- United States

- /

- Biotech

- /

- NasdaqGM:NTLA

Intellia Therapeutics (NTLA): Assessing Valuation After Recent Share Price Decline

Reviewed by Simply Wall St

See our latest analysis for Intellia Therapeutics.

Intellia Therapeutics’ 61.2% drop in share price over the past month is the latest in a string of declines, reflecting both shifting investor sentiment and growing caution around biotech volatility. Short-term momentum has clearly faded, and the one-year total shareholder return of -43.1% underscores that this has not been a mere blip. The company’s stock has struggled to regain traction despite signs of underlying growth potential.

If you’re curious what else is unfolding in this space, it’s well worth exploring the newest breakthroughs and leaders emerging via our See the full list for free.

With shares now trading well below analyst targets and a sharp decline over the past year, the key question remains: is Intellia Therapeutics being underestimated by the market, or is its current price a fair reflection of its prospects?

Most Popular Narrative: 70.5% Undervalued

Simply Wall St’s most followed narrative puts Intellia Therapeutics' fair value at $32.30, significantly higher than its recent $9.52 close. The difference between the projected upside and the current price sets the stage for what follows.

Improving financial discipline, as shown by successful restructuring, declining GAAP operating expenses (approximately 10% reduction YoY), and a robust cash runway into the first half of 2027, allows Intellia to absorb increased R&D investment, advance pipeline expansion, and build out commercial infrastructure without dilutive fundraising. This supports the protection of net margins and improves future earnings visibility.

What’s fueling this bold valuation call? It centers on rapid revenue expansion, stronger margins, and a projected profit surge—figures that rival high-growth tech companies. Interested in understanding exactly what drives this model’s optimistic outlook? The combination of aggressive growth and favorable cost projections may surprise you.

Result: Fair Value of $32.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory setbacks or persistent safety concerns could quickly shift sentiment and limit the strong upside projected for Intellia Therapeutics.

Find out about the key risks to this Intellia Therapeutics narrative.

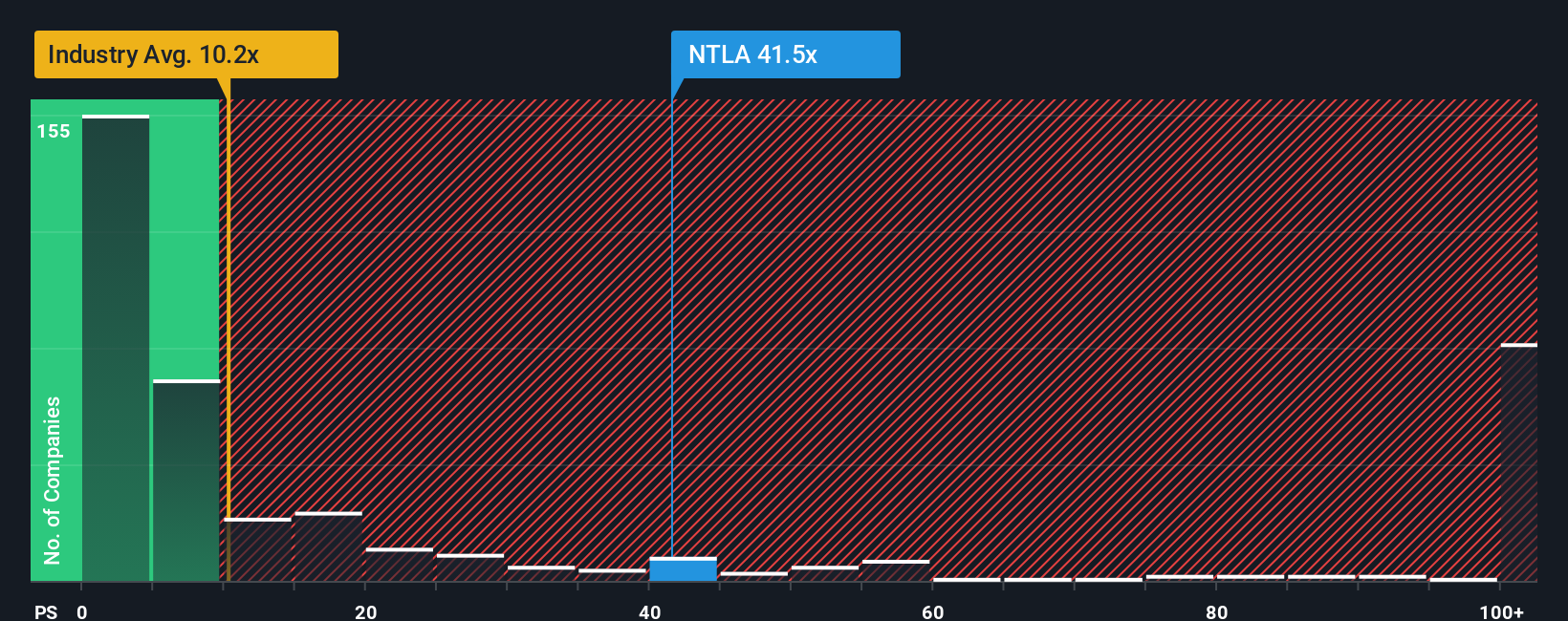

Another View: A Look at the Market Ratio

While the narrative points to Intellia Therapeutics being deeply undervalued, a look at its price-to-sales ratio tells a much less optimistic story. At 19.2x, the company appears expensive compared to both the US Biotechs industry average of 10.8x and the peer average of just 4.7x. The fair ratio is estimated to be 0x. This suggests the current valuation could have significant downside if sentiment shifts or results disappoint. Does this point to a hidden risk that is not captured in optimistic growth forecasts?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Intellia Therapeutics Narrative

If these perspectives differ from your take or you want to dig deeper yourself, you can put your own narrative together quickly to challenge or confirm the outlook. Do it your way

A great starting point for your Intellia Therapeutics research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors stay ahead by tapping into new opportunities. Don’t let the best ideas pass you by when fresh strategies could transform your portfolio.

- Accelerate your search for high-income picks with these 16 dividend stocks with yields > 3% uniquely positioned for yields above 3% and steady returns in any market.

- Spot tomorrow’s biggest disruptors by checking out these 25 AI penny stocks that are fueling the artificial intelligence revolution with breakthrough innovation.

- Supercharge your growth strategy by zeroing in on value-packed opportunities with these 872 undervalued stocks based on cash flows currently flying under the radar but primed for upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:NTLA

Intellia Therapeutics

A clinical-stage gene editing company, focuses on the development of curative genome editing treatments.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives