- United States

- /

- Biotech

- /

- NasdaqGS:NBIX

Neurocrine Biosciences (NBIX): Assessing Valuation After Lead Depression Drug Misses Phase 2 Study Goal

Reviewed by Simply Wall St

Neurocrine Biosciences (NBIX) just shared results from a Phase 2 study of its experimental treatment for major depressive disorder. The results revealed the compound failed to meet its main efficacy goal compared to placebo.

See our latest analysis for Neurocrine Biosciences.

Shares of Neurocrine Biosciences have shown resilience lately, with a 7.8% one-month share price return and a 12% gain over the past 90 days, despite news that its lead depression compound failed a key Phase 2 trial. Recent events, such as the launch of a high-value research collaboration targeting NLRP3 inhibitors, suggest that investor confidence in long-term innovation and partnerships could be supporting the positive price momentum. Overall, the stock’s one-year total shareholder return of 16% signals steady progress, even as sentiment moves through both clinical setbacks and expansion opportunities.

If you’re following the latest breakthroughs in drug development, now is the perfect time to explore more innovative companies with our See the full list for free..

With that context in mind, is Wall Street overlooking potential value after this setback, or does the current share price already reflect confidence in Neurocrine Biosciences’ future growth and pipeline prospects?

Most Popular Narrative: 39.8% Undervalued

The latest narrative, developed by kapirey, sets a fair value for Neurocrine Biosciences at $244.8, well above the current closing price of $147.29. This significant difference is based on assumptions about future earnings and profit multiples that may surprise cautious investors.

Risks and uncertainties associated with Neurocrine Biosciences' business and finances in general, as well as risks and uncertainties linked to the commercialization of INGREZZA and CRENESSITY.

Risks related to the development of product candidates.

There is more behind this valuation than meets the eye. Could future product launches or unexpected margin shifts change what the market sees as fair? The full narrative reveals the forecasting approach and the growth assumptions driving this bold price target.

Result: Fair Value of $244.8 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory decisions that restrict commercialization or setbacks in clinical trials could quickly shift sentiment and challenge even the most optimistic valuations.

Find out about the key risks to this Neurocrine Biosciences narrative.

Another View: Market Multiples Paint a Pricier Picture

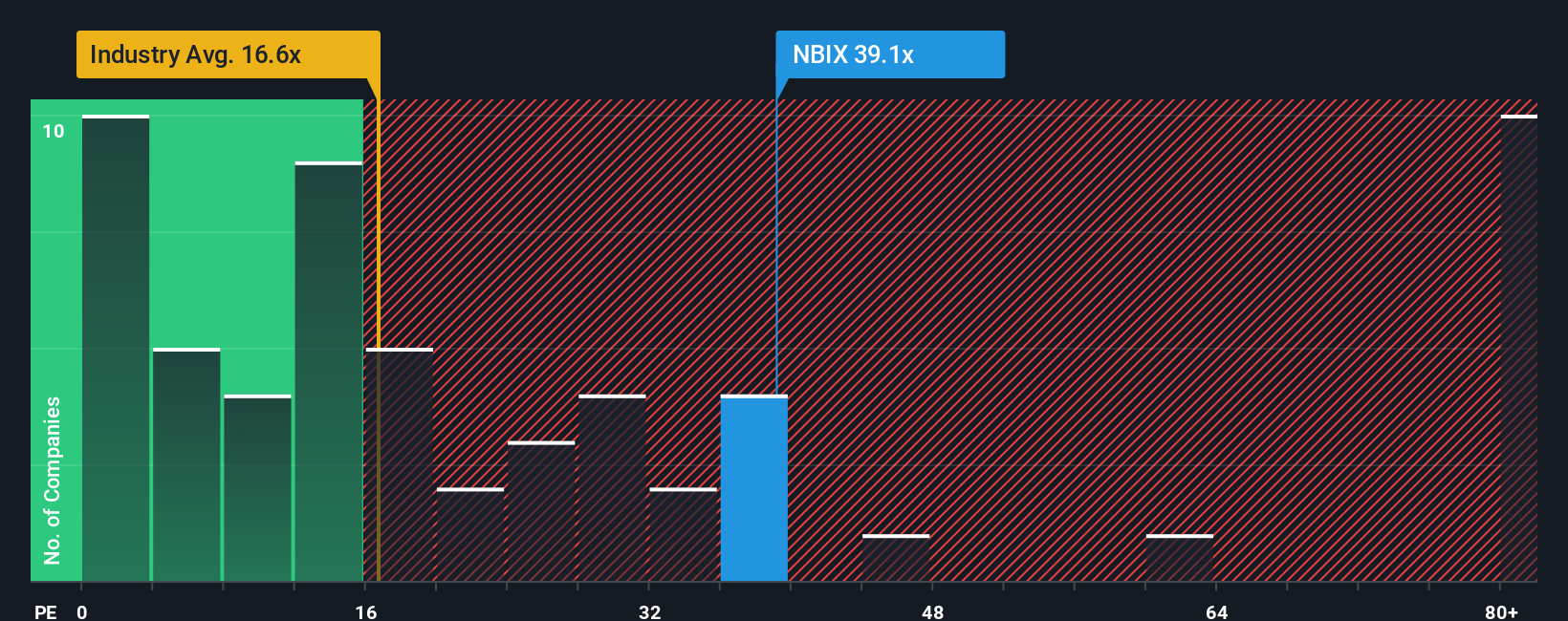

While the narrative set a bold fair value for Neurocrine Biosciences, the market’s price-to-earnings ratio tells a different story. At 34.3x earnings, shares trade at nearly double the US Biotechs industry average of 17.1x, and are also higher than peers at 17.7x. Even compared to a fair ratio of 25.4x, NBIX looks expensive. Does this premium reflect real potential, or could it signal caution ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Neurocrine Biosciences Narrative

If you see things differently or want to dig into the numbers yourself, you can craft a personalized narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Neurocrine Biosciences.

Looking for More Investment Ideas?

Your next great investment opportunity could be just a click away, so don’t let the smartest trends pass you by. Use these powerful tools right now.

- Secure passive income potential and compare yields instantly with these 15 dividend stocks with yields > 3% offering steady returns above 3%.

- Get ahead of tomorrow’s big trends by tracking the innovators behind these 25 AI penny stocks and see which names are building the future of automation and intelligence.

- Jump on underappreciated value plays with these 856 undervalued stocks based on cash flows, spotlighting stocks where strong cash flows could mean big upside ahead.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Neurocrine Biosciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NBIX

Neurocrine Biosciences

Neurocrine Biosciences, Inc. discovers, develops, and markets pharmaceuticals for neurological, neuroendocrine, and neuropsychiatric disorders in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives