- United States

- /

- Pharma

- /

- NasdaqCM:NKTR

Nektar Therapeutics (NKTR) Is Up 8.0% After Late-Breaking Phase 2b Rezpegaldesleukin Data Announcement

Reviewed by Sasha Jovanovic

- Nektar Therapeutics announced that new data from its Phase 2b REZOLVE-AD study of rezpegaldesleukin in atopic dermatitis will be featured as a late-breaking oral abstract at the American College of Allergy, Asthma & Immunology Annual Scientific Meeting in Orlando, which is set to take place from November 6 to 10, 2025.

- This follows the drug candidate's Fast Track designation by the FDA in February 2025, highlighting ongoing scientific and regulatory momentum for Nektar's late-stage pipeline in large autoimmune markets.

- We'll explore how anticipation around the upcoming clinical data release for rezpegaldesleukin may impact Nektar's investment outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Nektar Therapeutics Investment Narrative Recap

To invest in Nektar Therapeutics, you need conviction in the company's scientific and regulatory progress, particularly the potential for rezpegaldesleukin (REZPEG) to become a differentiated therapy in large autoimmune markets. The acceptance of new Phase 2b data for presentation underscores optimism around the REZPEG program, but does not materially change the immediate short-term catalyst, which remains the clinical and regulatory outcomes of the REZOLVE-AD study. The biggest near-term risk continues to be Nektar's pre-commercial status and its reliance on securing additional funding or major partnerships to sustain its operations through late-stage trials.

The upcoming third-quarter financial results announcement, scheduled for November 6, 2025, stands out as a relevant event, especially as it coincides with heightened attention from the Phase 2b REZOLVE-AD clinical update. For investors, both events will provide critical insight into the company’s financial flexibility and the scientific progress of its lead asset, shaping expectations around future catalysts and risks.

However, investors should also be aware that beyond clinical data, Nektar’s cash position and absence of approved products may expose shareholders to dilution if...

Read the full narrative on Nektar Therapeutics (it's free!)

Nektar Therapeutics' outlook anticipates $40.9 million in revenue and $9.5 million in earnings by 2028. This scenario reflects an 18.3% annual revenue decline and a $131.8 million increase in earnings from the current -$122.3 million.

Uncover how Nektar Therapeutics' forecasts yield a $93.86 fair value, a 45% upside to its current price.

Exploring Other Perspectives

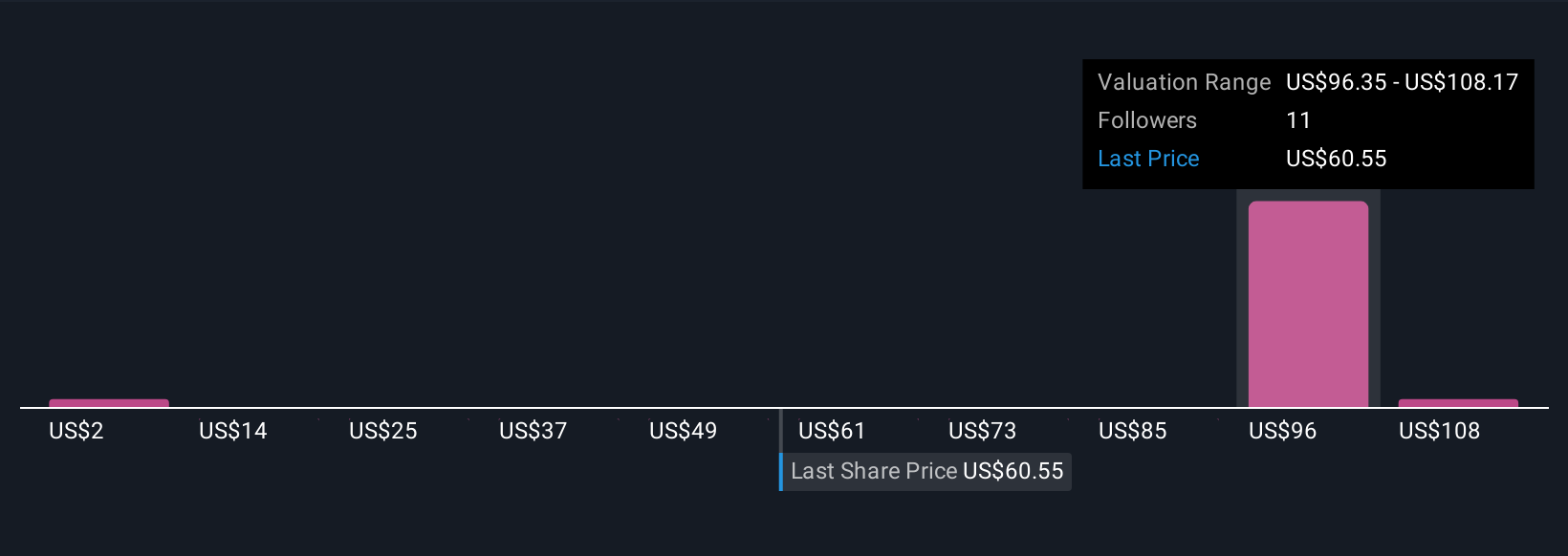

Private investors in the Simply Wall St Community provided four fair value estimates for Nektar, with a wide spread from US$1.74 to US$120 per share. Alongside these diverse views, the company’s reliance on pending clinical results and continued operating losses highlights just how differently market participants can assess risk and opportunity in a pre-commercial biotech; explore multiple perspectives to shape your own outlook.

Explore 4 other fair value estimates on Nektar Therapeutics - why the stock might be worth less than half the current price!

Build Your Own Nektar Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nektar Therapeutics research is our analysis highlighting 1 key reward and 6 important warning signs that could impact your investment decision.

- Our free Nektar Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nektar Therapeutics' overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nektar Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NKTR

Nektar Therapeutics

A biopharmaceutical company, focuses on discovering and developing therapies that selectively modulate the immune system to treat autoimmune disorders in the United States and internationally.

Medium-low risk with weak fundamentals.

Similar Companies

Market Insights

Community Narratives