- United States

- /

- Pharma

- /

- NasdaqCM:NKTR

Assessing Nektar Therapeutics (NKTR) Valuation Following Recent Share Price Surge

Reviewed by Simply Wall St

Nektar Therapeutics (NKTR) has caught some attention lately as investors review its share performance over the past few months. The company’s returns have fluctuated recently, which has drawn interest from market watchers tracking new trends in biotech.

See our latest analysis for Nektar Therapeutics.

Zooming out beyond this week’s swings, Nektar’s share price has soared 276.6% year-to-date, with the rally really catching momentum in the last quarter as the 90-day share price return hit an impressive 88.6%. Despite the sharp gains, long-term total shareholder returns remain mixed, reminding investors to weigh both growth potential and risk as the story develops.

If you’re looking for even more biotech or healthcare movers, it’s worth exploring the latest names on our curated list in See the full list for free.

With such dramatic recent gains, the key question is whether Nektar’s current share price still offers upside for investors or if the market has already priced in all the company’s future growth potential.Most Popular Narrative: 42% Undervalued

Compared to its last close of $54.28, Nektar Therapeutics is seen in this narrative as trading well below its calculated fair value of $93.86. This highlights a bold case for investors who believe the company can deliver on its future milestones and growth projections.

Strong initial Phase IIb and ongoing data for REZPEG in atopic dermatitis, combined with a large and growing addressable market (expected to reach nearly $30B by 2033), position Nektar to access significant new revenue streams and improve long-term earnings as the population ages and chronic inflammatory diseases rise globally.

Curious what ambitious financial leaps power this valuation? The narrative hinges on game-changing assumptions for future growth, margins, and a profit turnaround that defies sector norms. Want to see the numbers behind this optimism? Unlock the full story to spot exactly what could trigger the next surge.

Result: Fair Value of $93.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks in key clinical trials or unfavorable litigation outcomes could quickly dampen investor optimism and challenge the bullish case for Nektar.

Find out about the key risks to this Nektar Therapeutics narrative.

Another View: Reality Check on Sales Multiples

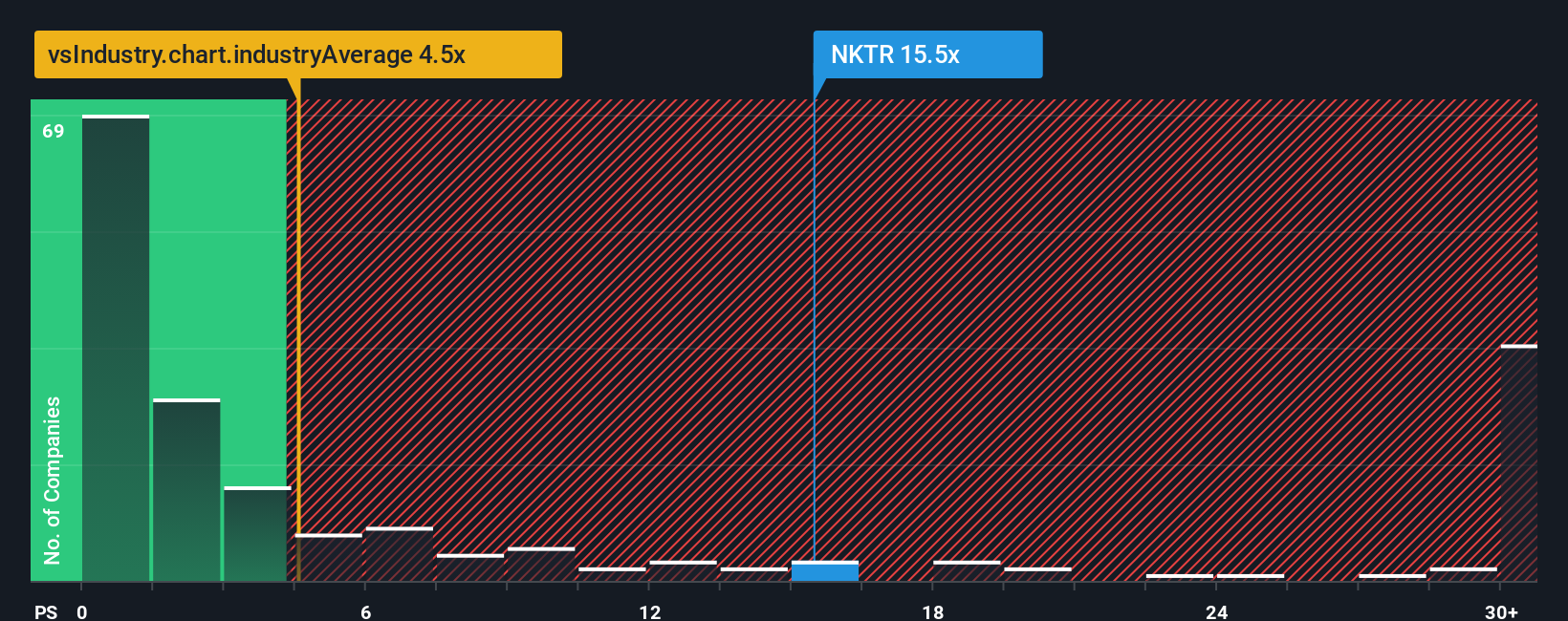

While fair value estimates imply Nektar Therapeutics is undervalued, the company's price-to-sales ratio is a hefty 17.6x. This is more than double the peer average of 7.5x and over four times the US pharmaceuticals industry average of 4x. Even compared to the fair ratio of 8.5x, shares appear expensive, which suggests today's optimism may already be factoring in a significant amount of future success.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nektar Therapeutics Narrative

If you'd rather take the data into your own hands or bring a fresh perspective, you can build your own narrative in just a few minutes. Do it your way

A great starting point for your Nektar Therapeutics research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Smart investors keep their watchlists fresh. Don’t let unique market trends pass you by. Tap into these standout stock picks and seize your next big opportunity.

- Unlock potential high-fliers in the market, starting with these 3597 penny stocks with strong financials. These are poised for growth thanks to robust financials and strategic execution.

- Tap into powerful tech shifts as you browse these 26 AI penny stocks. These stocks are set to shape tomorrow’s world through artificial intelligence innovation and scalable solutions.

- Secure attractive yields with these 15 dividend stocks with yields > 3%, a handpicked group offering consistently strong dividend payouts above 3% to boost your returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nektar Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NKTR

Nektar Therapeutics

A biopharmaceutical company, focuses on discovering and developing therapies that selectively modulate the immune system to treat autoimmune disorders in the United States and internationally.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives