- United States

- /

- Biotech

- /

- NasdaqGS:ONC

Is BeOne Medicines Opportunity Growing After New Pipeline and Clinical Trial Updates in 2025?

Reviewed by Bailey Pemberton

- Wondering whether BeOne Medicines stock is actually a good buy, or if the recent buzz is just noise? You’re in the right place to dig beyond the headlines and figure out if the current share price offers true value.

- The stock has seen some wild swings lately. It is down 2.4% over the past week and 10.1% in the last month, but still up a massive 68% year-to-date and 48.6% over the last year.

- This volatility has captured investor attention, with the latest news focusing on new pipeline announcements and regulatory progress that could have a meaningful impact on future growth. Recent updates around expanded clinical trial data and emerging partnerships have fanned the flames of both optimism and caution, which helps explain these sharp price moves.

- What really sets BeOne Medicines apart in today’s market is its impressive 6 out of 6 valuation score. This means it is underserved in every key check for undervaluation. We’ll break down how those traditional approaches measure up, and why there may be an even more insightful way to assess value by the end of this article.

Approach 1: BeOne Medicines Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by estimating a company’s future cash flows and then discounting those values back to today, providing a snapshot of what the business might really be worth. This approach is particularly useful for companies like BeOne Medicines, where near-term earnings might be volatile, and the long-term outlook is critical.

For BeOne Medicines, the current Free Cash Flow stands at minus $201.7 Million, reflecting ongoing investment and development. Looking ahead, analysts project significant growth, with Free Cash Flow expected to reach approximately $2.34 Billion by 2029. These projections are based on analyst estimates for the next five years, and longer-term forecasts are carefully extrapolated to give a full picture of potential value.

