- United States

- /

- Biotech

- /

- NasdaqGS:ORIC

Could ORIC Pharmaceuticals (ORIC) Unlock a Competitive Edge With Its Latest Brain Metastases Data?

Reviewed by Sasha Jovanovic

- ORIC Pharmaceuticals recently announced the publication of a peer-reviewed paper in Cancer Research highlighting enozertinib, its brain-penetrant, orally bioavailable EGFR inhibitor, demonstrating strong preclinical efficacy and a patient case of complete response in both systemic and brain metastases of non-small cell lung cancer (NSCLC).

- This publication underscores enozertinib’s potential to address an unmet need in NSCLC treatment, particularly for patients with EGFR exon 20 mutations who are at high risk for developing brain metastases.

- Let's examine how enozertinib’s showcased potential in targeting brain metastases informs ORIC Pharmaceuticals’ evolving investment narrative.

The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

What Is ORIC Pharmaceuticals' Investment Narrative?

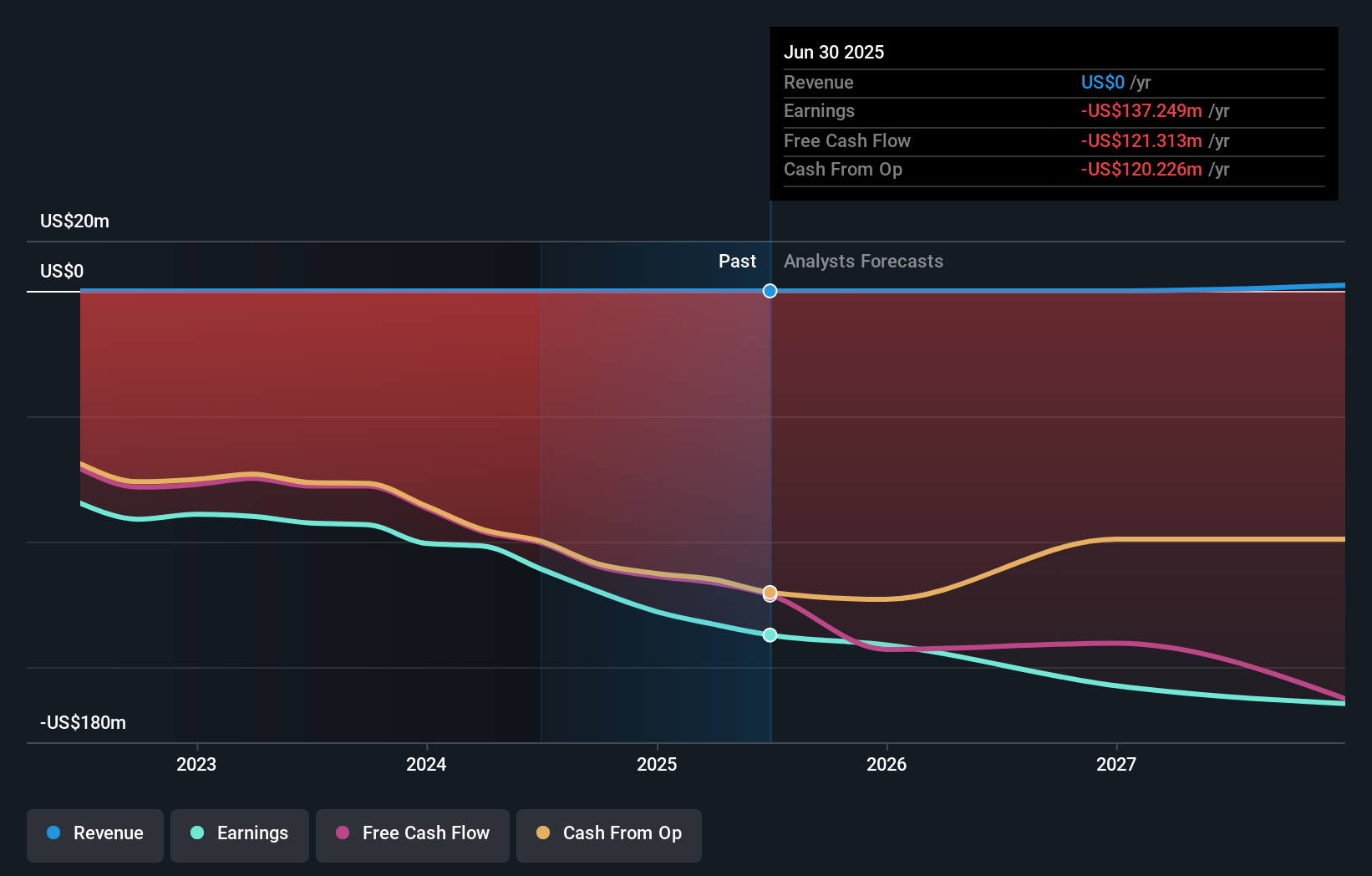

If you’re considering ORIC Pharmaceuticals as a potential investment, the big picture centers on belief in the company’s pipeline and its ability to translate scientific breakthroughs into meaningful clinical and commercial success, despite the absence of revenue and continued unprofitability. The recent publication on enozertinib provides concrete evidence of progress, highlighting both strong preclinical efficacy and a compelling patient case that could position ORIC at the forefront of targeted NSCLC treatments, especially for patients with high unmet need. This news arrives just ahead of major data milestones set for December 2025 and mid-2026, adding weight to upcoming catalysts and increasing the stakes around forthcoming trial results. While the validation is promising, the main risk remains clear: ORIC is still a pre-revenue biotech that has faced shareholder dilution and is not forecast to be profitable in the coming years. With recent momentum and attention from the Cancer Research publication, much now depends on clinical data and the company's ability to secure sustainable funding and partnerships. Yet the risk of further dilution persists, essential for anyone weighing an investment here.

Our expertly prepared valuation report on ORIC Pharmaceuticals implies its share price may be too high.Exploring Other Perspectives

Explore another fair value estimate on ORIC Pharmaceuticals - why the stock might be worth just $18.27!

Build Your Own ORIC Pharmaceuticals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ORIC Pharmaceuticals research is our analysis highlighting 4 important warning signs that could impact your investment decision.

- Our free ORIC Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ORIC Pharmaceuticals' overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ORIC

ORIC Pharmaceuticals

A clinical-stage biopharmaceutical company, engages in the discovery and development of therapies to counter the resistance mechanisms cancers in the United States.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives