaceutical company, focuses on the discovery, development, and commercialization of medicines to children and adults living with rare disorders in the United States and internationally.

Undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success