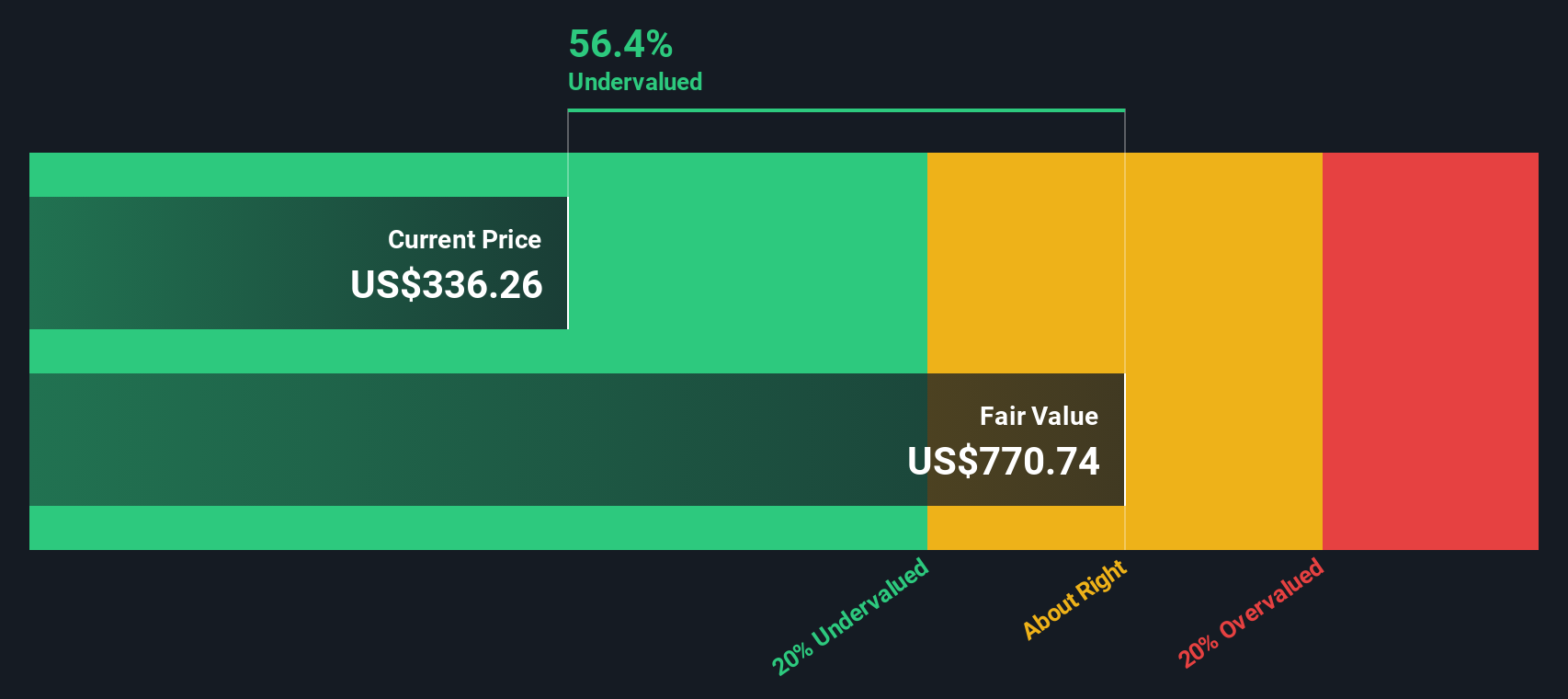

Based on this DCF model, the estimated intrinsic value for BeOne Medicines is $737.64 per share. This represents a 58.1% discount to the current share price, suggesting the stock could be significantly undervalued if these projections are realized.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests BeOne Medicines is undervalued by 58.1%. Track this in your watchlist or portfolio, or discover 844 more undervalued stocks based on cash flows.

Approach 2: BeOne Medicines Price vs Sales

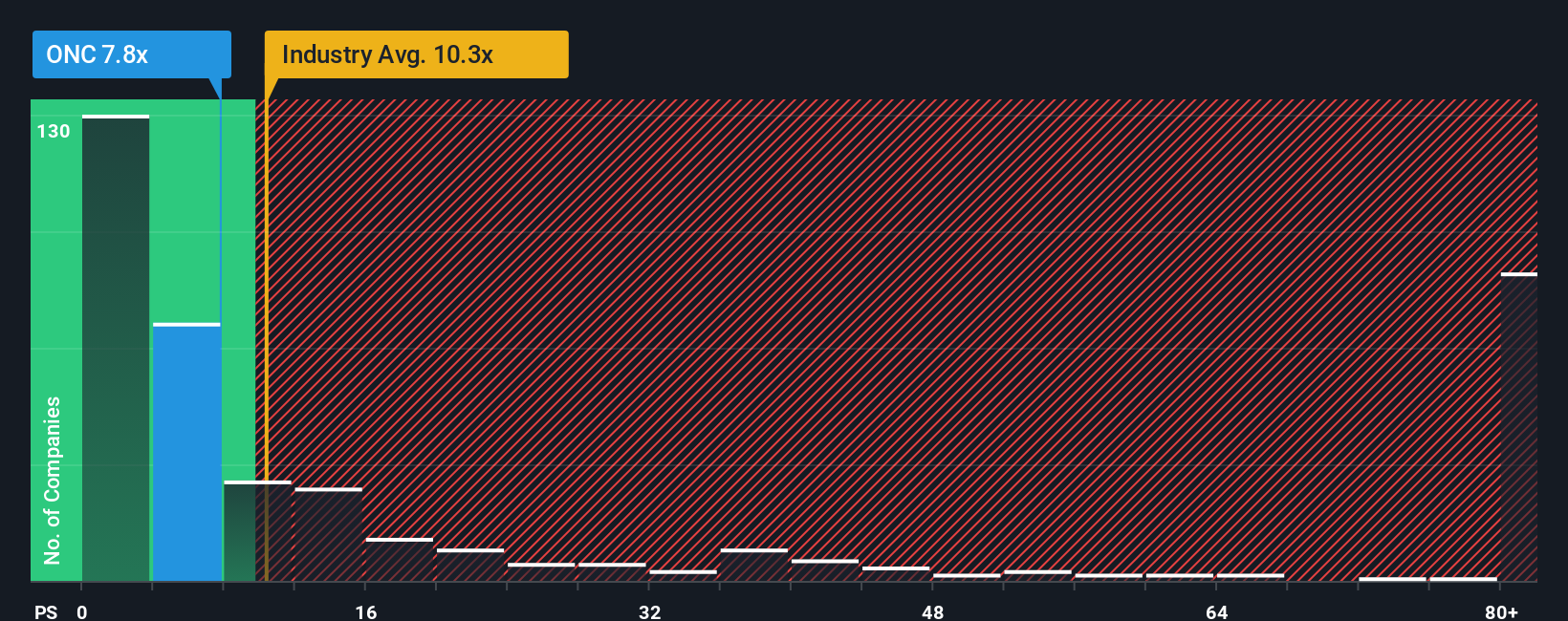

The Price-to-Sales (P/S) ratio is a widely used valuation metric for companies like BeOne Medicines, especially when positive earnings are not yet consistent or as robust as revenue growth. The P/S ratio helps investors consider progress and momentum, even in periods when profits may be uneven or negative, making it particularly apt for high-growth biotech firms.

Growth expectations and risk levels both play key roles in what is considered a fair or "normal" P/S ratio. Fast-growing companies or those with significant future potential often warrant higher multiples, while greater uncertainty and competitive risk drive them lower.

Currently, BeOne Medicines trades at a P/S ratio of 7.46x. For context, this is well below both the Biotechs industry average of 10.30x and the peer group average of 17.65x. While direct comparisons provide a helpful snapshot, they do not tell the whole story, as they ignore unique strengths or risks specific to BeOne Medicines.

This is where Simply Wall St’s “Fair Ratio” comes in. The Fair Ratio is a proprietary measure that adjusts for key factors such as earnings growth rate, profit margin, market cap, and the company’s specific risk profile alongside broader industry dynamics. Unlike traditional comparisons, it provides a holistic and forward-looking gauge of fair value.

BeOne Medicines’ Fair Ratio is calculated at 10.90x, which is comfortably higher than its current multiple of 7.46x. This substantial gap points to potential undervaluation based on the company’s growth profile, quality metrics and market context.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your BeOne Medicines Narrative

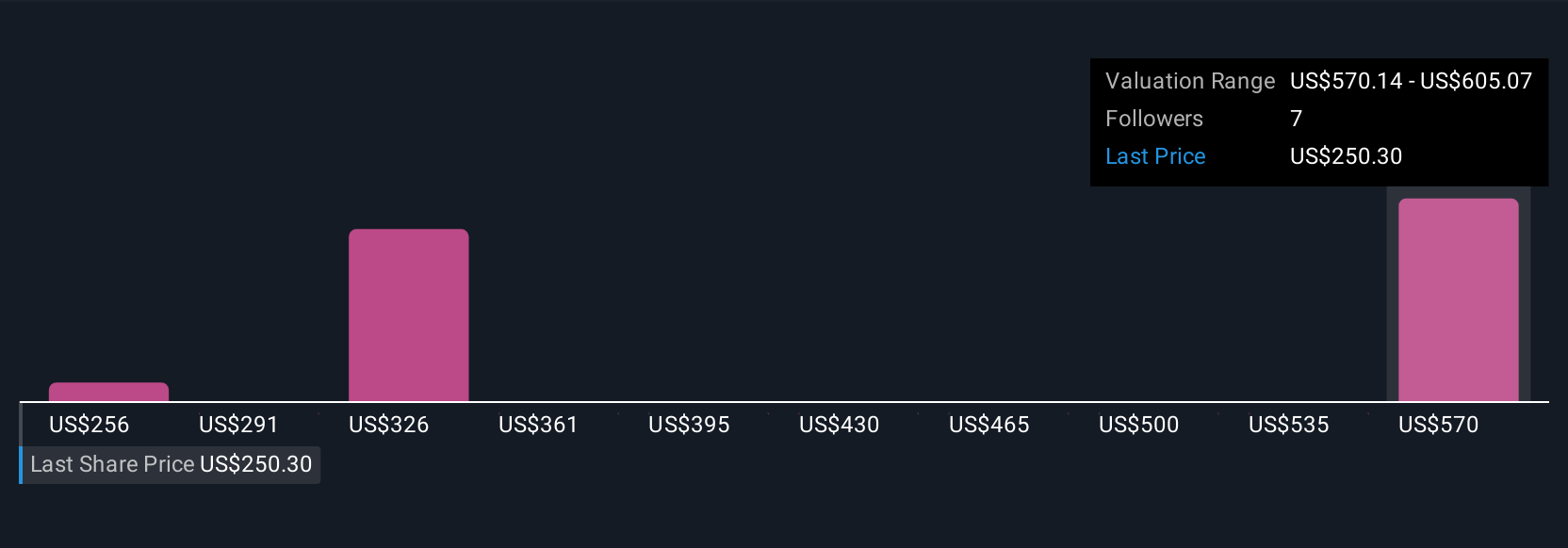

Earlier we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. Narratives are a simple, accessible way for you to connect the story of BeOne Medicines with what you expect the numbers to look like, combining your view of its business model, growth drivers, and risks with your own forecasts for future revenue, earnings, and profit margins to arrive at what you think is a fair value for the share price.

Think of a Narrative as your personal hypothesis about the company that links what’s happening in the real world with a financial forecast. This then translates directly to a fair value, empowering you to make buy, hold, or sell decisions grounded in both facts and your perspective. Narratives are available to everyone within the Simply Wall St Community page, used by millions of investors, and update dynamically whenever new information like news or earnings is released, so you always see the latest insights reflected.

For example, some investors might use a bullish Narrative for BeOne Medicines, expecting breakthrough oncology pipeline progress and forecast the stock rising to $563 per share. Others might focus on competitive risks and choose a more cautious Narrative, putting fair value at just $250. Narratives let you compare these perspectives instantly, so you can confidently find your own edge in evaluating BeOne Medicines at today’s price.

Do you think there's more to the story for BeOne Medicines? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BeOne Medicines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ONC

BeOne Medicines

An oncology company, engages in discovering and developing various treatments for cancer patients in the United States, China, Europe, and internationally.

Very undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives