- United States

- /

- Life Sciences

- /

- NasdaqGS:PACB

A Fresh Look at PacBio’s (PACB) Valuation Following ARK Invest’s Major Share Purchase

Reviewed by Simply Wall St

Pacific Biosciences of California (PACB) shares jumped after news broke that ARK Investment Management, led by Cathie Wood, had acquired over one million shares. This high-profile buy is increasing investor attention and speculation around PacBio’s DNA sequencing technology and its growth outlook.

See our latest analysis for Pacific Biosciences of California.

ARK’s sizeable buy-in comes as PacBio’s share price has staged a sharp reversal. After months of drifting, the past 30 days saw a dramatic 50% share price return, and momentum remains strong, even as the one-year total shareholder return is still down. Moves like these tend to spark new interest, especially with leading investors signaling confidence in the company’s technology pipeline and sector prospects.

If high-profile trading and biotech breakthroughs have your attention, this is the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

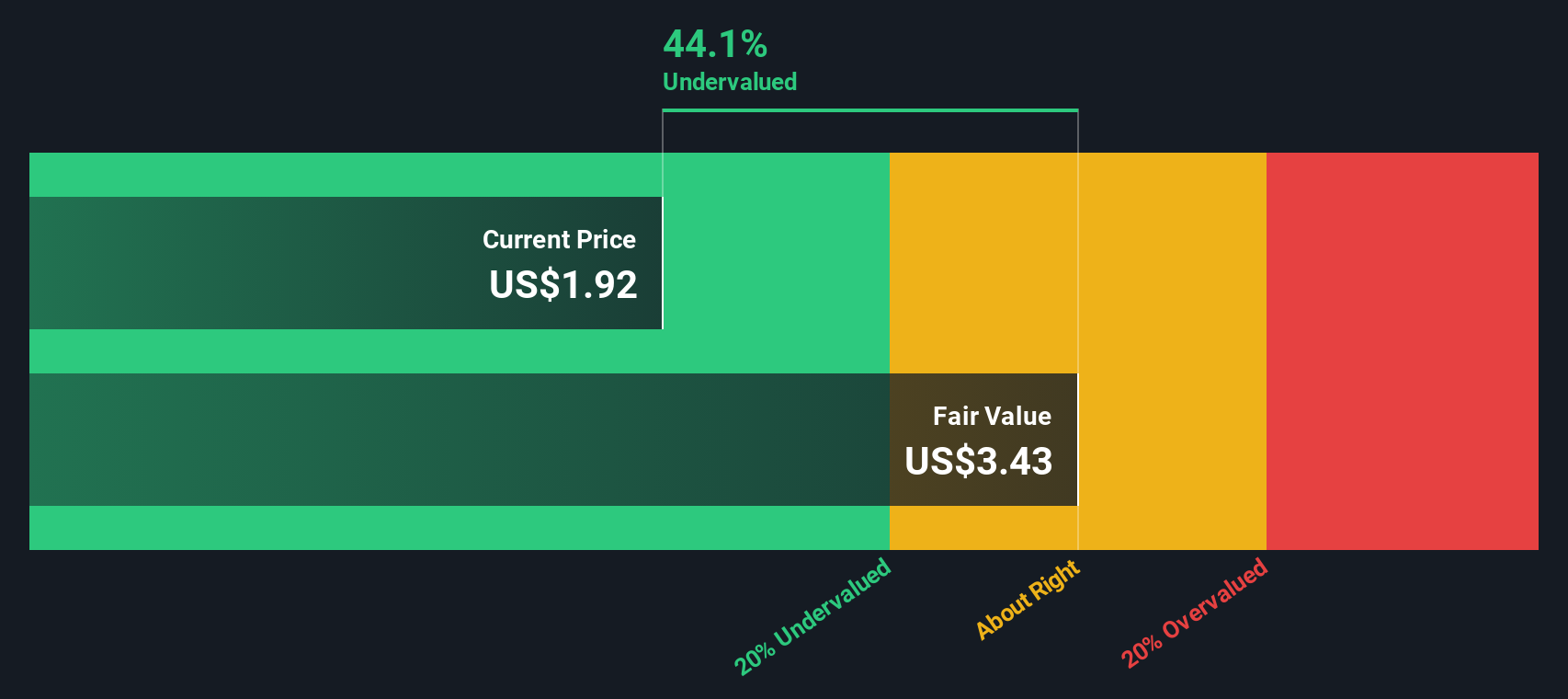

Still, with PacBio’s recent surge and a prominent backer piling in, the key question is whether the stock is now trading at a bargain or if the latest rally means the market already expects future growth. Is there truly a buying opportunity, or has optimism been fully priced in?

Most Popular Narrative: 6.1% Overvalued

Compared to Pacific Biosciences of California’s last close at $2.24, the most widely followed narrative points to a fair value of $2.11. This suggests the latest price is running ahead of fundamentals. With strong catalysts in play, the story behind this valuation is driven by tangible shifts in market adoption and margin trends.

The growing number of national-scale population genomics and multi-omic initiatives globally, many adopting PacBio's long-read HiFi technology (for example, 1,000 Genomes Long-Read Project, Southeast Asia and Nordic national programs), positions PacBio to capture expanding large-volume projects, which should materially increase future revenues and drive recurring consumables demand.

Want to know what powers this controversial price tag? The secret lies in ambitious growth projections and a bullish swing in profit outlook that will surprise you. Curious about the bold assumptions behind this eye-catching valuation? Unlock the full narrative to see what really drives PacBio’s fair value.

Result: Fair Value of $2.11 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent reliance on academic funding and ongoing losses could hinder PacBio’s growth story if these pressures continue to weigh on results.

Find out about the key risks to this Pacific Biosciences of California narrative.

Another View: Are Shares Actually Undervalued?

While the most popular narrative says PacBio shares are overpriced compared to its fair value, our DCF model tells a different story. The SWS DCF model estimates a fair value of $3.92, which is well above the current share price. Could this be an overlooked bargain, or is the market seeing risks that a model cannot?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Pacific Biosciences of California Narrative

If you see things differently or want to dig into the details yourself, you can build your own PacBio narrative in just a few minutes. Do it your way

A great starting point for your Pacific Biosciences of California research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors do not wait for headlines to move. They go straight to the source and find possibilities others have missed. Let Simply Wall Street’s powerful Screener uncover fresh stock opportunities tailor-made for your strategy.

- Uncover undervalued gems poised for tomorrow’s growth by using these 843 undervalued stocks based on cash flows. Spot stocks trading below their intrinsic worth before the crowd.

- Accelerate your portfolio with exposure to the booming world of artificial intelligence by tapping into these 26 AI penny stocks. Ride the wave of rapid tech adoption.

- Boost your income potential with stable companies offering generous yields when you check out these 18 dividend stocks with yields > 3%. Secure higher cash returns in any market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PACB

Pacific Biosciences of California

Designs, develops, and manufactures sequencing solution to resolve genetically complex problems.

Fair value with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives