- United States

- /

- Pharma

- /

- NasdaqGM:PAHC

Phibro Animal Health Shares Surge 103% in 2025 Amid New Market Expansions

Reviewed by Bailey Pemberton

- Ever wonder if Phibro Animal Health is actually a bargain right now? You are not alone. Many investors are examining this stock more closely to uncover potential value.

- Recently, the share price has risen by 102.9% year-to-date and by 217.0% over the past three years. However, it dipped slightly by 0.6% in the last week.

- These significant movements have coincided with notable updates, such as the company’s expansion into new animal health markets and announcements regarding innovative product launches. Such developments have helped boost optimism among shareholders. Additionally, recent regulatory approvals and supply chain improvements have played a role in shaping broader investor sentiment over the past few months.

- Phibro Animal Health currently receives a value score of 2 out of 6. This provides an opportunity to explore the stock using several common valuation approaches, along with a more in-depth strategy that will be discussed at the end.

Phibro Animal Health scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Phibro Animal Health Discounted Cash Flow (DCF) Analysis

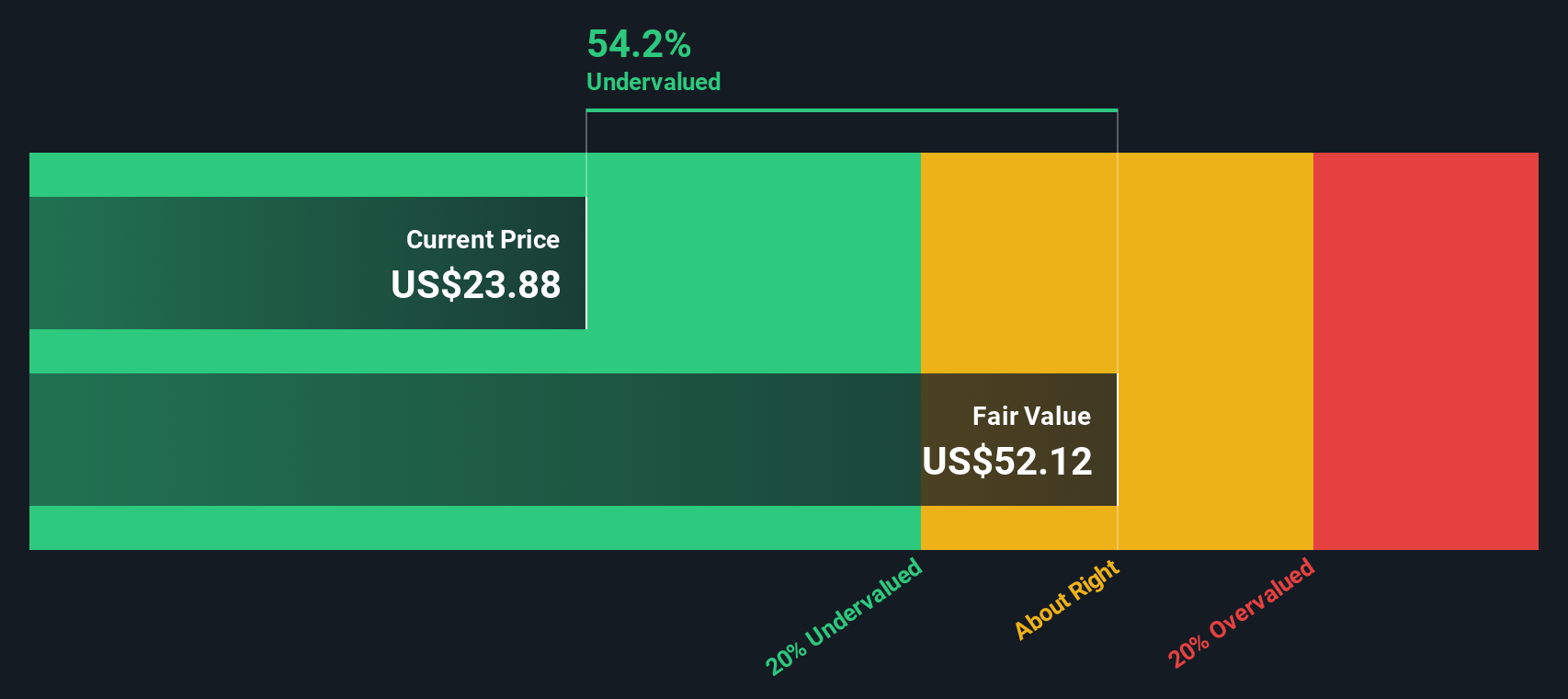

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's dollars. This approach helps investors determine what a stock is truly worth based on its ability to generate cash.

For Phibro Animal Health, the current Free Cash Flow stands at $28.41 million. Analysts forecast steady growth in these cash flows, projecting an increase to $99.8 million by 2028. Beyond the next five years, future cash flows are extrapolated, with estimates indicating continued growth and reaching approximately $160.60 million by 2035, according to extended projections.

Based on these projections, the DCF valuation arrives at an intrinsic value of $77.67 per share. With the current share price trading at a 45.8% discount to this calculated fair value, the model points to the stock being significantly undervalued right now.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Phibro Animal Health is undervalued by 45.8%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: Phibro Animal Health Price vs Earnings (P/E)

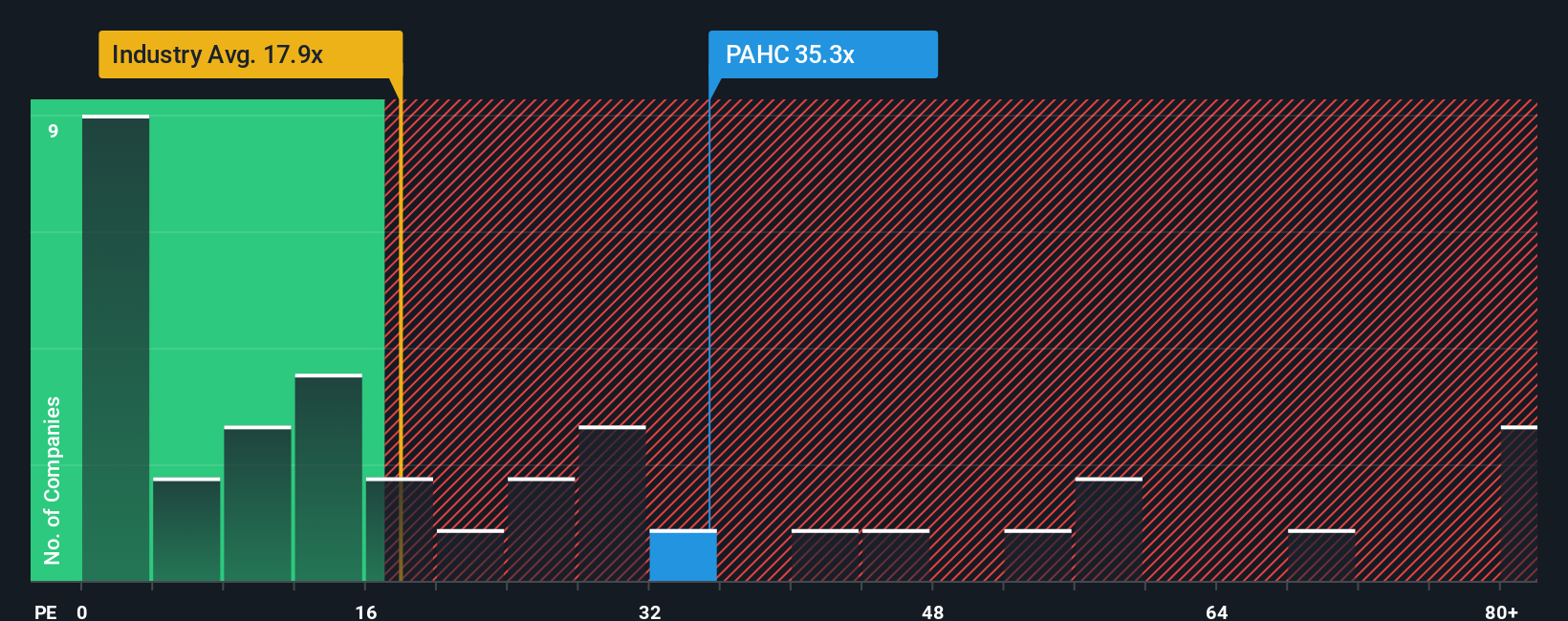

The price-to-earnings (P/E) ratio is a widely used valuation tool for companies that are consistently profitable. It offers investors a quick snapshot of how much they are paying for each dollar of current earnings. This is especially useful when comparing mature businesses with stable profit histories.

Not all P/E ratios are created equal. A higher P/E can be justified by strong expected growth, lower risk, or a unique market position. On the other hand, a lower P/E might reflect slower growth or greater uncertainties. Investors need context, such as how a company’s P/E compares to both its industry and its peers, as well as the underlying drivers of future performance.

Phibro Animal Health currently trades at a P/E of 35.3x. For context, the average P/E across the Pharmaceuticals industry is 18.1x, while the company’s peer group averages just 6.9x. However, Simply Wall St’s Fair Ratio, a proprietary valuation metric, calculates a P/E of 22.3x for Phibro. This Fair Ratio considers not only earnings but also the company’s growth outlook, profit margins, industry positioning, and risk profile, making it a more holistic measure than simple industry or peer averages.

Comparing the actual P/E (35.3x) to the Fair Ratio (22.3x), Phibro Animal Health appears overvalued using this method, as its current price is significantly higher than what underlying fundamentals suggest is fair.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1414 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Phibro Animal Health Narrative

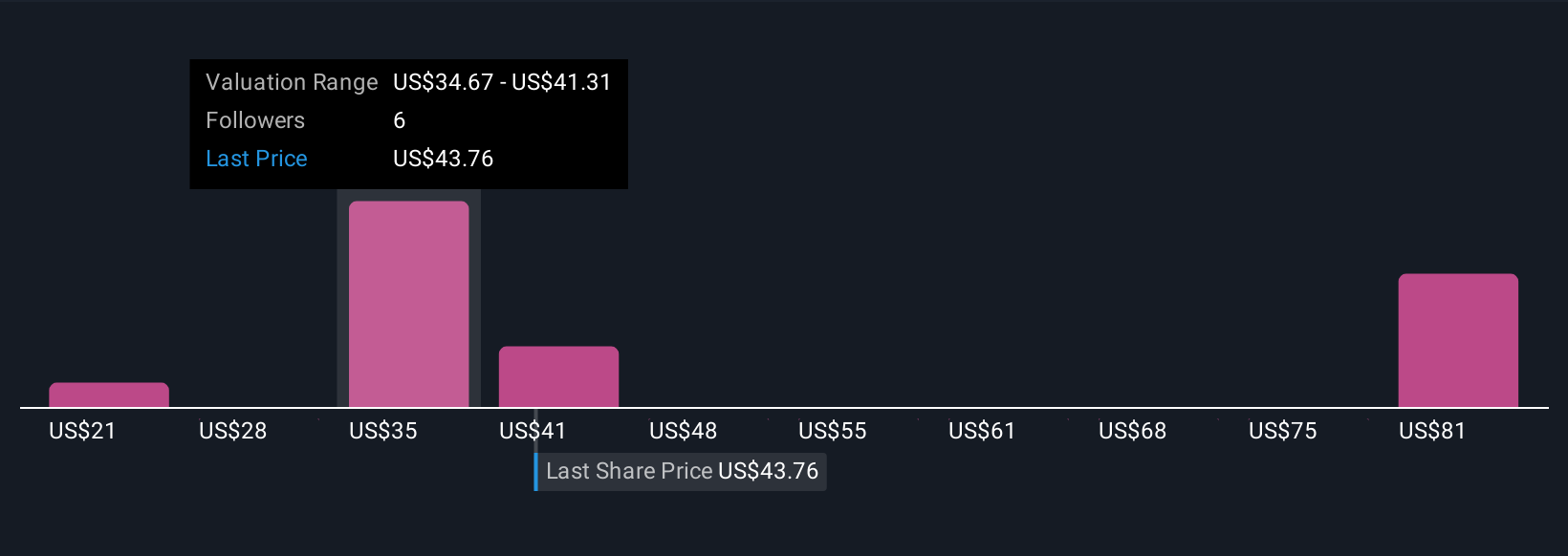

Earlier, we mentioned that there is an even better way to understand valuation, so now let us introduce you to Narratives. A Narrative is simply your own perspective or story about a company, where you connect your assumptions for future revenue, earnings, and profit margins to your view of what the stock is worth. Narratives link a company’s unique story to concrete forecasts and fair value estimates, helping you move beyond just numbers to a more complete investment picture.

Narratives are easy to create and compare on Simply Wall St’s Community page, the same place millions of investors share their views. With Narratives, you can easily see if your thesis suggests Phibro Animal Health is a buy, sell, or hold, by comparing your calculated fair value to today’s price. What is most powerful is that Narratives update dynamically whenever key news or earnings are released, so your investment view always reflects the latest information.

For example, some investors see Phibro Animal Health thriving from innovative feed additives and vaccines and give it a high target of $45.00, while others worry about industry headwinds and assign a low value of $27.00. This shows how different Narratives help explain why investors disagree and enables you to choose the story that best fits your own outlook.

Do you think there's more to the story for Phibro Animal Health? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:PAHC

Phibro Animal Health

Operates as an animal health and mineral nutrition company in the United States, Latin America and Canada, Europe, the Middle East, Africa, and the Asia Pacific.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives