- United States

- /

- Biotech

- /

- NasdaqCM:OCGN

Ocugen (OCGN) Is Down 7.0% After Mixed Q3 Results and Gene Therapy Milestones – What's Changed

Reviewed by Sasha Jovanovic

- Ocugen, Inc. recently reported its third-quarter 2025 earnings, showing revenue of US$1.75 million and a net loss of US$20.05 million, alongside notable progress in its gene therapy pipeline and business development activities.

- Significantly, the company advanced its OCU400 program toward Phase 3 enrollment completion, secured a South Korean licensing deal, and extended its cash runway, highlighting material updates across both clinical and financial fronts.

- We'll examine how Ocugen's progress with the OCU400 clinical program and new licensing agreement impacts its overall investment outlook.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Ocugen Investment Narrative Recap

For shareholders, believing in Ocugen means having confidence in the company’s ability to translate its late-stage gene therapy pipeline, especially OCU400, into eventual regulatory approval and commercial success. The Q3 2025 earnings update increases urgency around the biggest near-term risk: ongoing cash burn and the need for more funding, since the cash runway now extends only into the second quarter of 2026; however, the news does not alter the core catalyst, which remains completing pivotal OCU400 trial enrollment and reaching major regulatory milestones.

Among all recent announcements, the exclusive South Korean licensing agreement for OCU400 with Kwangdong Pharmaceutical stands out. It expands Ocugen’s future global footprint, provides upfront and milestone payments, and supports the investment case that the business can attract external partners that might offset the capital needed in the clinical and pre-commercialization phase.

Yet, while partnership revenue helps, investors should still be aware that funding uncertainty could resurface as...

Read the full narrative on Ocugen (it's free!)

Ocugen's narrative projects $159.7 million revenue and $24.9 million earnings by 2028. This requires 228.1% yearly revenue growth and a $82.4 million increase in earnings from the current -$57.5 million.

Uncover how Ocugen's forecasts yield a $8.20 fair value, a 517% upside to its current price.

Exploring Other Perspectives

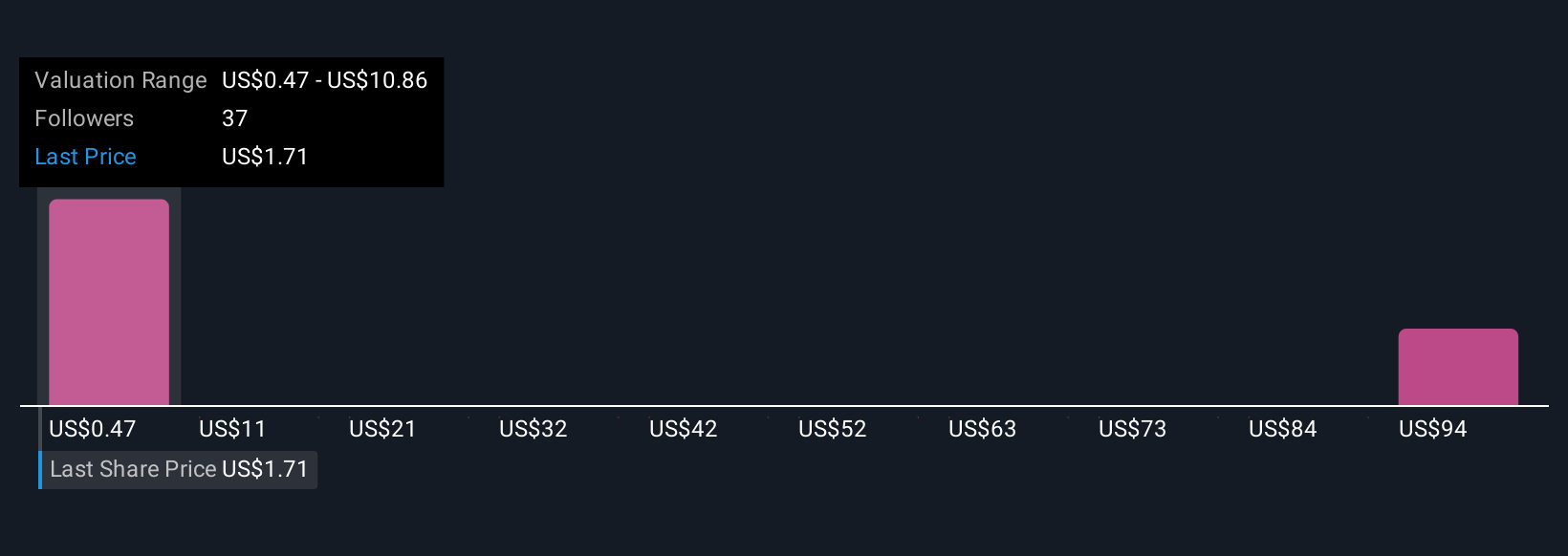

Eight fair value estimates from the Simply Wall St Community span US$0.47 to US$102, suggesting a wide split in expectations. Many are watching whether Ocugen’s cash needs and future funding activity will affect existing shareholders or the development timeline, so it is worth considering several points of view before making a decision.

Explore 8 other fair value estimates on Ocugen - why the stock might be a potential multi-bagger!

Build Your Own Ocugen Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ocugen research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ocugen research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ocugen's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:OCGN

Ocugen

A biopharmaceutical company, focuses on discovering, developing, and commercializing novel gene and cell therapies, biologic, and vaccines that improve patients’ health.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives