- United States

- /

- Biotech

- /

- NasdaqGS:NTRA

Natera (NTRA): Reassessing Valuation After Raised 2025 Guidance and Strong Quarterly Results

Reviewed by Simply Wall St

Natera (NTRA) just raised its earnings and revenue outlook for 2025, increasing guidance by $160 million at the midpoint. The company’s new targets come as gross margin strength and ongoing cost momentum continue to drive performance.

See our latest analysis for Natera.

It’s been an active stretch for Natera, with expanded guidance, solid quarterly results, and new product milestones all contributing to improved sentiment. The latest share price stands at $199.57, up 17.9% over the past month. The company’s impressive 1-year total shareholder return of nearly 49% reflects building momentum as investors take notice of accelerating top-line growth and clinical progress.

If you’re looking for other healthcare stocks with strong fundamentals and growth stories, you can discover See the full list for free.

While Natera’s recent upgrades and clinical milestones have fueled sharp gains, investors may wonder whether the stock’s current run still offers room for upside or if the rapid growth story is already fully reflected in the price.

Most Popular Narrative: 1.4% Undervalued

According to the most widely followed narrative, Natera’s fair value estimate sits just above the last close, at $202.50 versus $199.57. With shares basically in line with projected value, it all comes down to how you interpret the company’s growth runway from here.

Updated financial models project multiple pathways for sustained double-digit revenue growth, supported by expanding market opportunities and potential new test launches.

Curious how bullish revenue forecasts stack up against razor-thin profit assumptions and a towering future earnings multiple? The numbers in this narrative hinge on bold projections that could dramatically change the stock’s story. Want to see which financial drivers are the linchpin for this hefty fair value? The full narrative unpacks the real math beneath the surface.

Result: Fair Value of $202.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks in key clinical trials or delays in gaining new regulatory approvals could quickly undermine the optimistic outlook for Natera's continued growth.

Find out about the key risks to this Natera narrative.

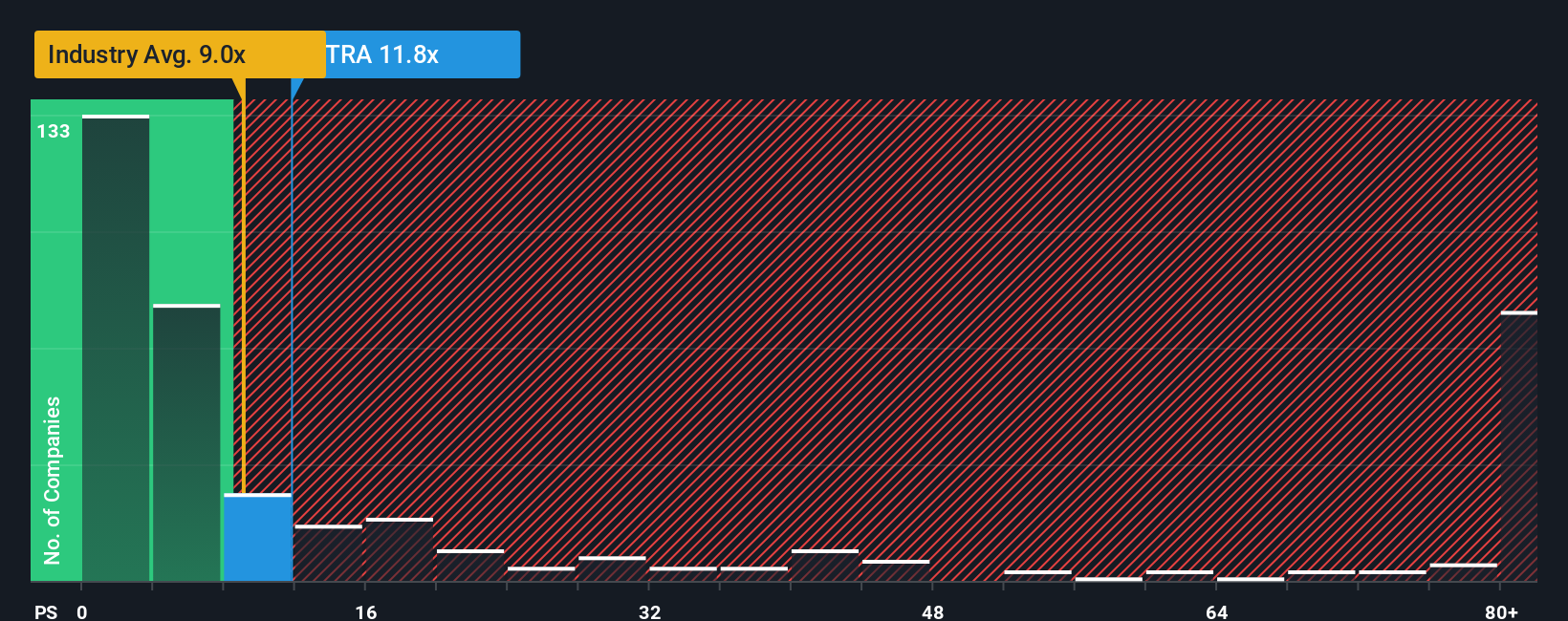

Another View: Price-to-Sales Tells a Cautionary Tale

Looking at valuation through one of the simplest lenses, Natera trades at a price-to-sales ratio of 13x. That is well above both the US Biotechs industry average of 10.7x and its direct peers at 9x, and it also tops our fair ratio estimate of 7.9x. This premium suggests the market is already pricing in a lot of future growth, leaving less margin for error if things do not go perfectly. For investors, does paying such a steep multiple leave much upside if expectations falter?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Natera Narrative

If you want to dig into the numbers yourself or approach the story from a different angle, it takes only a few minutes to assemble your own take. Do it your way

A great starting point for your Natera research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors do not settle for just one opportunity. Find your next winner before the crowd catches on by using specialist tools that highlight clear market advantages.

- Capitalize on disruptive innovation and stay ahead of the curve by checking out these 24 AI penny stocks, which are changing the AI landscape right now.

- Unlock high-yielding opportunities and strengthen your portfolio's income stream through these 16 dividend stocks with yields > 3% with attractive cash returns.

- Zero in on high-growth, under-the-radar companies by tracking these 3587 penny stocks with strong financials, which are showing impressive momentum and untapped potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Natera might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTRA

Natera

A diagnostics company, provides molecular testing services worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives