- United States

- /

- Biotech

- /

- NasdaqGM:NAMS

NewAmsterdam Pharma (NasdaqGM:NAMS): Evaluating Valuation After Q3 Results Show Falling Sales and Wider Quarterly Loss

Reviewed by Simply Wall St

NewAmsterdam Pharma (NasdaqGM:NAMS) published its third quarter and nine-month earnings, revealing a sharp drop in quarterly sales and an increased net loss for the period compared to the previous year.

See our latest analysis for NewAmsterdam Pharma.

Despite posting a sharp drop in quarterly sales and a wider net loss this quarter, NewAmsterdam Pharma’s share price has surged nearly 60% over the past 90 days, with a standout 12-month total shareholder return of 64%. This suggests that, while short-term results have been challenging, investors are focusing on the company’s long-term growth story and perhaps reassessing its risk profile as new data emerges.

If NewAmsterdam’s volatility has you thinking about what’s next in biotech and pharma, it might be time to discover See the full list for free.

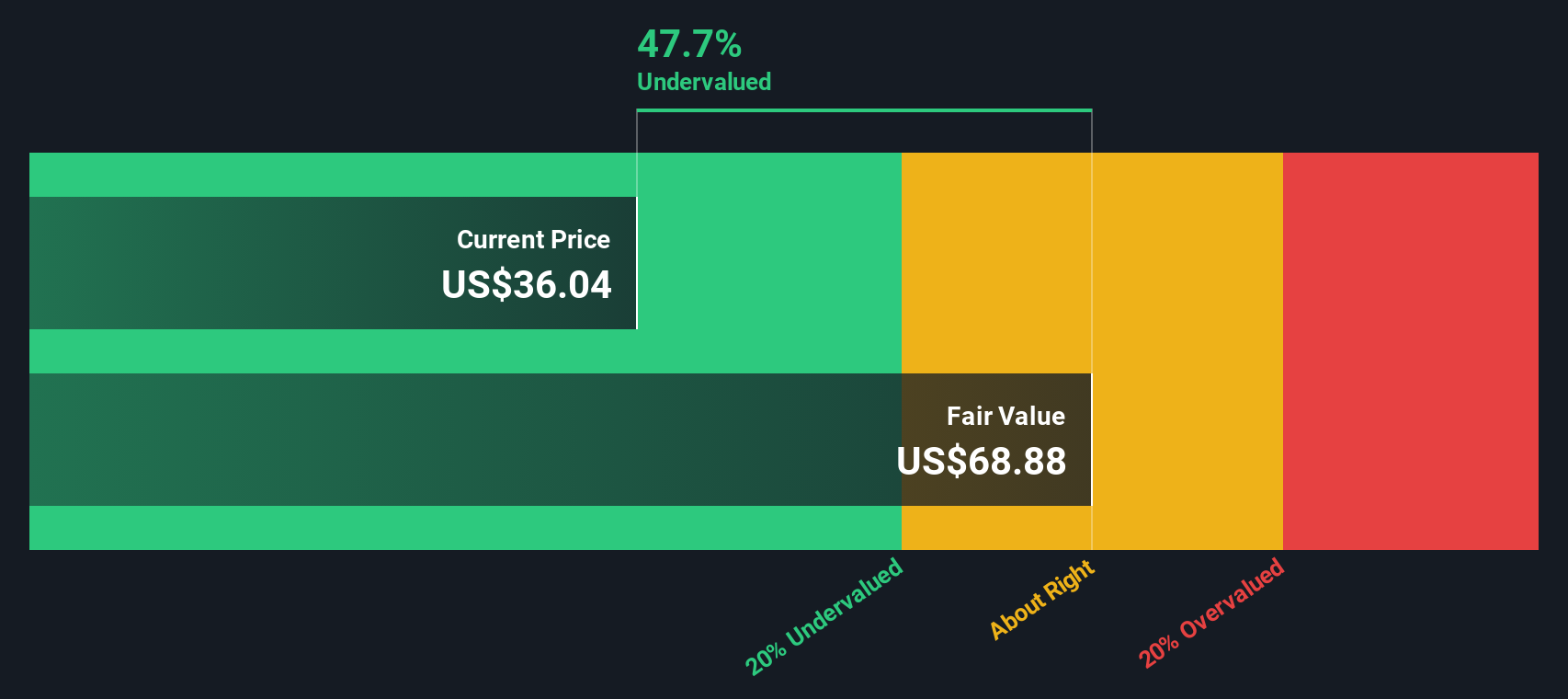

With shares soaring and financial results in flux, the big question remains: is NewAmsterdam Pharma’s stock now undervalued based on future prospects, or are today’s prices already factoring in all the growth ahead?

Price-to-Book Ratio of 6.1x: Is it justified?

NewAmsterdam Pharma is trading at a price-to-book ratio of 6.1x, which is substantially higher than the US Biotechs industry average. With the last close at $38.91, this means the stock is valued more aggressively relative to its book value than many of its biotech peers.

The price-to-book (P/B) ratio compares a company’s market value to its net assets. It is often used to gauge whether a stock is reasonably priced, especially in asset-light, research-driven sectors like biotech. For NewAmsterdam Pharma, a lofty P/B ratio typically suggests that the market anticipates outsized growth prospects or premium brand value not reflected on the balance sheet.

Looking more closely, NewAmsterdam’s P/B ratio far exceeds the industry average of 2.5x but is lower than its peer group’s average of 13.6x. This implies the market is valuing NewAmsterdam more optimistically than the broader industry, but not as exuberantly as some of its closest comparables. There isn't enough data to judge what the "fair" P/B ratio should be for NewAmsterdam. If the market’s optimism about future growth persists, the current valuation could be supported.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book Ratio of 6.1x (OVERVALUED)

However, sustained losses and aggressive valuation could weigh on sentiment if revenue growth stumbles or clinical results disappoint in the coming quarters.

Find out about the key risks to this NewAmsterdam Pharma narrative.

Another View: Discounted Cash Flow Signals Undervaluation

While NewAmsterdam Pharma appears expensive based on its price-to-book ratio, our DCF model takes a different approach. It estimates the company's fair value at $66.82, which is 41.8% above the current share price. Could the market be underestimating the company's long-term cash flow potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NewAmsterdam Pharma for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 905 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NewAmsterdam Pharma Narrative

If you want to dig deeper or reach your own conclusions, you can easily uncover the figures and shape your own perspective in just a few minutes. Do it your way

A great starting point for your NewAmsterdam Pharma research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Compelling Investment Ideas?

Smart investors always keep their radar tuned for the next big opportunity. Don’t let this moment pass. Explore new angles and tap into market trends that matter.

- Spot unique value plays and set yourself apart by accessing these 905 undervalued stocks based on cash flows selected for their attractive fundamentals and untapped growth stories.

- Boost your future prospects and strengthen your portfolio with consistent income streams. Start with these 18 dividend stocks with yields > 3% boasting robust yields above 3%.

- Stay ahead of technological shifts by seizing the potential in these 27 AI penny stocks driving innovation across artificial intelligence sectors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NewAmsterdam Pharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:NAMS

NewAmsterdam Pharma

A late-stage biopharmaceutical company, develops therapies to enhance patient care in populations with metabolic disease.

Excellent balance sheet and fair value.

Market Insights

Community Narratives