- United States

- /

- Biotech

- /

- NasdaqGS:PTCT

How Investors May Respond To PTC Therapeutics (PTCT) Analysts' Optimism on Sephience Launch Momentum

Reviewed by Sasha Jovanovic

- In late October 2025, PTC Therapeutics announced inducement grants of non-statutory stock options and restricted stock units for two new employees, with these grants approved by the Compensation Committee under Nasdaq Listing Rule 5635(c)(4).

- Industry analysts have emphasized early commercial momentum for the newly approved Sephience therapy, citing high initial prescription rates by specialists and favorable payor coverage trends.

- We'll now examine how analyst optimism around Sephience's commercial launch could influence PTC Therapeutics' overall investment outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

PTC Therapeutics Investment Narrative Recap

Owning shares in PTC Therapeutics means believing in the company’s ability to successfully commercialize innovative rare disease treatments like Sephience, while managing risks from product concentration and uncertain international revenue streams. The latest inducement grants for new hires are routine administrative actions and are not expected to materially impact the short-term catalyst, which remains Sephience’s launch trajectory; however, investor focus is still firmly on the therapy’s market uptake, pricing, and access dynamics as immediate drivers of performance and risk. The recent expansion of the partnership with RareMed Solutions, enabling specialized non-commercial pharmacy services for Sephience, directly supports near-term commercial execution and could smooth patient access, aligning with the company’s strategy to build broad, early adoption of this key therapy. Yet, against these promising initial steps, investors should be aware of ongoing negative cash flow and the risk that revenue concentration could...

Read the full narrative on PTC Therapeutics (it's free!)

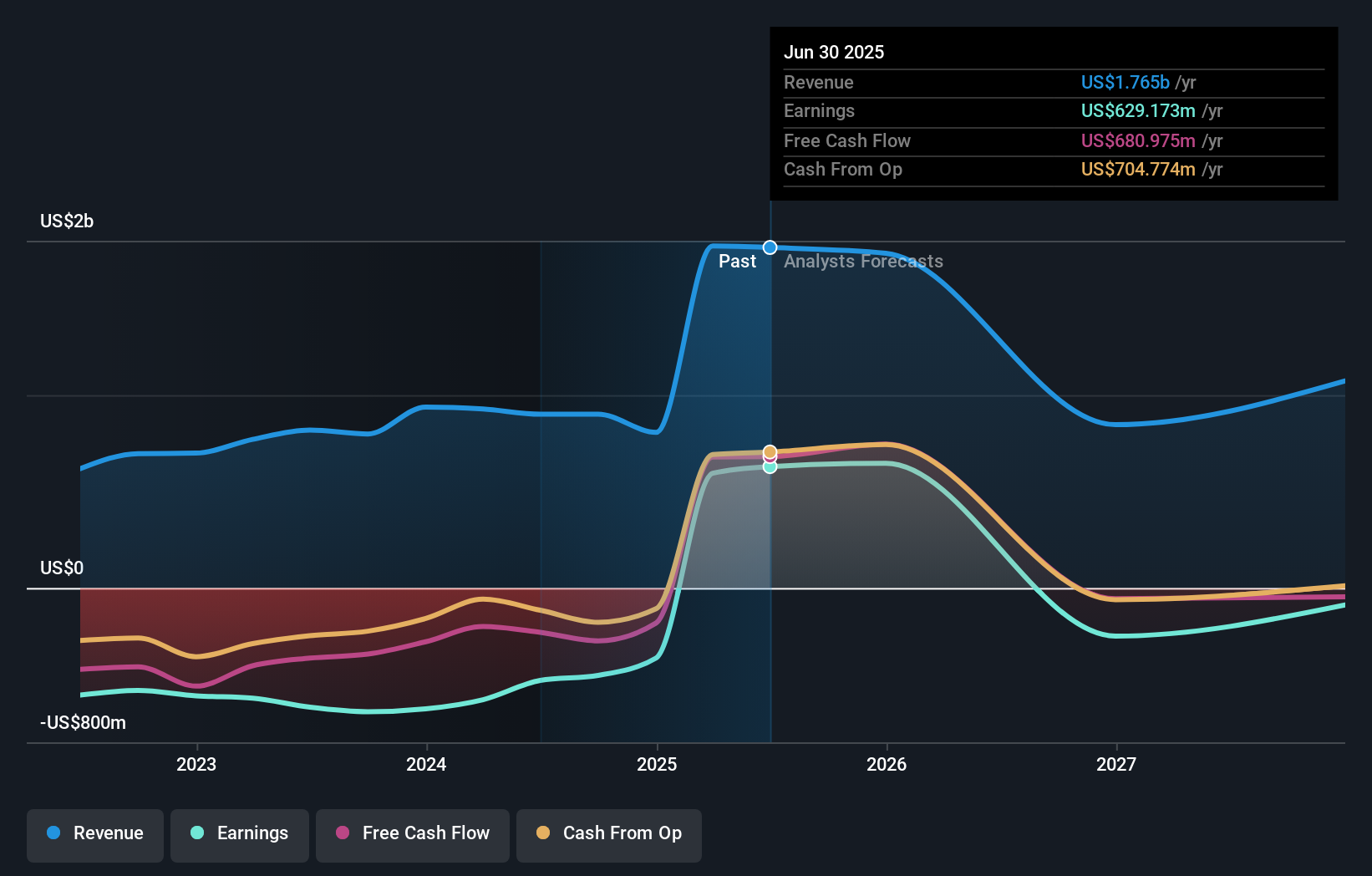

PTC Therapeutics' narrative projects $1.3 billion revenue and $55.4 million earnings by 2028. This requires a 10.3% annual revenue decline and a $573.8 million decrease in earnings from $629.2 million today.

Uncover how PTC Therapeutics' forecasts yield a $67.93 fair value, in line with its current price.

Exploring Other Perspectives

Two members of the Simply Wall St Community estimate PTC Therapeutics’ fair value between US$67.93 and US$188.89 per share. While the Sephience launch is seen as a central catalyst, differing opinions show how market participants assess both growth and risk, inviting you to explore the full range of views.

Explore 2 other fair value estimates on PTC Therapeutics - why the stock might be worth over 2x more than the current price!

Build Your Own PTC Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PTC Therapeutics research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free PTC Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PTC Therapeutics' overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PTCT

PTC Therapeutics

A biopharmaceutical company, focuses on the discovery, development, and commercialization of medicines to children and adults living with rare disorders in the United States and internationally.

Undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives