- United States

- /

- Biotech

- /

- NasdaqGS:PCVX

Vaxcyte (PCVX) Is Down 7.2% After Reporting Sharply Wider Q3 Net Losses and EPS Gap

Reviewed by Sasha Jovanovic

- Vaxcyte recently reported financial results for the third quarter and nine months ended September 30, 2025, revealing a net loss of US$212.83 million for the quarter, more than doubling compared to the same period last year.

- An important detail is that basic and diluted loss per share for both the quarter and year-to-date also increased, highlighting a greater gap between expenses and potential revenue.

- We'll explore how the widening net losses and per-share results may influence Vaxcyte's investment narrative and future outlook.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Vaxcyte's Investment Narrative?

For investors considering Vaxcyte, the story largely hinges on belief in the company’s ability to convert high R&D spending and rapid pipeline development into future commercial success. The most recent earnings report revealing a much larger net loss than last year, with loss per share almost doubling, puts an even greater spotlight on near-term risks. Previously, the most important short-term catalyst was the advancement of late-stage vaccine candidates like VAX-31, supported by recent regulatory momentum and manufacturing partnerships. However, with widening losses and no revenue yet, the company’s cash burn has become a more pressing concern, potentially altering both the pace and sustainability of product launches and expansion. While the partnership with Thermo Fisher and breakthrough designations remain immediate positives, investors may react to the latest financials by reassessing the balance between expected growth and mounting risks.

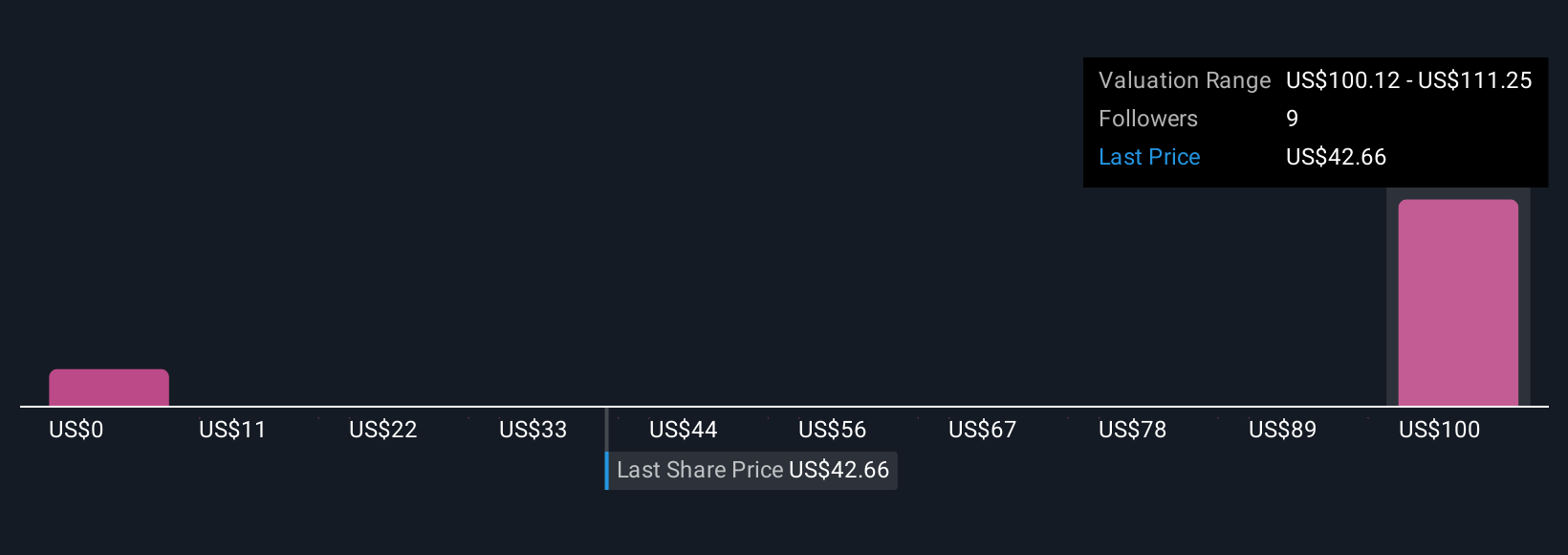

But against that optimism, the company’s increasing net losses are hard to ignore for shareholders. In light of our recent valuation report, it seems possible that Vaxcyte is trading beyond its estimated value.Exploring Other Perspectives

Explore 2 other fair value estimates on Vaxcyte - why the stock might be worth over 2x more than the current price!

Build Your Own Vaxcyte Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vaxcyte research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Vaxcyte research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vaxcyte's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PCVX

Vaxcyte

A clinical-stage vaccine innovation company, develops conjugate and novel protein vaccines to prevent or treat bacterial infectious diseases.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives