Stock Analysis

- United States

- /

- Biotech

- /

- NasdaqCM:AKBA

Exploring High Growth Tech Stocks In The US Market

Reviewed by Simply Wall St

Over the last 7 days, the United States market has dropped 4.6%, yet it remains up by 8.8% over the past year and earnings are expected to grow by 14% per annum in the coming years. In this context, identifying high growth tech stocks involves looking for companies that demonstrate strong potential for innovation and scalability, aligning with broader market trends and growth expectations.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| TG Therapeutics | 26.19% | 37.78% | ★★★★★★ |

| Alkami Technology | 21.98% | 85.17% | ★★★★★★ |

| Travere Therapeutics | 28.43% | 65.01% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.90% | 58.64% | ★★★★★★ |

| AVITA Medical | 27.78% | 55.33% | ★★★★★★ |

| Bitdeer Technologies Group | 44.71% | 127.60% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Blueprint Medicines | 22.38% | 55.75% | ★★★★★★ |

| Alvotech | 31.17% | 100.18% | ★★★★★★ |

| Lumentum Holdings | 21.24% | 119.37% | ★★★★★★ |

Click here to see the full list of 235 stocks from our US High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Akebia Therapeutics (NasdaqCM:AKBA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Akebia Therapeutics, Inc. is a biopharmaceutical company dedicated to developing and commercializing therapeutics for kidney disease patients, with a market cap of $414.54 million.

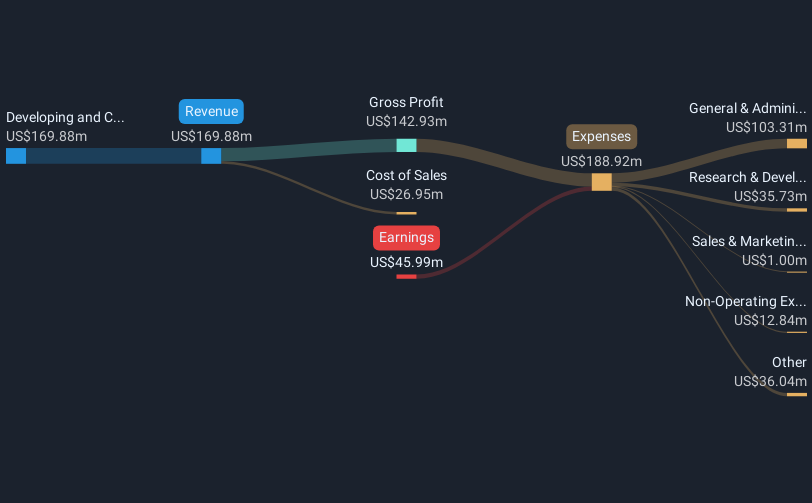

Operations: Akebia Therapeutics focuses on developing and commercializing novel therapeutics for kidney disease, generating $169.88 million in revenue from this segment.

Akebia Therapeutics, despite its current unprofitability, is navigating a promising trajectory with forecasted revenue growth at 28.7% per year, significantly outpacing the US market average of 8.4%. This growth is complemented by an anticipated earnings increase of 56.3% annually. Recent strategic moves include securing a senior secured term loan facility totaling $55 million to bolster its financial position and fuel ongoing projects, reflecting a proactive approach to managing capital needs while driving forward its biotechnological innovations. With earnings having surged by 35.6% annually over the past five years and an expected shift into profitability within three years, Akebia's aggressive investment in R&D and market expansion strategies could position it well within the high-growth biotech landscape.

- Unlock comprehensive insights into our analysis of Akebia Therapeutics stock in this health report.

Evaluate Akebia Therapeutics' historical performance by accessing our past performance report.

Mereo BioPharma Group (NasdaqCM:MREO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Mereo BioPharma Group plc is a biopharmaceutical company focused on developing and commercializing therapeutics for oncology and rare diseases across the UK, US, and internationally, with a market cap of $385.70 million.

Operations: The company specializes in developing therapeutics for oncology and rare diseases, targeting international markets including the UK and US. It operates with a market capitalization of approximately $385.70 million.

Mereo BioPharma Group, amid recent strategic developments, has positioned itself prominently within the biotech sector. The company's revenue is expected to surge by 54.8% annually, significantly outstripping the US market average growth of 8.4%. This growth trajectory is complemented by a forecasted annual profit increase of 60.7%, with profitability anticipated within three years. Recent filings for a $120 million Shelf Registration and updates on advanced clinical programs like setrusumab and alvelestat highlight Mereo's proactive approach in securing financial stability and advancing its pipeline. These efforts are further supported by strategic partnerships and regulatory milestones such as the positive opinion from EMA’s Committee for Orphan Medicinal Products for alvelestat, setting the stage for potential market exclusivity upon approval.

- Navigate through the intricacies of Mereo BioPharma Group with our comprehensive health report here.

Precigen (NasdaqGS:PGEN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Precigen, Inc. is a biopharmaceutical company focused on developing gene and cell therapies for diseases in immuno-oncology, autoimmune disorders, and infectious diseases with a market cap of $544.74 million.

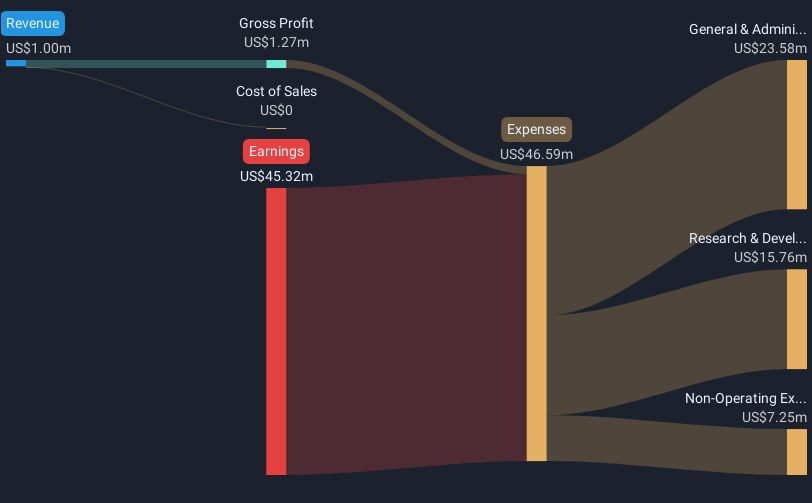

Operations: The company focuses on developing gene and cell therapies using precision technology across immuno-oncology, autoimmune disorders, and infectious diseases. It operates as a discovery and clinical-stage biopharmaceutical entity with revenue segments including Exemplar at $3.89 million.

Precigen stands out in the high-growth tech landscape, notably through its innovative gene therapies and strategic FDA engagements. The company's recent acceptance of a biologics license application for PRGN-2012 by the FDA, which targets a rare respiratory condition, underscores its potential to address unmet medical needs—a significant driver of its 47.9% annual revenue growth. Despite not yet being profitable, Precigen's R&D commitment is evident with substantial investments aimed at pioneering treatments in complex diseases. This focus on high-stakes, high-reward technologies could reshape treatment paradigms and fuel future growth.

- Delve into the full analysis health report here for a deeper understanding of Precigen.

Gain insights into Precigen's past trends and performance with our Past report.

Seize The Opportunity

- Investigate our full lineup of 235 US High Growth Tech and AI Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:AKBA

Akebia Therapeutics

A biopharmaceutical company, focuses on the development and commercialization of therapeutics for patients with kidney diseases.