- United States

- /

- Biotech

- /

- NasdaqGS:NBIX

Neurocrine Biosciences (NBIX) Is Up 12.1% After Strong Q3 Earnings Report and Upgraded Guidance – Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Neurocrine Biosciences reported third quarter 2025 earnings, showing revenue of US$794.9 million and net income of US$209.5 million, both up from the same period last year, with increased basic and diluted earnings per share from continuing operations.

- This strong financial performance was driven by revenue and profit gains across both the quarter and nine-month period, reflecting robust demand for Neurocrine's products and operational efficiency.

- We'll explore how these third quarter earnings gains influence the outlook for Neurocrine's long-term revenue and earnings growth assumptions.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Neurocrine Biosciences Investment Narrative Recap

To be a Neurocrine Biosciences shareholder, you need to believe in the company's capacity to drive sustained growth through leading CNS therapies, propelled by INGREZZA and new launches like CRENESSITY. The latest quarterly earnings underscore solid execution and top-line strength, supporting short-term optimism around product demand. However, the results do not materially shift the major near-term catalyst, increasing CRENESSITY uptake, nor do they resolve the key risk of ongoing pricing and rebate pressure from Medicare contracting, which continues to weigh on long-term margin expectations.

Among recent announcements, the new KINECT-HD2 study data establishing long-term safety for INGREZZA in Huntington's disease stands out. This aligns with strong reported product demand but does not outweigh the pressure from payer and pricing risks, highlighting a balance between innovation-driven growth and persistent headwinds affecting Neurocrine’s flagship franchises.

Yet, if payer scrutiny intensifies, even strong quarterly earnings may not fully insulate investors from the challenge of...

Read the full narrative on Neurocrine Biosciences (it's free!)

Neurocrine Biosciences is projected to reach $3.8 billion in revenue and $976.5 million in earnings by 2028. Achieving this outlook would require annual revenue growth of 14.6% and a $628.2 million increase in earnings from the current $348.3 million.

Uncover how Neurocrine Biosciences' forecasts yield a $174.81 fair value, a 13% upside to its current price.

Exploring Other Perspectives

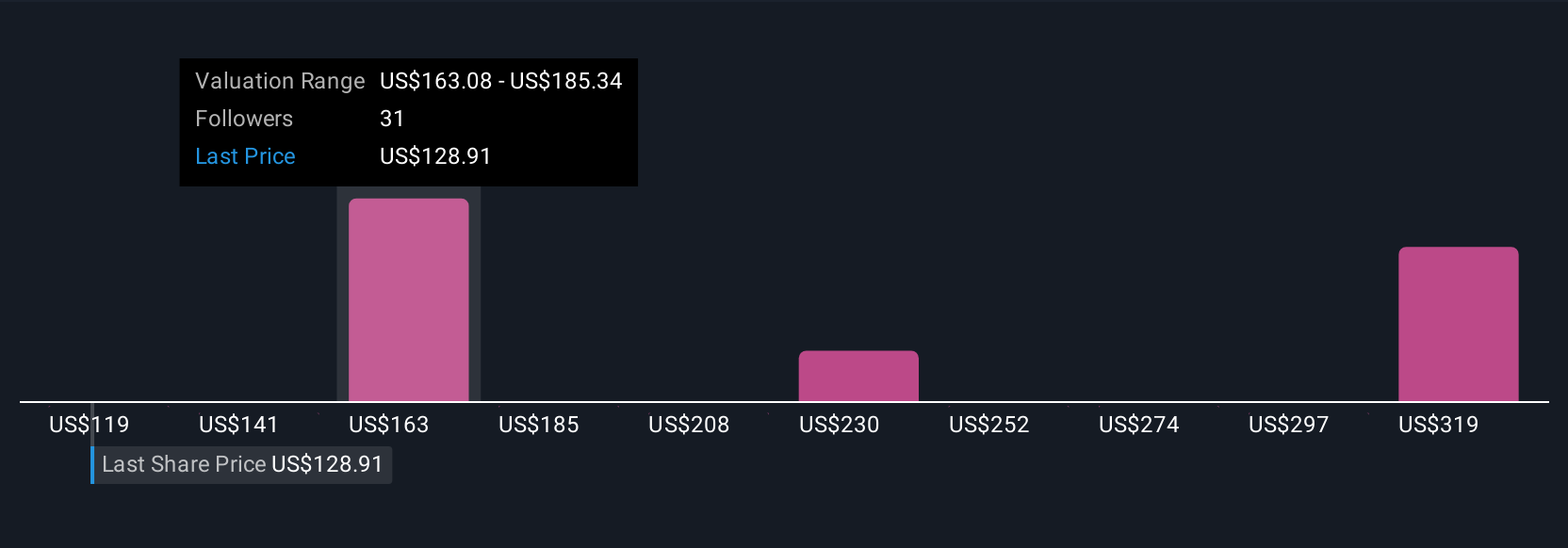

Five different fair value estimates from the Simply Wall St Community range from US$118.58 to US$252.92 per share, reflecting wide disagreement about the company’s outlook. While many see upside in robust product demand, ongoing payer pressure could create strong divergence in long-term profitability, so be sure to check several viewpoints before making decisions.

Explore 5 other fair value estimates on Neurocrine Biosciences - why the stock might be worth as much as 63% more than the current price!

Build Your Own Neurocrine Biosciences Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Neurocrine Biosciences research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Neurocrine Biosciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Neurocrine Biosciences' overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Neurocrine Biosciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NBIX

Neurocrine Biosciences

Neurocrine Biosciences, Inc. discovers, develops, and markets pharmaceuticals for neurological, neuroendocrine, and neuropsychiatric disorders in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives