- United States

- /

- Biotech

- /

- NasdaqGM:NAMS

NewAmsterdam Pharma (NAMS): Losses Worsen by 52% Annually as Revenue Forecasts Outpace Market

Reviewed by Simply Wall St

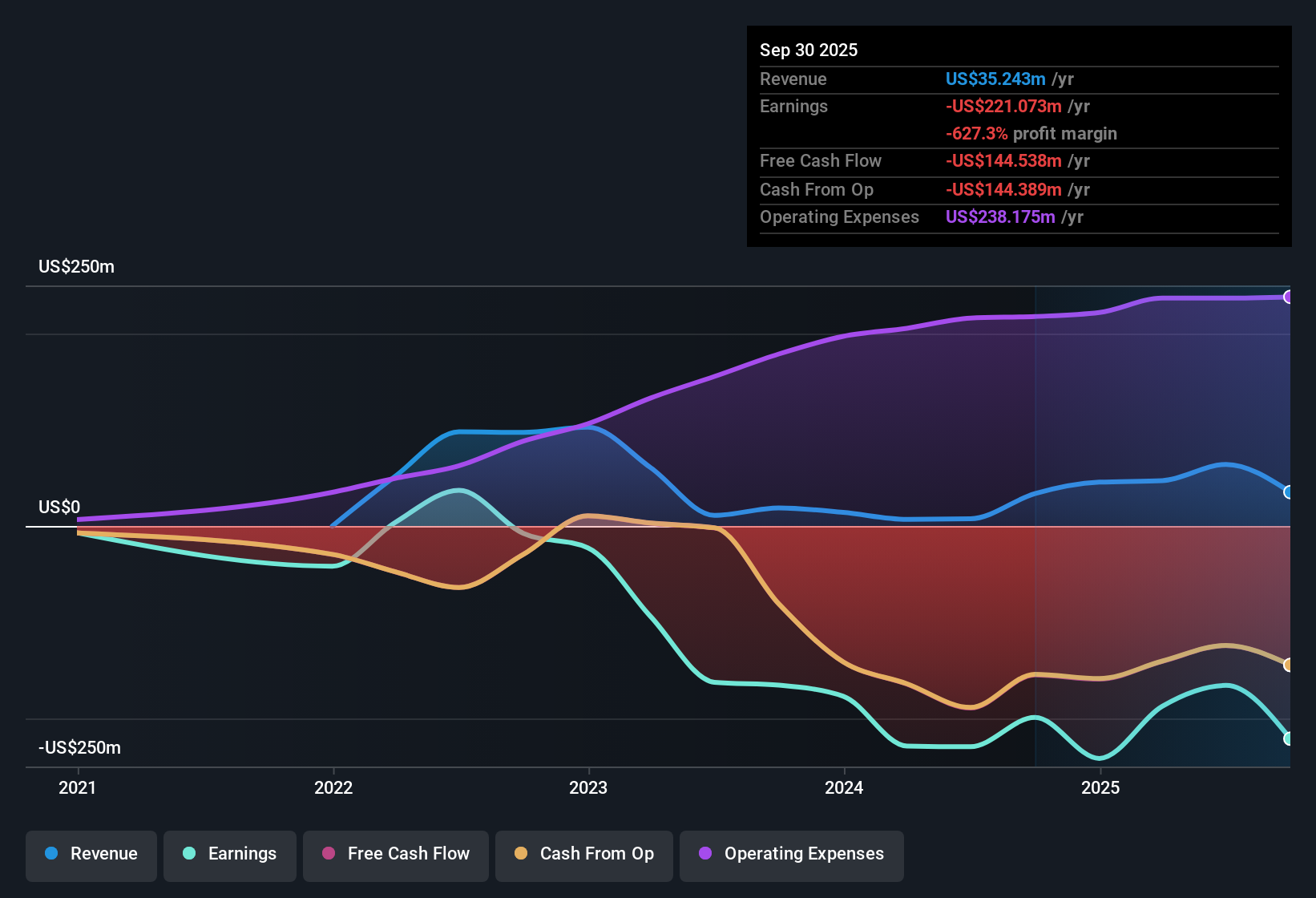

NewAmsterdam Pharma (NasdaqGM:NAMS) remains unprofitable, with net losses worsening at an average annual rate of 52% over the past five years. While the company is forecast to stay in the red for at least the next three years, revenue is expected to surge by 59.1% per year, outpacing the broader US market’s 10.5% annual growth. Despite its stock trading below the estimated fair value of $69.50, investors should note share dilution over the past year and ongoing profitability challenges even as expectations for revenue expansion remain high.

See our full analysis for NewAmsterdam Pharma.Next up, we’re putting these headline numbers side-by-side with the major narratives followed by the market to see what holds up and what deserves a closer look.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Mount as Profit Remains Out of Reach

- Net losses have accelerated at a steep pace, rising by an average of 52% per year over the past five years, with no forecast for return to profitability through at least the next three years.

- What stands out is the ongoing loss trajectory, as highlighted in the prevailing market view. While investors may be encouraged by sector-wide advances and the promise of NewAmsterdam Pharma’s clinical pipeline, persistent deep losses keep the spotlight on execution risk and durability.

- The inability to measure profit margin improvements or earnings growth, due to the continued unprofitability, presents a meaningful tension for those searching for earnings durability.

- Despite biopharma sector tailwinds, market optimism hinges on future pipeline achievements rather than fundamental profitability gains today.

Share Price Lags DCF Value but Trades at Industry Premium

- The stock trades below its DCF fair value, with a current share price of $38.13 compared to a DCF fair value estimate of $69.50. Yet it appears expensive against the broader biotech industry when using the price-to-book metric.

- The prevailing market view draws a valuation contrast. Bulls may point to the share price discount relative to intrinsic value, but skeptics highlight the risk of overvaluation on peer-based metrics.

- The fair value gap suggests long-term upside for patient investors, yet the premium price-to-book ratio flags potential overheating relative to industry norms.

- For growth-focused funds weighing a position, this valuation mismatch will invite closer scrutiny of both clinical progress and liquidity risks.

Revenue Growth Outpaces Market but Dilution Weighs on Owners

- Revenue is forecast to expand rapidly at 59.1% per year, far outstripping the US market’s projected 10.5% rate. Yet recent share dilution underscores a key risk for existing shareholders.

- The prevailing market view sees this high growth outlook as a powerful reward driver, but points to the effect of dilution as a counterweight.

- Investors may be attracted by the scale of potential future revenues, but must weigh this against the impact additional shares have had and may continue to have on the value of their holdings.

- As funding and losses persist, the tension between growth prospects and shareholder dilution is likely to be a pivotal factor in assessing investment appeal.

Strong forecast growth and valuation gaps catch attention, but the true test for NewAmsterdam Pharma will come as it proves it can translate pipeline promise into durable profits without eroding shareholder value along the way.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on NewAmsterdam Pharma's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

NewAmsterdam Pharma’s deepening losses, ongoing unprofitability, and shareholder dilution raise real concerns about financial health and resilience.

If you want to focus on companies with stronger fundamentals and less financial risk, search with our solid balance sheet and fundamentals stocks screener (1979 results) to immediately surface safer alternatives fit for turbulent markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NewAmsterdam Pharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:NAMS

NewAmsterdam Pharma

A late-stage biopharmaceutical company, develops therapies to enhance patient care in populations with metabolic disease.

Excellent balance sheet with low risk.

Market Insights

Community Narratives