- United States

- /

- Pharma

- /

- NasdaqGS:PCRX

Pacira BioSciences (PCRX): Assessing Valuation After Activist Urges Sale and Company Returns to Profitability

Reviewed by Simply Wall St

Pacira BioSciences (PCRX) saw a surge in investor attention after an activist investor, DOMA Perpetual Capital Management, publicly called on the board to pursue a full sale process. This development came just days after Pacira reported quarterly earnings and updated revenue guidance.

See our latest analysis for Pacira BioSciences.

Pacira’s shares have staged an impressive comeback in 2025, with a year-to-date share price return of 30.28 percent and a one-year total shareholder return of 43.51 percent, signaling real momentum despite a challenging few years. Recent activist pressure and the company’s swift shift back to profitability have energized sentiment, and investors appear to be weighing both fresh growth potential and ongoing risks as strategic options come into focus.

If the sudden burst of investor interest in Pacira has you curious, it is a great time to broaden your search and discover See the full list for free.

With shares still trading well below their analyst price target, and recent gains fueled by both improved profitability and speculation about a company sale, the central question is whether Pacira remains undervalued or if future upside is already reflected in the stock price.

Most Popular Narrative: 17.7% Undervalued

Pacira BioSciences’ most widely cited narrative points to a fair value of $29 per share, meaning the market price still lags behind what analysts expect based on future performance. With the share price last closing at $23.88, this gap has put valuation center stage for investors debating the next move.

The new strategic partnership with Johnson & Johnson MedTech for ZILRETTA is expected to double sales coverage and significantly expand reach across new physician specialties and healthcare systems. This development may serve as a forward catalyst for revenue growth in 2026 and beyond.

Want to see what powers this bullish price target? The secret sauce is a mix of ambitious growth forecasts and margin upgrades that might surprise you. One number, in particular, is the linchpin for this valuation. Find out which metric could turn the tide for Pacira’s future. Unlock the full narrative for every key driver and the bold, maybe risky, projections analysts are leaning on.

Result: Fair Value of $29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent reliance on EXPAREL and slow market adoption could quickly alter the bullish outlook if competition or pricing pressure increases.

Find out about the key risks to this Pacira BioSciences narrative.

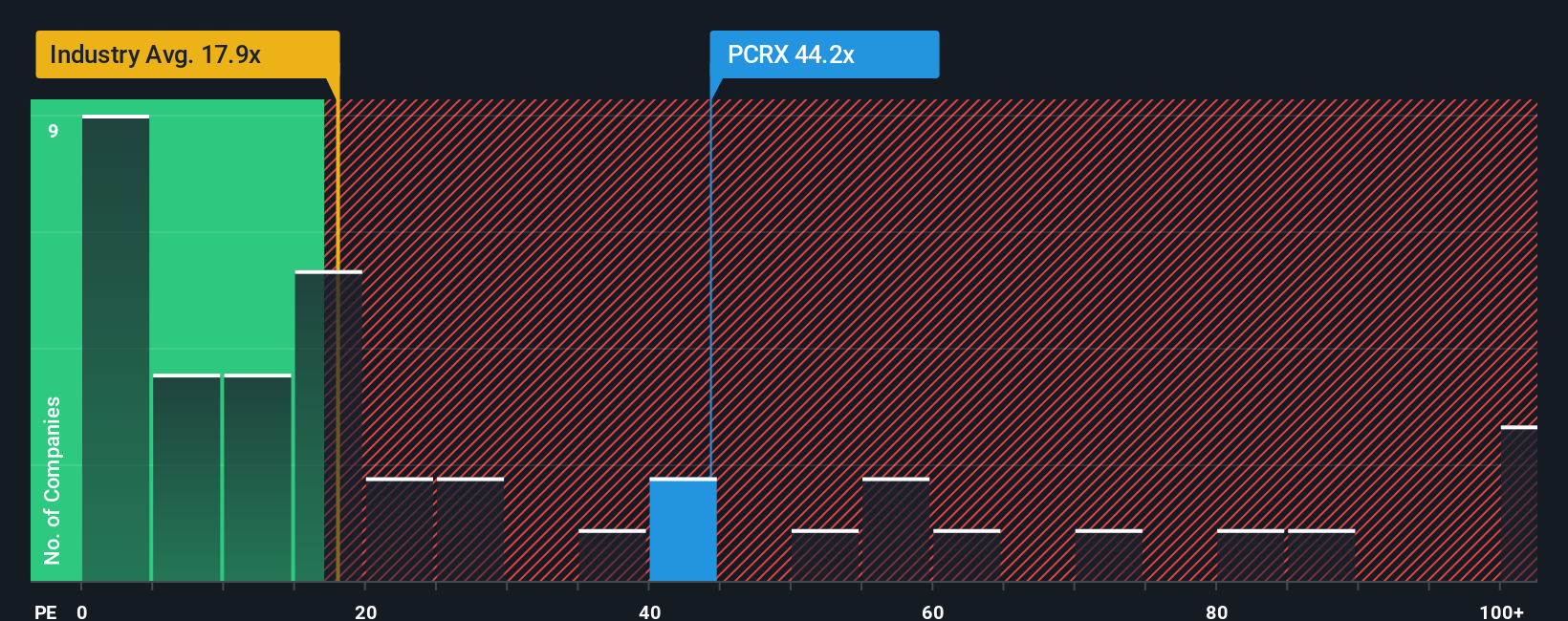

Another View: Multiples Tell a Different Story

While analysts see Pacira BioSciences as undervalued, the price-to-earnings ratio paints a different picture. At 47.9 times earnings, Pacira trades much higher than both the US Pharmaceuticals industry average of 18.8x and its fair ratio of 22.2x. This wide gap suggests the market may be factoring in more risk or optimism than fundamentals justify. Could valuation risk outweigh the upside from strategic catalysts?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Pacira BioSciences Narrative

If you want to test your own assumptions or take a different angle on Pacira’s story, dive into the numbers and shape your own view in just a few minutes, Do it your way

A great starting point for your Pacira BioSciences research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Step ahead of the crowd, broaden your opportunities, and target trends the market is buzzing about by using the Simply Wall Street Screener. If you only stick with what's familiar, you might miss the most exciting opportunities of this cycle.

- Spot high-potential companies with strong fundamentals by checking out these 899 undervalued stocks based on cash flows before the rest of the market notices them.

- Boost your passive income strategy with these 18 dividend stocks with yields > 3%, featuring companies offering attractive yields and dependable cash flows.

- Ride the AI investment wave by finding the next movers in technology with these 26 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PCRX

Pacira BioSciences

Engages in the development, manufacture, marketing, distribution, and sale of non-opioid pain management and regenerative health solutions to healthcare practitioners in the United States.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives